Rice Hall James & Associates LLC purchased a new position in shares of Navitas Semiconductor Co. (NASDAQ:NVTS - Free Report) during the 2nd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The firm purchased 547,247 shares of the company's stock, valued at approximately $2,151,000. Rice Hall James & Associates LLC owned about 0.30% of Navitas Semiconductor as of its most recent filing with the Securities and Exchange Commission (SEC).

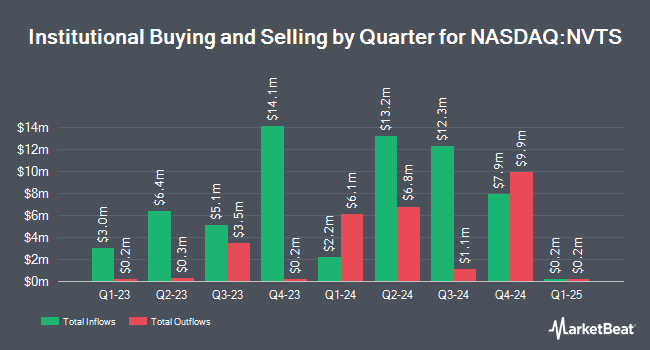

Several other large investors have also modified their holdings of the stock. Wedbush Securities Inc. bought a new position in shares of Navitas Semiconductor during the second quarter worth about $49,000. Rhumbline Advisers lifted its position in shares of Navitas Semiconductor by 10.5% during the second quarter. Rhumbline Advisers now owns 178,306 shares of the company's stock worth $701,000 after purchasing an additional 16,892 shares during the last quarter. Commonwealth Equity Services LLC lifted its position in shares of Navitas Semiconductor by 5.4% during the second quarter. Commonwealth Equity Services LLC now owns 77,940 shares of the company's stock worth $306,000 after purchasing an additional 4,000 shares during the last quarter. Bank of New York Mellon Corp lifted its position in shares of Navitas Semiconductor by 28.6% during the second quarter. Bank of New York Mellon Corp now owns 486,640 shares of the company's stock worth $1,912,000 after purchasing an additional 108,122 shares during the last quarter. Finally, 180 Wealth Advisors LLC lifted its position in shares of Navitas Semiconductor by 63.0% during the second quarter. 180 Wealth Advisors LLC now owns 52,405 shares of the company's stock worth $206,000 after purchasing an additional 20,247 shares during the last quarter. Institutional investors own 46.14% of the company's stock.

Navitas Semiconductor Stock Performance

Shares of NASDAQ:NVTS traded down $0.15 during trading hours on Thursday, hitting $2.32. The stock had a trading volume of 2,077,535 shares, compared to its average volume of 2,691,088. The stock's fifty day simple moving average is $3.44 and its 200 day simple moving average is $4.08. Navitas Semiconductor Co. has a 1-year low of $2.22 and a 1-year high of $8.44. The firm has a market capitalization of $424.79 million, a price-to-earnings ratio of -4.57 and a beta of 2.40.

Navitas Semiconductor (NASDAQ:NVTS - Get Free Report) last announced its quarterly earnings results on Monday, August 5th. The company reported ($0.07) EPS for the quarter, missing the consensus estimate of ($0.06) by ($0.01). Navitas Semiconductor had a negative net margin of 55.70% and a negative return on equity of 22.29%. The firm had revenue of $20.50 million during the quarter, compared to analyst estimates of $20.01 million. During the same quarter in the previous year, the business posted ($0.12) EPS. Navitas Semiconductor's revenue for the quarter was up 13.3% compared to the same quarter last year. As a group, research analysts anticipate that Navitas Semiconductor Co. will post -0.53 EPS for the current year.

Analyst Upgrades and Downgrades

Several brokerages have recently commented on NVTS. Craig Hallum reduced their price target on shares of Navitas Semiconductor from $7.50 to $6.50 and set a "buy" rating on the stock in a research report on Tuesday, August 6th. Deutsche Bank Aktiengesellschaft dropped their price objective on shares of Navitas Semiconductor from $7.00 to $6.00 and set a "buy" rating on the stock in a research note on Tuesday, August 6th. Rosenblatt Securities reiterated a "buy" rating and set a $10.00 price objective on shares of Navitas Semiconductor in a research note on Friday, August 2nd. Morgan Stanley dropped their price objective on shares of Navitas Semiconductor from $4.60 to $3.50 and set an "equal weight" rating on the stock in a research note on Tuesday, August 6th. Finally, Needham & Company LLC dropped their price objective on shares of Navitas Semiconductor from $7.00 to $5.00 and set a "buy" rating on the stock in a research note on Tuesday, August 6th. Three research analysts have rated the stock with a hold rating and five have issued a buy rating to the stock. According to MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average price target of $6.00.

View Our Latest Analysis on NVTS

Insider Buying and Selling at Navitas Semiconductor

In other Navitas Semiconductor news, COO Daniel M. Kinzer sold 150,000 shares of the firm's stock in a transaction that occurred on Tuesday, August 27th. The shares were sold at an average price of $3.10, for a total value of $465,000.00. Following the sale, the chief operating officer now owns 4,388,353 shares in the company, valued at $13,603,894.30. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. In other news, COO Daniel M. Kinzer sold 150,000 shares of the stock in a transaction that occurred on Tuesday, August 27th. The shares were sold at an average price of $3.10, for a total value of $465,000.00. Following the completion of the transaction, the chief operating officer now directly owns 4,388,353 shares in the company, valued at $13,603,894.30. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, Director David Moxam sold 33,000 shares of the stock in a transaction that occurred on Thursday, August 15th. The shares were sold at an average price of $3.13, for a total transaction of $103,290.00. Following the completion of the transaction, the director now owns 867,848 shares of the company's stock, valued at $2,716,364.24. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 829,852 shares of company stock worth $2,528,252. 31.80% of the stock is owned by company insiders.

Navitas Semiconductor Company Profile

(

Free Report)

Navitas Semiconductor Corporation designs, develops, and markets gallium nitride power integrated circuits, silicon carbide, associated high-speed silicon system controllers, and digital isolators used in power conversion and charging. The company's products are used in mobile, consumer, data center, solar, electric vehicle, industrial motor drive, smart grid, and transportation applications.

Featured Articles

Before you consider Navitas Semiconductor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Navitas Semiconductor wasn't on the list.

While Navitas Semiconductor currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report