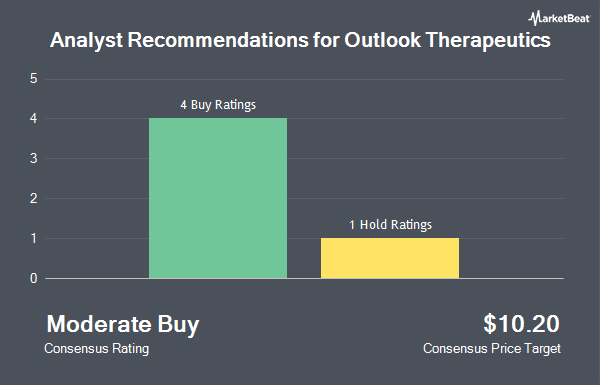

Outlook Therapeutics, Inc. (NASDAQ:OTLK - Get Free Report) has received a consensus recommendation of "Buy" from the seven research firms that are currently covering the firm, MarketBeat reports. Seven research analysts have rated the stock with a buy recommendation. The average 1 year price objective among brokerages that have issued a report on the stock in the last year is $48.20.

Several analysts have issued reports on the stock. Ascendiant Capital Markets decreased their price objective on shares of Outlook Therapeutics from $35.00 to $33.00 and set a "buy" rating for the company in a research note on Tuesday, September 3rd. BTIG Research reissued a "buy" rating and set a $50.00 price target on shares of Outlook Therapeutics in a research note on Friday, October 18th. HC Wainwright reaffirmed a "buy" rating and issued a $30.00 price objective on shares of Outlook Therapeutics in a research report on Thursday, August 15th. Finally, Chardan Capital reiterated a "buy" rating and set a $53.00 target price on shares of Outlook Therapeutics in a research report on Friday, August 16th.

View Our Latest Report on Outlook Therapeutics

Outlook Therapeutics Trading Up 0.5 %

NASDAQ:OTLK traded up $0.03 during midday trading on Wednesday, hitting $5.77. 97,130 shares of the company traded hands, compared to its average volume of 350,703. The firm has a market capitalization of $136.50 million, a P/E ratio of -0.50 and a beta of 0.62. The firm's fifty day moving average is $6.13 and its 200-day moving average is $7.19. Outlook Therapeutics has a 12-month low of $4.61 and a 12-month high of $13.32.

Outlook Therapeutics (NASDAQ:OTLK - Get Free Report) last announced its earnings results on Wednesday, August 14th. The company reported ($0.83) earnings per share for the quarter, beating the consensus estimate of ($1.06) by $0.23. On average, research analysts expect that Outlook Therapeutics will post -3.63 EPS for the current fiscal year.

Insider Transactions at Outlook Therapeutics

In other Outlook Therapeutics news, CFO Lawrence A. Kenyon acquired 5,000 shares of the company's stock in a transaction dated Thursday, September 26th. The shares were purchased at an average cost of $5.69 per share, for a total transaction of $28,450.00. Following the completion of the purchase, the chief financial officer now owns 5,946 shares in the company, valued at approximately $33,832.74. This trade represents a 500.00 % increase in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which can be accessed through this link. Corporate insiders own 3.40% of the company's stock.

Institutional Investors Weigh In On Outlook Therapeutics

A number of institutional investors have recently added to or reduced their stakes in the stock. Great Point Partners LLC lifted its position in shares of Outlook Therapeutics by 15.0% during the second quarter. Great Point Partners LLC now owns 1,701,510 shares of the company's stock valued at $12,557,000 after buying an additional 221,510 shares during the last quarter. Rosalind Advisors Inc. lifted its position in Outlook Therapeutics by 44.3% during the second quarter. Rosalind Advisors Inc. now owns 450,000 shares of the company's stock valued at $3,321,000 after acquiring an additional 138,225 shares during the last quarter. LVW Advisors LLC acquired a new stake in Outlook Therapeutics in the second quarter valued at approximately $352,000. Susquehanna Fundamental Investments LLC acquired a new stake in Outlook Therapeutics in the second quarter valued at approximately $303,000. Finally, Squarepoint Ops LLC purchased a new position in Outlook Therapeutics in the second quarter worth $232,000. Institutional investors own 11.20% of the company's stock.

About Outlook Therapeutics

(

Get Free ReportOutlook Therapeutics, Inc, operates as a clinical-stage biopharmaceutical company, focuses on developing and commercializing monoclonal antibodies for various ophthalmic indications. Its lead product candidate is ONS-5010, an ophthalmic formulation of bevacizumab product candidate that is in Phase-III clinical trial for the treatment of wet age-related macular degeneration and other retina diseases.

Featured Stories

Before you consider Outlook Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Outlook Therapeutics wasn't on the list.

While Outlook Therapeutics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.