Canoe Financial LP grew its position in Open Text Co. (NASDAQ:OTEX - Free Report) TSE: OTC by 33.6% in the 3rd quarter, according to its most recent filing with the Securities & Exchange Commission. The firm owned 66,000 shares of the software maker's stock after buying an additional 16,585 shares during the period. Canoe Financial LP's holdings in Open Text were worth $2,184,000 at the end of the most recent quarter.

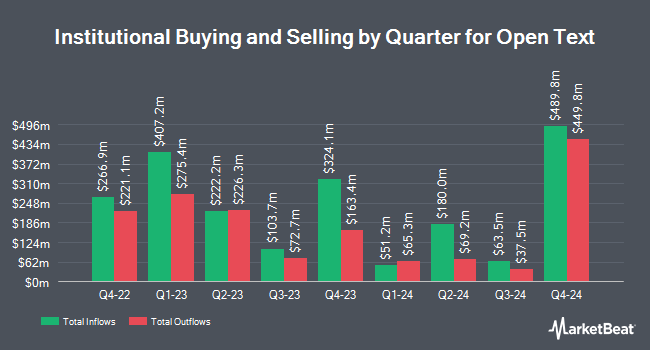

A number of other large investors have also made changes to their positions in the company. Brandes Investment Partners LP increased its position in shares of Open Text by 236.8% during the second quarter. Brandes Investment Partners LP now owns 1,834,835 shares of the software maker's stock worth $55,059,000 after acquiring an additional 1,290,011 shares in the last quarter. The Manufacturers Life Insurance Company increased its holdings in Open Text by 25.1% during the 2nd quarter. The Manufacturers Life Insurance Company now owns 5,578,835 shares of the software maker's stock worth $167,277,000 after purchasing an additional 1,118,479 shares in the last quarter. Cooke & Bieler LP raised its stake in shares of Open Text by 18.6% in the 2nd quarter. Cooke & Bieler LP now owns 5,536,769 shares of the software maker's stock valued at $166,325,000 after purchasing an additional 867,978 shares during the period. JARISLOWSKY FRASER Ltd lifted its holdings in shares of Open Text by 5.1% in the second quarter. JARISLOWSKY FRASER Ltd now owns 15,702,510 shares of the software maker's stock valued at $471,415,000 after purchasing an additional 767,822 shares in the last quarter. Finally, National Bank of Canada FI grew its holdings in shares of Open Text by 17.5% during the second quarter. National Bank of Canada FI now owns 4,021,893 shares of the software maker's stock worth $120,390,000 after buying an additional 599,790 shares in the last quarter. Institutional investors own 70.37% of the company's stock.

Analyst Ratings Changes

Several research firms have commented on OTEX. National Bank Financial cut Open Text from an "outperform" rating to a "sector perform" rating in a research note on Friday, August 2nd. National Bankshares downgraded shares of Open Text from an "outperform" rating to a "sector perform" rating and set a $38.00 target price for the company. in a research report on Friday, August 2nd. Jefferies Financial Group cut their price target on shares of Open Text from $42.00 to $35.00 and set a "buy" rating on the stock in a research report on Friday, August 2nd. CIBC reduced their price target on Open Text from $36.00 to $33.00 and set a "neutral" rating for the company in a research report on Friday, July 19th. Finally, Citigroup upped their price objective on Open Text from $32.00 to $34.00 and gave the stock a "neutral" rating in a research note on Wednesday, September 25th. Seven analysts have rated the stock with a hold rating and five have issued a buy rating to the company. According to MarketBeat, the stock currently has an average rating of "Hold" and an average target price of $38.89.

Check Out Our Latest Analysis on OTEX

Open Text Stock Performance

Shares of OTEX traded up $0.47 during trading hours on Monday, hitting $33.75. The company had a trading volume of 295,745 shares, compared to its average volume of 628,419. The firm has a market cap of $8.96 billion, a price-to-earnings ratio of 19.74 and a beta of 1.12. The company has a quick ratio of 0.81, a current ratio of 0.81 and a debt-to-equity ratio of 1.51. The business has a fifty day moving average of $32.74 and a 200-day moving average of $31.64. Open Text Co. has a 12 month low of $27.50 and a 12 month high of $45.47.

Open Text (NASDAQ:OTEX - Get Free Report) TSE: OTC last issued its quarterly earnings data on Thursday, August 1st. The software maker reported $0.98 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.93 by $0.05. Open Text had a net margin of 8.06% and a return on equity of 25.00%. The firm had revenue of $1.36 billion during the quarter, compared to the consensus estimate of $1.41 billion. During the same period last year, the business posted $0.79 earnings per share. The business's revenue for the quarter was down 8.6% compared to the same quarter last year. Equities analysts anticipate that Open Text Co. will post 3.23 EPS for the current fiscal year.

Open Text Cuts Dividend

The company also recently disclosed a quarterly dividend, which was paid on Friday, September 20th. Shareholders of record on Friday, August 30th were issued a $0.192 dividend. This represents a $0.77 dividend on an annualized basis and a yield of 2.28%. The ex-dividend date was Friday, August 30th. Open Text's dividend payout ratio is 61.40%.

Open Text Profile

(

Free Report)

Open Text Corporation provides information management software and solutions. The company offers content services, which includes content collaboration and intelligent capture to records management, collaboration, e-signatures, and archiving; and operates experience cloud platform that provides customer experience and web content management, digital asset management, customer analytics, AI and insights, e-discovery, digital fax, omnichannel communications, secure messaging, and voice of customer, as well as customer journey, testing, and segmentation.

Read More

Before you consider Open Text, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Open Text wasn't on the list.

While Open Text currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.