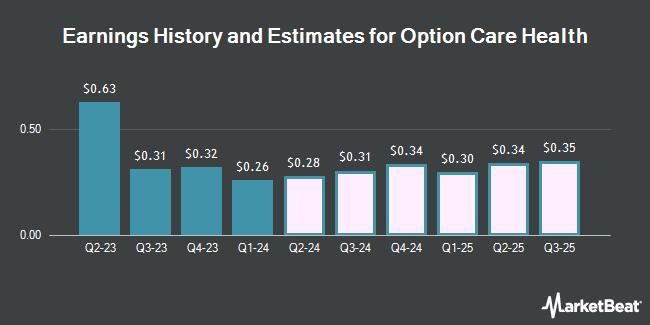

Option Care Health, Inc. (NASDAQ:OPCH - Free Report) - Analysts at Barrington Research decreased their FY2025 earnings per share (EPS) estimates for Option Care Health in a report issued on Thursday, October 31st. Barrington Research analyst M. Petusky now expects that the company will post earnings of $1.12 per share for the year, down from their previous estimate of $1.40. Barrington Research has a "Outperform" rating and a $32.00 price target on the stock. The consensus estimate for Option Care Health's current full-year earnings is $1.23 per share. Barrington Research also issued estimates for Option Care Health's FY2026 earnings at $1.32 EPS.

Other research analysts also recently issued reports about the stock. Truist Financial lowered their price objective on shares of Option Care Health from $41.00 to $34.00 and set a "buy" rating on the stock in a research report on Friday. The Goldman Sachs Group cut Option Care Health from a "buy" rating to a "neutral" rating and set a $27.00 price target for the company. in a research note on Monday. Bank of America downgraded shares of Option Care Health from a "buy" rating to a "neutral" rating and cut their price target for the company from $43.00 to $29.00 in a report on Wednesday, October 30th. Jefferies Financial Group lowered Option Care Health from a "buy" rating to a "hold" rating and cut their target price for the company from $38.00 to $26.00 in a report on Thursday. Finally, JMP Securities upped their price target on Option Care Health from $36.00 to $37.00 and gave the stock a "market outperform" rating in a research note on Monday, September 30th. Three analysts have rated the stock with a hold rating and three have given a buy rating to the company. According to data from MarketBeat, Option Care Health has an average rating of "Moderate Buy" and an average price target of $30.83.

Check Out Our Latest Analysis on OPCH

Option Care Health Stock Down 6.7 %

NASDAQ:OPCH traded down $1.62 on Monday, hitting $22.49. 3,605,767 shares of the company's stock traded hands, compared to its average volume of 1,483,424. The company has a market cap of $3.83 billion, a PE ratio of 19.16, a price-to-earnings-growth ratio of 1.74 and a beta of 1.32. Option Care Health has a 1 year low of $22.46 and a 1 year high of $34.63. The company has a current ratio of 1.73, a quick ratio of 1.36 and a debt-to-equity ratio of 0.77. The firm has a 50-day moving average price of $30.49 and a 200-day moving average price of $29.91.

Insider Activity at Option Care Health

In other Option Care Health news, Director Elizabeth Quadros Betten sold 47,531 shares of Option Care Health stock in a transaction that occurred on Wednesday, August 21st. The stock was sold at an average price of $31.09, for a total value of $1,477,738.79. Following the transaction, the director now directly owns 21,339 shares of the company's stock, valued at $663,429.51. The trade was a 0.00 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available at the SEC website. In related news, Director Elizabeth Quadros Betten sold 47,531 shares of Option Care Health stock in a transaction dated Wednesday, August 21st. The stock was sold at an average price of $31.09, for a total transaction of $1,477,738.79. Following the sale, the director now directly owns 21,339 shares of the company's stock, valued at $663,429.51. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, CFO Michael H. Shapiro sold 23,217 shares of the company's stock in a transaction that occurred on Thursday, August 22nd. The shares were sold at an average price of $30.95, for a total value of $718,566.15. Following the completion of the transaction, the chief financial officer now directly owns 247,317 shares of the company's stock, valued at approximately $7,654,461.15. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. 0.64% of the stock is owned by corporate insiders.

Hedge Funds Weigh In On Option Care Health

A number of hedge funds have recently made changes to their positions in the business. UMB Bank n.a. raised its position in Option Care Health by 937.5% in the third quarter. UMB Bank n.a. now owns 830 shares of the company's stock worth $26,000 after purchasing an additional 750 shares in the last quarter. GAMMA Investing LLC raised its holdings in shares of Option Care Health by 110.6% in the 3rd quarter. GAMMA Investing LLC now owns 897 shares of the company's stock worth $28,000 after buying an additional 471 shares in the last quarter. Whittier Trust Co. of Nevada Inc. lifted its position in shares of Option Care Health by 3,362.8% during the 3rd quarter. Whittier Trust Co. of Nevada Inc. now owns 1,489 shares of the company's stock worth $47,000 after buying an additional 1,446 shares during the period. Blue Trust Inc. boosted its stake in Option Care Health by 14.8% in the 2nd quarter. Blue Trust Inc. now owns 2,931 shares of the company's stock valued at $81,000 after buying an additional 377 shares in the last quarter. Finally, SageView Advisory Group LLC acquired a new stake in Option Care Health in the 1st quarter valued at $85,000. Institutional investors and hedge funds own 98.05% of the company's stock.

About Option Care Health

(

Get Free Report)

Option Care Health, Inc offers home and alternate site infusion services in the United States. The company provides anti-infective therapies; home infusion services to treat heart failures; home parenteral nutrition and enteral nutrition support services for numerous acute and chronic conditions, such as stroke, cancer, and gastrointestinal diseases; immunoglobulin infusion therapies for the treatment of immune deficiencies; and treatments for chronic inflammatory disorders, including crohn's disease, plaque psoriasis, psoriatic arthritis, rheumatoid arthritis, ulcerative colitis, and other chronic inflammatory disorders.

Featured Articles

Before you consider Option Care Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Option Care Health wasn't on the list.

While Option Care Health currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.