Horrell Capital Management Inc. cut its stake in shares of O'Reilly Automotive, Inc. (NASDAQ:ORLY - Free Report) by 10.1% during the 3rd quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 18,631 shares of the specialty retailer's stock after selling 2,086 shares during the period. O'Reilly Automotive comprises about 6.4% of Horrell Capital Management Inc.'s investment portfolio, making the stock its biggest position. Horrell Capital Management Inc.'s holdings in O'Reilly Automotive were worth $21,455,000 as of its most recent filing with the SEC.

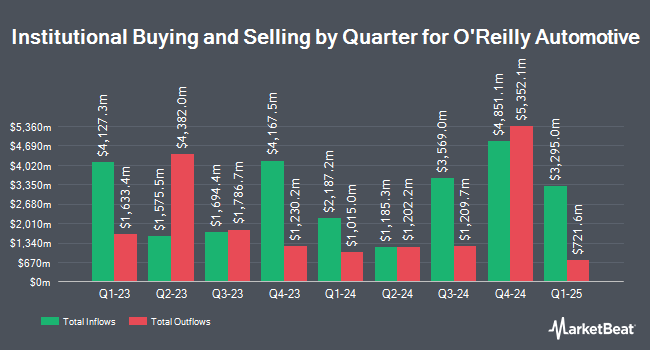

Other institutional investors and hedge funds also recently bought and sold shares of the company. GW Henssler & Associates Ltd. purchased a new position in shares of O'Reilly Automotive in the third quarter valued at about $211,000. MONECO Advisors LLC lifted its position in shares of O'Reilly Automotive by 5.1% in the third quarter. MONECO Advisors LLC now owns 393 shares of the specialty retailer's stock valued at $453,000 after acquiring an additional 19 shares in the last quarter. Integrated Advisors Network LLC lifted its position in shares of O'Reilly Automotive by 32.7% in the third quarter. Integrated Advisors Network LLC now owns 1,679 shares of the specialty retailer's stock valued at $1,934,000 after acquiring an additional 414 shares in the last quarter. China Universal Asset Management Co. Ltd. lifted its position in shares of O'Reilly Automotive by 107.9% in the third quarter. China Universal Asset Management Co. Ltd. now owns 736 shares of the specialty retailer's stock valued at $848,000 after acquiring an additional 382 shares in the last quarter. Finally, Boston Financial Mangement LLC lifted its position in shares of O'Reilly Automotive by 2.8% in the third quarter. Boston Financial Mangement LLC now owns 24,846 shares of the specialty retailer's stock valued at $28,613,000 after acquiring an additional 668 shares in the last quarter. 85.00% of the stock is currently owned by hedge funds and other institutional investors.

O'Reilly Automotive Price Performance

Shares of ORLY traded down $21.21 during mid-day trading on Tuesday, reaching $1,175.90. 470,604 shares of the company's stock traded hands, compared to its average volume of 374,669. The stock has a market cap of $68.21 billion, a P/E ratio of 29.62, a P/E/G ratio of 2.42 and a beta of 0.92. The stock's 50-day moving average is $1,152.02 and its two-hundred day moving average is $1,082.71. O'Reilly Automotive, Inc. has a 12 month low of $914.50 and a 12 month high of $1,221.18.

O'Reilly Automotive (NASDAQ:ORLY - Get Free Report) last released its earnings results on Wednesday, October 23rd. The specialty retailer reported $11.41 EPS for the quarter, missing analysts' consensus estimates of $11.53 by ($0.12). O'Reilly Automotive had a net margin of 14.52% and a negative return on equity of 155.25%. The business had revenue of $4.36 billion for the quarter, compared to the consensus estimate of $4.42 billion. During the same period in the prior year, the company posted $10.72 EPS. The company's quarterly revenue was up 3.8% compared to the same quarter last year. Research analysts predict that O'Reilly Automotive, Inc. will post 40.85 earnings per share for the current year.

Analyst Ratings Changes

Several equities analysts have recently commented on the company. JPMorgan Chase & Co. boosted their price objective on O'Reilly Automotive from $1,125.00 to $1,300.00 and gave the company an "overweight" rating in a research report on Wednesday, October 16th. Roth Mkm reiterated a "buy" rating and issued a $1,337.00 target price on shares of O'Reilly Automotive in a research report on Wednesday, October 16th. Barclays boosted their target price on O'Reilly Automotive from $986.00 to $1,088.00 and gave the stock an "equal weight" rating in a research report on Friday. TD Cowen boosted their target price on O'Reilly Automotive from $1,300.00 to $1,375.00 and gave the stock a "buy" rating in a research report on Friday. Finally, Wedbush reiterated a "neutral" rating and issued a $1,200.00 target price on shares of O'Reilly Automotive in a research report on Thursday, October 24th. Four research analysts have rated the stock with a hold rating, thirteen have issued a buy rating and two have assigned a strong buy rating to the company. According to MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average target price of $1,242.13.

Get Our Latest Stock Analysis on ORLY

Insider Buying and Selling

In related news, Chairman David E. Oreilly sold 1,000 shares of the stock in a transaction that occurred on Monday, August 19th. The stock was sold at an average price of $1,118.88, for a total value of $1,118,880.00. Following the transaction, the chairman now owns 183,583 shares of the company's stock, valued at $205,407,347.04. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. In other O'Reilly Automotive news, Director Gregory D. Johnson sold 15,364 shares of the company's stock in a transaction on Wednesday, July 31st. The stock was sold at an average price of $1,136.16, for a total transaction of $17,455,962.24. Following the completion of the sale, the director now owns 5,016 shares in the company, valued at $5,698,978.56. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website. Also, Chairman David E. Oreilly sold 1,000 shares of the company's stock in a transaction on Monday, August 19th. The stock was sold at an average price of $1,118.88, for a total value of $1,118,880.00. Following the sale, the chairman now owns 183,583 shares of the company's stock, valued at approximately $205,407,347.04. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 31,734 shares of company stock valued at $35,789,929 over the last quarter. 1.18% of the stock is owned by corporate insiders.

O'Reilly Automotive Profile

(

Free Report)

O'Reilly Automotive, Inc, together with its subsidiaries, operates as a retailer and supplier of automotive aftermarket parts, tools, supplies, equipment, and accessories in the United States, Puerto Rico, and Mexico. The company provides new and remanufactured automotive hard parts and maintenance items, such as alternators, batteries, brake system components, belts, chassis parts, driveline parts, engine parts, fuel pumps, hoses, starters, temperature control, water pumps, antifreeze, appearance products, engine additives, filters, fluids, lighting products, and oil and wiper blades; and accessories, including floor mats, seat covers, and truck accessories.

Featured Articles

Before you consider O'Reilly Automotive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and O'Reilly Automotive wasn't on the list.

While O'Reilly Automotive currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report