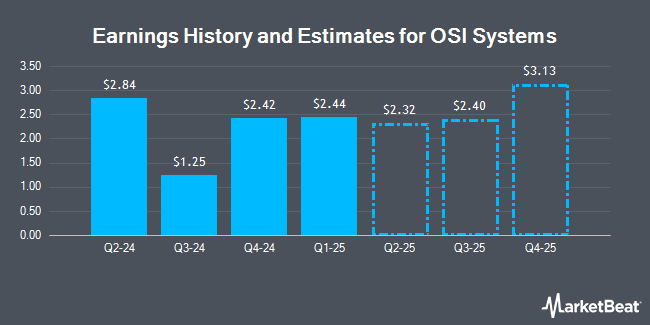

OSI Systems, Inc. (NASDAQ:OSIS - Free Report) - Investment analysts at B. Riley boosted their Q3 2025 EPS estimates for shares of OSI Systems in a research note issued on Friday, October 25th. B. Riley analyst J. Nichols now forecasts that the technology company will earn $2.46 per share for the quarter, up from their prior forecast of $2.45. B. Riley has a "Buy" rating and a $180.00 price objective on the stock. The consensus estimate for OSI Systems' current full-year earnings is $9.09 per share. B. Riley also issued estimates for OSI Systems' Q4 2025 earnings at $3.02 EPS, FY2025 earnings at $9.13 EPS and FY2026 earnings at $9.50 EPS.

OSIS has been the subject of a number of other research reports. Wells Fargo & Company assumed coverage on shares of OSI Systems in a research report on Wednesday, September 18th. They set an "overweight" rating and a $170.00 target price for the company. Bank of America assumed coverage on shares of OSI Systems in a research report on Monday, September 30th. They set a "buy" rating and a $175.00 target price for the company. Finally, Roth Mkm increased their target price on shares of OSI Systems from $172.00 to $178.00 and gave the stock a "buy" rating in a research report on Friday, August 23rd. One equities research analyst has rated the stock with a hold rating and five have given a buy rating to the company's stock. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus target price of $172.60.

View Our Latest Research Report on OSI Systems

OSI Systems Price Performance

Shares of OSI Systems stock traded down $2.95 during mid-day trading on Monday, reaching $131.41. 297,502 shares of the stock were exchanged, compared to its average volume of 119,883. The company has a market cap of $2.18 billion, a price-to-earnings ratio of 17.05, a price-to-earnings-growth ratio of 1.25 and a beta of 1.08. The company has a current ratio of 1.84, a quick ratio of 1.20 and a debt-to-equity ratio of 0.60. The firm has a 50-day simple moving average of $145.19 and a 200 day simple moving average of $141.47. OSI Systems has a fifty-two week low of $103.04 and a fifty-two week high of $158.69.

OSI Systems (NASDAQ:OSIS - Get Free Report) last released its quarterly earnings data on Thursday, October 24th. The technology company reported $1.25 EPS for the quarter, topping analysts' consensus estimates of $1.06 by $0.19. The company had revenue of $344.01 million during the quarter, compared to the consensus estimate of $318.66 million. OSI Systems had a net margin of 8.31% and a return on equity of 18.17%. The firm's revenue for the quarter was up 23.2% compared to the same quarter last year. During the same period last year, the firm earned $0.91 EPS.

Institutional Inflows and Outflows

Hedge funds and other institutional investors have recently bought and sold shares of the company. Arizona State Retirement System lifted its stake in OSI Systems by 2.2% in the second quarter. Arizona State Retirement System now owns 4,532 shares of the technology company's stock valued at $623,000 after buying an additional 97 shares in the last quarter. Louisiana State Employees Retirement System lifted its stake in OSI Systems by 1.3% in the second quarter. Louisiana State Employees Retirement System now owns 7,900 shares of the technology company's stock valued at $1,086,000 after buying an additional 100 shares in the last quarter. US Bancorp DE lifted its stake in OSI Systems by 4.8% in the third quarter. US Bancorp DE now owns 2,418 shares of the technology company's stock valued at $367,000 after buying an additional 111 shares in the last quarter. Inspire Investing LLC lifted its stake in OSI Systems by 7.9% in the third quarter. Inspire Investing LLC now owns 2,741 shares of the technology company's stock valued at $416,000 after buying an additional 200 shares in the last quarter. Finally, Zurcher Kantonalbank Zurich Cantonalbank raised its holdings in shares of OSI Systems by 5.5% in the second quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 3,901 shares of the technology company's stock valued at $536,000 after purchasing an additional 202 shares during the last quarter. Institutional investors own 89.21% of the company's stock.

Insider Buying and Selling at OSI Systems

In other OSI Systems news, CEO Deepak Chopra sold 20,000 shares of the firm's stock in a transaction dated Monday, September 16th. The shares were sold at an average price of $144.92, for a total value of $2,898,400.00. Following the completion of the sale, the chief executive officer now owns 459,033 shares in the company, valued at approximately $66,523,062.36. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. In other news, CEO Deepak Chopra sold 20,000 shares of the firm's stock in a transaction dated Monday, September 16th. The shares were sold at an average price of $144.92, for a total value of $2,898,400.00. Following the transaction, the chief executive officer now owns 459,033 shares of the company's stock, valued at approximately $66,523,062.36. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this hyperlink. Also, Director Gerald M. Chizever sold 3,000 shares of the firm's stock in a transaction dated Wednesday, September 11th. The shares were sold at an average price of $138.41, for a total transaction of $415,230.00. Following the completion of the transaction, the director now directly owns 3,462 shares in the company, valued at $479,175.42. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders sold 24,107 shares of company stock worth $3,474,189. 5.60% of the stock is currently owned by corporate insiders.

OSI Systems Company Profile

(

Get Free Report)

OSI Systems, Inc designs and manufactures electronic systems and components. It operates in three segments: Security, Healthcare, and Optoelectronics and Manufacturing. The Security segment offers baggage and parcel inspection, cargo and vehicle inspection, hold baggage and people screening, radiation monitoring, explosive and narcotics trace detection systems, and optical inspection systems under the Rapiscan name.

Further Reading

Before you consider OSI Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and OSI Systems wasn't on the list.

While OSI Systems currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.