Newell Brands (NASDAQ:NWL - Free Report) had its price target raised by Wells Fargo & Company from $8.00 to $9.00 in a research report report published on Monday, Benzinga reports. Wells Fargo & Company currently has an equal weight rating on the stock.

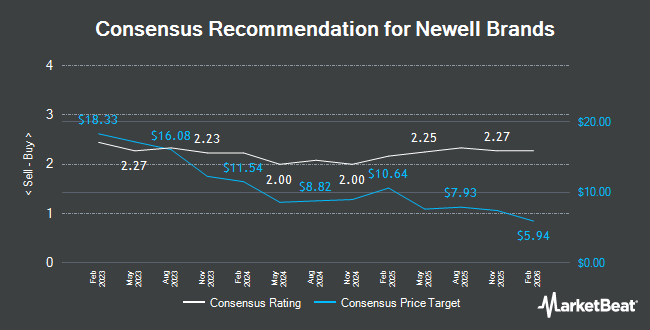

NWL has been the topic of several other reports. Canaccord Genuity Group increased their target price on shares of Newell Brands from $12.00 to $13.00 and gave the stock a "buy" rating in a report on Monday. Citigroup lowered shares of Newell Brands from a "hold" rating to a "strong sell" rating in a research note on Tuesday, August 13th. Royal Bank of Canada boosted their price target on Newell Brands from $7.50 to $9.50 and gave the company a "sector perform" rating in a research note on Monday, July 29th. Truist Financial raised their target price on shares of Newell Brands from $8.00 to $10.00 and gave the stock a "hold" rating in a report on Tuesday, July 30th. Finally, JPMorgan Chase & Co. decreased their target price on shares of Newell Brands from $9.00 to $8.00 and set a "neutral" rating for the company in a research report on Friday, October 11th. One investment analyst has rated the stock with a sell rating, ten have given a hold rating and one has issued a buy rating to the company. According to data from MarketBeat.com, the company currently has an average rating of "Hold" and an average target price of $8.90.

Read Our Latest Research Report on NWL

Newell Brands Stock Up 9.2 %

NASDAQ NWL traded up $0.80 on Monday, reaching $9.53. 11,575,767 shares of the stock were exchanged, compared to its average volume of 5,791,539. The company has a debt-to-equity ratio of 1.43, a current ratio of 0.99 and a quick ratio of 0.50. Newell Brands has a one year low of $5.39 and a one year high of $9.68. The company's 50-day simple moving average is $7.44 and its two-hundred day simple moving average is $7.32.

Newell Brands (NASDAQ:NWL - Get Free Report) last released its earnings results on Friday, October 25th. The company reported $0.16 EPS for the quarter, hitting the consensus estimate of $0.16. The firm had revenue of $1.95 billion for the quarter, compared to the consensus estimate of $1.96 billion. Newell Brands had a negative net margin of 3.22% and a positive return on equity of 10.22%. The company's quarterly revenue was down 2.6% compared to the same quarter last year. During the same quarter in the previous year, the firm earned $0.39 earnings per share. As a group, sell-side analysts expect that Newell Brands will post 0.65 earnings per share for the current fiscal year.

Newell Brands Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Friday, September 13th. Shareholders of record on Friday, August 30th were given a $0.07 dividend. The ex-dividend date of this dividend was Friday, August 30th. This represents a $0.28 dividend on an annualized basis and a yield of 2.94%. Newell Brands's dividend payout ratio is currently -46.67%.

Institutional Trading of Newell Brands

Institutional investors and hedge funds have recently added to or reduced their stakes in the company. Cornerstone Wealth Group LLC purchased a new position in Newell Brands in the third quarter valued at $143,000. Pallas Capital Advisors LLC acquired a new position in shares of Newell Brands during the third quarter worth $196,000. Nisa Investment Advisors LLC increased its holdings in Newell Brands by 1,194.8% in the third quarter. Nisa Investment Advisors LLC now owns 21,300 shares of the company's stock valued at $164,000 after buying an additional 19,655 shares during the last quarter. State of Alaska Department of Revenue raised its stake in Newell Brands by 5.5% in the third quarter. State of Alaska Department of Revenue now owns 237,391 shares of the company's stock valued at $1,823,000 after buying an additional 12,444 shares in the last quarter. Finally, Wealth Enhancement Advisory Services LLC lifted its holdings in Newell Brands by 105.4% during the 3rd quarter. Wealth Enhancement Advisory Services LLC now owns 37,995 shares of the company's stock worth $292,000 after buying an additional 19,493 shares during the last quarter. Hedge funds and other institutional investors own 92.50% of the company's stock.

Newell Brands Company Profile

(

Get Free Report)

Newell Brands Inc engages in the design, manufacture, sourcing, and distribution of consumer and commercial products worldwide. The company operates in three segments: Home and Commercial Solutions, Learning and Development, and Outdoor and Recreation. The Commercial Solutions segment provides commercial cleaning and maintenance solution products under the Rubbermaid, Rubbermaid Commercial Products, Mapa, and Spontex brands; closet and garage organization products; hygiene systems and material handling solutions; household products, such as kitchen appliances under the Crockpot, Mr.

Featured Articles

Before you consider Newell Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Newell Brands wasn't on the list.

While Newell Brands currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.