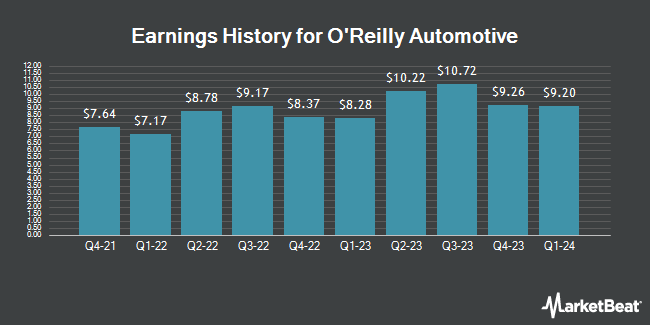

O'Reilly Automotive (NASDAQ:ORLY - Get Free Report) issued its quarterly earnings results on Wednesday. The specialty retailer reported $11.41 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $11.53 by ($0.12), Briefing.com reports. The firm had revenue of $4.36 billion during the quarter, compared to analyst estimates of $4.42 billion. O'Reilly Automotive had a negative return on equity of 146.57% and a net margin of 14.57%. The business's revenue was up 3.8% on a year-over-year basis. During the same period in the prior year, the firm earned $10.72 earnings per share. O'Reilly Automotive updated its FY24 guidance to $40.60 to $41.10 EPS and its FY 2024 guidance to 40.600-41.100 EPS.

O'Reilly Automotive Stock Performance

O'Reilly Automotive stock traded up $0.52 during mid-day trading on Thursday, reaching $1,199.77. 430,628 shares of the company were exchanged, compared to its average volume of 261,559. The firm's 50-day simple moving average is $1,147.32 and its two-hundred day simple moving average is $1,080.64. The firm has a market cap of $69.60 billion, a PE ratio of 30.20, a price-to-earnings-growth ratio of 2.29 and a beta of 0.92. O'Reilly Automotive has a twelve month low of $860.10 and a twelve month high of $1,221.18.

Analyst Upgrades and Downgrades

A number of research firms have weighed in on ORLY. Bank of America boosted their price objective on O'Reilly Automotive from $1,204.00 to $1,290.00 and gave the stock a "buy" rating in a research note on Thursday, August 22nd. Roth Mkm reissued a "buy" rating and set a $1,337.00 price objective on shares of O'Reilly Automotive in a research note on Wednesday, October 16th. DA Davidson reissued a "buy" rating and set a $1,275.00 price objective on shares of O'Reilly Automotive in a research note on Thursday. Wedbush reissued a "neutral" rating and set a $1,200.00 price objective on shares of O'Reilly Automotive in a research note on Thursday. Finally, Royal Bank of Canada decreased their price target on O'Reilly Automotive from $1,124.00 to $1,115.00 and set an "outperform" rating on the stock in a research note on Friday, July 26th. Four investment analysts have rated the stock with a hold rating, thirteen have given a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average price target of $1,209.56.

Read Our Latest Stock Analysis on O'Reilly Automotive

Insider Activity

In other news, SVP Mark Joseph Merz sold 413 shares of the firm's stock in a transaction that occurred on Tuesday, July 30th. The stock was sold at an average price of $1,120.00, for a total value of $462,560.00. Following the completion of the sale, the senior vice president now directly owns 265 shares of the company's stock, valued at $296,800. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. In other news, SVP Mark Joseph Merz sold 413 shares of the firm's stock in a transaction that occurred on Tuesday, July 30th. The stock was sold at an average price of $1,120.00, for a total value of $462,560.00. Following the completion of the sale, the senior vice president now directly owns 265 shares of the company's stock, valued at $296,800. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, Director Gregory D. Johnson sold 15,364 shares of the firm's stock in a transaction that occurred on Wednesday, July 31st. The shares were sold at an average price of $1,136.16, for a total value of $17,455,962.24. Following the completion of the sale, the director now directly owns 5,016 shares of the company's stock, valued at $5,698,978.56. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 50,411 shares of company stock valued at $56,846,062 in the last three months. 1.55% of the stock is currently owned by company insiders.

About O'Reilly Automotive

(

Get Free Report)

O'Reilly Automotive, Inc, together with its subsidiaries, operates as a retailer and supplier of automotive aftermarket parts, tools, supplies, equipment, and accessories in the United States, Puerto Rico, and Mexico. The company provides new and remanufactured automotive hard parts and maintenance items, such as alternators, batteries, brake system components, belts, chassis parts, driveline parts, engine parts, fuel pumps, hoses, starters, temperature control, water pumps, antifreeze, appearance products, engine additives, filters, fluids, lighting products, and oil and wiper blades; and accessories, including floor mats, seat covers, and truck accessories.

Further Reading

Before you consider O'Reilly Automotive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and O'Reilly Automotive wasn't on the list.

While O'Reilly Automotive currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.