Harbor Capital Advisors Inc. lifted its holdings in shares of Option Care Health, Inc. (NASDAQ:OPCH - Free Report) by 115.4% during the 3rd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund owned 207,560 shares of the company's stock after purchasing an additional 111,185 shares during the quarter. Harbor Capital Advisors Inc. owned about 0.12% of Option Care Health worth $6,497,000 as of its most recent SEC filing.

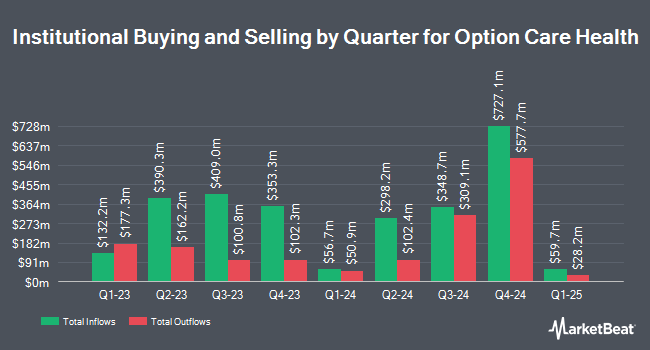

Several other hedge funds have also made changes to their positions in the business. UMB Bank n.a. raised its position in shares of Option Care Health by 937.5% in the 3rd quarter. UMB Bank n.a. now owns 830 shares of the company's stock worth $26,000 after buying an additional 750 shares during the period. GAMMA Investing LLC raised its position in shares of Option Care Health by 110.6% in the 3rd quarter. GAMMA Investing LLC now owns 897 shares of the company's stock worth $28,000 after buying an additional 471 shares during the period. Whittier Trust Co. of Nevada Inc. raised its position in shares of Option Care Health by 3,362.8% in the 3rd quarter. Whittier Trust Co. of Nevada Inc. now owns 1,489 shares of the company's stock worth $47,000 after buying an additional 1,446 shares during the period. SageView Advisory Group LLC purchased a new position in Option Care Health in the first quarter valued at about $85,000. Finally, International Assets Investment Management LLC raised its position in Option Care Health by 3,029.7% in the third quarter. International Assets Investment Management LLC now owns 2,848 shares of the company's stock valued at $91,000 after purchasing an additional 2,757 shares during the period. Institutional investors and hedge funds own 98.05% of the company's stock.

Option Care Health Stock Up 4.6 %

Shares of NASDAQ OPCH traded up $1.07 during midday trading on Friday, reaching $24.11. 7,222,745 shares of the company's stock were exchanged, compared to its average volume of 1,970,709. Option Care Health, Inc. has a 52-week low of $22.84 and a 52-week high of $34.63. The stock has a market capitalization of $4.10 billion, a PE ratio of 20.26, a price-to-earnings-growth ratio of 1.74 and a beta of 1.32. The company has a debt-to-equity ratio of 0.77, a quick ratio of 1.36 and a current ratio of 1.73. The business's fifty day moving average price is $30.49 and its two-hundred day moving average price is $29.91.

Option Care Health (NASDAQ:OPCH - Get Free Report) last announced its earnings results on Wednesday, July 31st. The company reported $0.30 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.27 by $0.03. The business had revenue of $1.23 billion for the quarter, compared to analyst estimates of $1.17 billion. Option Care Health had a return on equity of 15.30% and a net margin of 4.37%. The company's revenue for the quarter was up 14.8% compared to the same quarter last year. During the same period in the previous year, the company earned $0.63 earnings per share. Analysts forecast that Option Care Health, Inc. will post 1.23 EPS for the current year.

Insider Buying and Selling

In related news, CFO Michael H. Shapiro sold 23,217 shares of Option Care Health stock in a transaction dated Thursday, August 22nd. The stock was sold at an average price of $30.95, for a total value of $718,566.15. Following the completion of the transaction, the chief financial officer now directly owns 247,317 shares in the company, valued at approximately $7,654,461.15. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. In other Option Care Health news, Director Elizabeth Quadros Betten sold 47,531 shares of Option Care Health stock in a transaction that occurred on Wednesday, August 21st. The stock was sold at an average price of $31.09, for a total value of $1,477,738.79. Following the completion of the transaction, the director now directly owns 21,339 shares in the company, valued at $663,429.51. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this link. Also, CFO Michael H. Shapiro sold 23,217 shares of Option Care Health stock in a transaction that occurred on Thursday, August 22nd. The shares were sold at an average price of $30.95, for a total value of $718,566.15. Following the completion of the transaction, the chief financial officer now owns 247,317 shares of the company's stock, valued at approximately $7,654,461.15. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders own 0.64% of the company's stock.

Analyst Upgrades and Downgrades

Several research analysts have commented on OPCH shares. Bank of America lowered Option Care Health from a "buy" rating to a "neutral" rating and cut their price objective for the company from $43.00 to $29.00 in a research report on Wednesday. Barrington Research cut their price objective on Option Care Health from $40.00 to $32.00 and set an "outperform" rating on the stock in a research report on Thursday. Jefferies Financial Group lowered Option Care Health from a "buy" rating to a "hold" rating and cut their price objective for the company from $38.00 to $26.00 in a research report on Thursday. JMP Securities raised their price objective on Option Care Health from $36.00 to $37.00 and gave the company a "market outperform" rating in a research report on Monday, September 30th. Finally, Truist Financial cut their price objective on Option Care Health from $41.00 to $34.00 and set a "buy" rating on the stock in a research report on Friday. Two research analysts have rated the stock with a hold rating and three have issued a buy rating to the stock. According to data from MarketBeat, Option Care Health currently has an average rating of "Moderate Buy" and a consensus target price of $31.60.

Read Our Latest Research Report on OPCH

About Option Care Health

(

Free Report)

Option Care Health, Inc offers home and alternate site infusion services in the United States. The company provides anti-infective therapies; home infusion services to treat heart failures; home parenteral nutrition and enteral nutrition support services for numerous acute and chronic conditions, such as stroke, cancer, and gastrointestinal diseases; immunoglobulin infusion therapies for the treatment of immune deficiencies; and treatments for chronic inflammatory disorders, including crohn's disease, plaque psoriasis, psoriatic arthritis, rheumatoid arthritis, ulcerative colitis, and other chronic inflammatory disorders.

Further Reading

Before you consider Option Care Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Option Care Health wasn't on the list.

While Option Care Health currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.