Smith Group Asset Management LLC trimmed its position in shares of Nextracker Inc. (NASDAQ:NXT - Free Report) by 39.0% during the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 233,761 shares of the company's stock after selling 149,231 shares during the period. Smith Group Asset Management LLC owned about 0.16% of Nextracker worth $8,761,000 as of its most recent SEC filing.

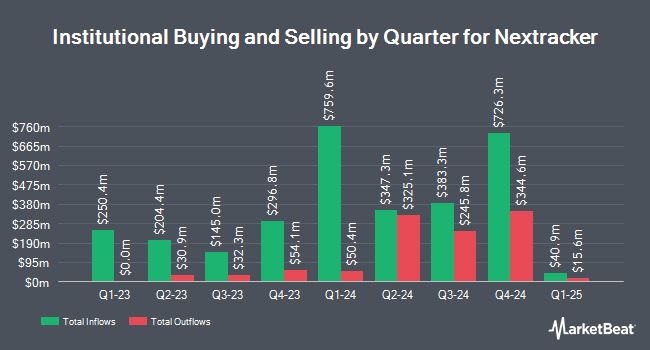

A number of other hedge funds also recently bought and sold shares of the company. Wellington Management Group LLP bought a new position in Nextracker during the 4th quarter worth approximately $2,775,000. Vanguard Group Inc. raised its holdings in Nextracker by 4.8% during the 4th quarter. Vanguard Group Inc. now owns 4,710,158 shares of the company's stock valued at $220,671,000 after buying an additional 216,674 shares during the last quarter. PNC Financial Services Group Inc. purchased a new stake in Nextracker during the 4th quarter valued at $183,000. Park Avenue Securities LLC bought a new stake in Nextracker in the 1st quarter worth $268,000. Finally, Allspring Global Investments Holdings LLC grew its holdings in Nextracker by 15.9% in the 1st quarter. Allspring Global Investments Holdings LLC now owns 450,298 shares of the company's stock worth $25,338,000 after acquiring an additional 61,934 shares during the last quarter. Institutional investors own 67.41% of the company's stock.

Analysts Set New Price Targets

A number of research firms have recently weighed in on NXT. BMO Capital Markets dropped their target price on shares of Nextracker from $56.00 to $44.00 and set a "market perform" rating for the company in a report on Monday, October 14th. Barclays cut their price target on shares of Nextracker from $61.00 to $47.00 and set an "equal weight" rating on the stock in a report on Thursday, October 3rd. Guggenheim lowered their price objective on shares of Nextracker from $60.00 to $55.00 and set a "buy" rating for the company in a report on Friday, August 16th. Wells Fargo & Company dropped their price objective on shares of Nextracker from $64.00 to $58.00 and set an "overweight" rating on the stock in a research note on Tuesday. Finally, JPMorgan Chase & Co. reduced their price objective on shares of Nextracker from $62.00 to $58.00 and set an "overweight" rating for the company in a research note on Thursday, October 17th. Five equities research analysts have rated the stock with a hold rating and fifteen have issued a buy rating to the company. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $56.35.

Get Our Latest Analysis on Nextracker

Nextracker Price Performance

NASDAQ NXT traded down $0.23 during trading hours on Tuesday, reaching $32.33. The company's stock had a trading volume of 2,196,990 shares, compared to its average volume of 3,708,157. The company has a quick ratio of 1.91, a current ratio of 2.11 and a debt-to-equity ratio of 0.13. Nextracker Inc. has a 1 year low of $30.93 and a 1 year high of $62.31. The firm's 50-day moving average price is $36.30 and its 200-day moving average price is $43.75. The company has a market capitalization of $4.70 billion, a price-to-earnings ratio of 8.58 and a beta of 2.47.

Nextracker (NASDAQ:NXT - Get Free Report) last announced its quarterly earnings results on Thursday, August 1st. The company reported $0.93 EPS for the quarter, topping the consensus estimate of $0.66 by $0.27. Nextracker had a net margin of 14.87% and a negative return on equity of 36.33%. The business had revenue of $719.92 million for the quarter, compared to analysts' expectations of $616.71 million. During the same quarter in the previous year, the company earned $0.48 EPS. The business's quarterly revenue was up 50.1% compared to the same quarter last year. On average, equities research analysts predict that Nextracker Inc. will post 2.52 EPS for the current fiscal year.

About Nextracker

(

Free Report)

Nextracker Inc, an energy solutions company, provides solar tracker and software solutions for utility-scale and distributed generation solar projects in the United States and internationally. The company offers tracking solutions, which includes NX Horizon, a solar tracking solution; and NX Horizon-XTR, a terrain-following tracker designed to expand the addressable market for trackers on sites with sloped, uneven, and challenging terrain.

Further Reading

Before you consider Nextracker, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nextracker wasn't on the list.

While Nextracker currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.