Busey Bank boosted its position in O'Reilly Automotive, Inc. (NASDAQ:ORLY - Free Report) by 164.2% in the 3rd quarter, according to its most recent filing with the SEC. The firm owned 7,632 shares of the specialty retailer's stock after acquiring an additional 4,743 shares during the period. Busey Bank's holdings in O'Reilly Automotive were worth $8,789,000 at the end of the most recent reporting period.

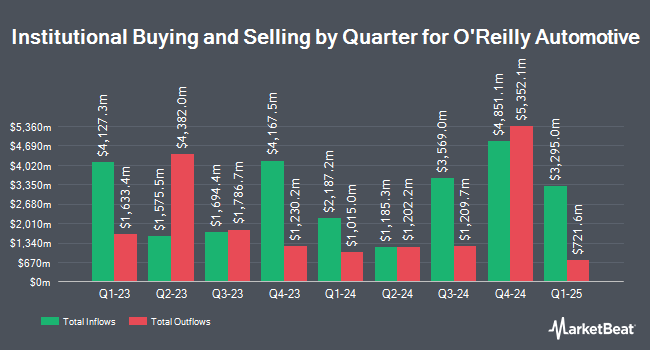

Several other hedge funds and other institutional investors have also recently bought and sold shares of ORLY. Sunbelt Securities Inc. grew its stake in O'Reilly Automotive by 10.5% in the 1st quarter. Sunbelt Securities Inc. now owns 516 shares of the specialty retailer's stock worth $583,000 after acquiring an additional 49 shares during the period. 180 Wealth Advisors LLC purchased a new stake in shares of O'Reilly Automotive during the 1st quarter valued at $308,000. Hengehold Capital Management LLC purchased a new stake in shares of O'Reilly Automotive during the 1st quarter valued at $239,000. Fifth Third Wealth Advisors LLC grew its stake in shares of O'Reilly Automotive by 5.1% during the 1st quarter. Fifth Third Wealth Advisors LLC now owns 536 shares of the specialty retailer's stock valued at $605,000 after buying an additional 26 shares during the period. Finally, Indiana Trust & Investment Management CO grew its stake in shares of O'Reilly Automotive by 325.0% during the 1st quarter. Indiana Trust & Investment Management CO now owns 34 shares of the specialty retailer's stock valued at $38,000 after buying an additional 26 shares during the period. 85.00% of the stock is owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

Several brokerages have recently issued reports on ORLY. Wells Fargo & Company boosted their price objective on shares of O'Reilly Automotive from $1,250.00 to $1,325.00 and gave the company an "overweight" rating in a research note on Monday, October 14th. Bank of America boosted their price objective on shares of O'Reilly Automotive from $1,204.00 to $1,290.00 and gave the company a "buy" rating in a research note on Thursday, August 22nd. Roth Mkm reissued a "buy" rating and set a $1,337.00 price objective on shares of O'Reilly Automotive in a research note on Wednesday, October 16th. Royal Bank of Canada upped their price target on shares of O'Reilly Automotive from $1,115.00 to $1,286.00 and gave the stock an "outperform" rating in a research report on Friday. Finally, Evercore ISI upped their price target on shares of O'Reilly Automotive from $1,215.00 to $1,230.00 and gave the stock an "outperform" rating in a research report on Thursday, August 22nd. Four equities research analysts have rated the stock with a hold rating, thirteen have given a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat, O'Reilly Automotive currently has a consensus rating of "Moderate Buy" and a consensus target price of $1,242.13.

Check Out Our Latest Stock Report on O'Reilly Automotive

Insider Activity

In other news, Director Gregory D. Johnson sold 15,364 shares of the company's stock in a transaction dated Wednesday, July 31st. The shares were sold at an average price of $1,136.16, for a total value of $17,455,962.24. Following the sale, the director now owns 5,016 shares in the company, valued at approximately $5,698,978.56. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. In related news, SVP Mark Joseph Merz sold 413 shares of the stock in a transaction dated Tuesday, July 30th. The shares were sold at an average price of $1,120.00, for a total transaction of $462,560.00. Following the sale, the senior vice president now owns 265 shares in the company, valued at $296,800. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, Director Gregory D. Johnson sold 15,364 shares of the stock in a transaction dated Wednesday, July 31st. The stock was sold at an average price of $1,136.16, for a total transaction of $17,455,962.24. Following the sale, the director now owns 5,016 shares in the company, valued at approximately $5,698,978.56. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 50,411 shares of company stock worth $56,846,062. 1.55% of the stock is currently owned by corporate insiders.

O'Reilly Automotive Trading Down 0.4 %

ORLY stock traded down $4.55 during trading on Friday, reaching $1,195.22. The stock had a trading volume of 238,279 shares, compared to its average volume of 374,296. O'Reilly Automotive, Inc. has a 1-year low of $895.88 and a 1-year high of $1,221.18. The company has a market capitalization of $69.33 billion, a P/E ratio of 30.22, a PEG ratio of 2.29 and a beta of 0.92. The firm has a fifty day moving average price of $1,149.00 and a 200 day moving average price of $1,081.47.

O'Reilly Automotive (NASDAQ:ORLY - Get Free Report) last issued its earnings results on Wednesday, October 23rd. The specialty retailer reported $11.41 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $11.53 by ($0.12). The company had revenue of $4.36 billion during the quarter, compared to analyst estimates of $4.42 billion. O'Reilly Automotive had a net margin of 14.57% and a negative return on equity of 146.57%. The business's revenue for the quarter was up 3.8% compared to the same quarter last year. During the same quarter last year, the company posted $10.72 EPS. Sell-side analysts predict that O'Reilly Automotive, Inc. will post 41.05 EPS for the current year.

O'Reilly Automotive Company Profile

(

Free Report)

O'Reilly Automotive, Inc, together with its subsidiaries, operates as a retailer and supplier of automotive aftermarket parts, tools, supplies, equipment, and accessories in the United States, Puerto Rico, and Mexico. The company provides new and remanufactured automotive hard parts and maintenance items, such as alternators, batteries, brake system components, belts, chassis parts, driveline parts, engine parts, fuel pumps, hoses, starters, temperature control, water pumps, antifreeze, appearance products, engine additives, filters, fluids, lighting products, and oil and wiper blades; and accessories, including floor mats, seat covers, and truck accessories.

See Also

Before you consider O'Reilly Automotive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and O'Reilly Automotive wasn't on the list.

While O'Reilly Automotive currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report