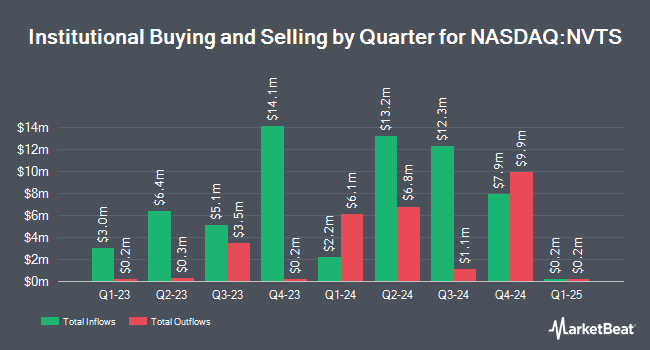

Squarepoint Ops LLC acquired a new stake in shares of Navitas Semiconductor Co. (NASDAQ:NVTS - Free Report) during the second quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund acquired 601,498 shares of the company's stock, valued at approximately $2,364,000. Squarepoint Ops LLC owned about 0.33% of Navitas Semiconductor as of its most recent SEC filing.

Other hedge funds also recently added to or reduced their stakes in the company. Intrinsic Edge Capital Management LLC boosted its holdings in shares of Navitas Semiconductor by 91.6% in the fourth quarter. Intrinsic Edge Capital Management LLC now owns 2,717,692 shares of the company's stock valued at $21,932,000 after purchasing an additional 1,299,524 shares during the period. Masters Capital Management LLC lifted its stake in Navitas Semiconductor by 55.3% in the fourth quarter. Masters Capital Management LLC now owns 1,700,000 shares of the company's stock worth $13,719,000 after acquiring an additional 605,000 shares during the period. G2 Investment Partners Management LLC bought a new position in shares of Navitas Semiconductor during the fourth quarter valued at approximately $574,000. 180 Wealth Advisors LLC increased its holdings in Navitas Semiconductor by 91.2% during the first quarter. 180 Wealth Advisors LLC now owns 32,158 shares of the company's stock valued at $153,000 after buying an additional 15,335 shares during the period. Finally, Benjamin F. Edwards & Company Inc. raised its stake in Navitas Semiconductor by 72.5% in the first quarter. Benjamin F. Edwards & Company Inc. now owns 13,200 shares of the company's stock worth $63,000 after buying an additional 5,550 shares in the last quarter. 46.14% of the stock is currently owned by institutional investors.

Insiders Place Their Bets

In other news, CEO Eugene Sheridan sold 193,662 shares of the stock in a transaction on Friday, August 30th. The stock was sold at an average price of $3.03, for a total transaction of $586,795.86. Following the completion of the transaction, the chief executive officer now directly owns 2,149,631 shares in the company, valued at approximately $6,513,381.93. This represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. In related news, Director David Moxam sold 33,000 shares of Navitas Semiconductor stock in a transaction that occurred on Thursday, August 15th. The shares were sold at an average price of $3.13, for a total value of $103,290.00. Following the completion of the sale, the director now owns 867,848 shares in the company, valued at approximately $2,716,364.24. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, CEO Eugene Sheridan sold 193,662 shares of the business's stock in a transaction that occurred on Friday, August 30th. The shares were sold at an average price of $3.03, for a total value of $586,795.86. Following the completion of the sale, the chief executive officer now directly owns 2,149,631 shares in the company, valued at approximately $6,513,381.93. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 829,852 shares of company stock valued at $2,528,252 over the last quarter. 31.80% of the stock is owned by insiders.

Navitas Semiconductor Stock Up 2.1 %

NVTS traded up $0.05 during trading on Friday, reaching $2.44. The company's stock had a trading volume of 1,598,026 shares, compared to its average volume of 2,709,130. The firm has a fifty day simple moving average of $2.82 and a two-hundred day simple moving average of $3.76. The company has a market cap of $446.77 million, a price-to-earnings ratio of -4.82 and a beta of 2.38. Navitas Semiconductor Co. has a 1 year low of $2.14 and a 1 year high of $8.44.

Navitas Semiconductor (NASDAQ:NVTS - Get Free Report) last announced its quarterly earnings data on Monday, August 5th. The company reported ($0.07) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.06) by ($0.01). The firm had revenue of $20.50 million during the quarter, compared to analysts' expectations of $20.01 million. Navitas Semiconductor had a negative net margin of 55.70% and a negative return on equity of 22.29%. The company's revenue for the quarter was up 13.3% compared to the same quarter last year. During the same period in the prior year, the company posted ($0.12) EPS. As a group, equities analysts forecast that Navitas Semiconductor Co. will post -0.53 EPS for the current fiscal year.

Analyst Ratings Changes

A number of brokerages recently weighed in on NVTS. Craig Hallum decreased their price objective on Navitas Semiconductor from $7.50 to $6.50 and set a "buy" rating for the company in a research note on Tuesday, August 6th. Deutsche Bank Aktiengesellschaft lowered their price target on shares of Navitas Semiconductor from $7.00 to $6.00 and set a "buy" rating on the stock in a report on Tuesday, August 6th. Rosenblatt Securities reissued a "buy" rating and set a $10.00 target price on shares of Navitas Semiconductor in a research report on Friday, August 2nd. Needham & Company LLC lowered their target price on shares of Navitas Semiconductor from $7.00 to $5.00 and set a "buy" rating for the company in a research note on Tuesday, August 6th. Finally, Morgan Stanley reduced their price target on Navitas Semiconductor from $4.60 to $3.50 and set an "equal weight" rating on the stock in a research report on Tuesday, August 6th. Three investment analysts have rated the stock with a hold rating and five have given a buy rating to the company. Based on data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average price target of $6.00.

Get Our Latest Stock Report on Navitas Semiconductor

Navitas Semiconductor Company Profile

(

Free Report)

Navitas Semiconductor Corporation designs, develops, and markets gallium nitride power integrated circuits, silicon carbide, associated high-speed silicon system controllers, and digital isolators used in power conversion and charging. The company's products are used in mobile, consumer, data center, solar, electric vehicle, industrial motor drive, smart grid, and transportation applications.

Featured Stories

Before you consider Navitas Semiconductor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Navitas Semiconductor wasn't on the list.

While Navitas Semiconductor currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report