Otter Tail (NASDAQ:OTTR - Get Free Report) issued an update on its FY 2024 earnings guidance on Monday morning. The company provided EPS guidance of 6.970-7.170 for the period, compared to the consensus EPS estimate of 7.100. The company issued revenue guidance of -.

Otter Tail Stock Up 0.6 %

Shares of OTTR traded up $0.44 during midday trading on Monday, reaching $78.53. The stock had a trading volume of 206,228 shares, compared to its average volume of 229,542. The company's fifty day simple moving average is $79.11 and its two-hundred day simple moving average is $85.74. Otter Tail has a 1-year low of $74.09 and a 1-year high of $100.84. The company has a debt-to-equity ratio of 0.60, a current ratio of 2.27 and a quick ratio of 1.67. The company has a market cap of $3.28 billion, a price-to-earnings ratio of 10.55 and a beta of 0.52.

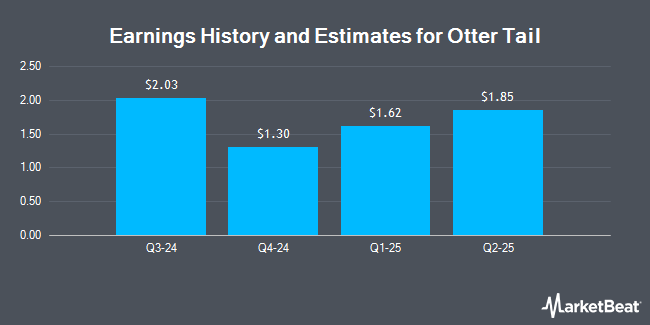

Otter Tail (NASDAQ:OTTR - Get Free Report) last announced its quarterly earnings results on Monday, August 5th. The utilities provider reported $2.07 EPS for the quarter, topping the consensus estimate of $1.69 by $0.38. Otter Tail had a net margin of 22.84% and a return on equity of 21.06%. The firm had revenue of $342.34 million for the quarter, compared to analyst estimates of $367.71 million. During the same period last year, the business earned $1.95 EPS. Otter Tail's revenue for the quarter was up 1.4% compared to the same quarter last year. Equities research analysts expect that Otter Tail will post 7.01 earnings per share for the current year.

Insider Buying and Selling at Otter Tail

In other Otter Tail news, VP Jennifer O. Smestad sold 4,000 shares of Otter Tail stock in a transaction on Tuesday, August 13th. The shares were sold at an average price of $88.74, for a total value of $354,960.00. Following the transaction, the vice president now directly owns 12,300 shares in the company, valued at approximately $1,091,502. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. 2.30% of the stock is currently owned by company insiders.

About Otter Tail

(

Get Free Report)

Otter Tail Corporation, together with its subsidiaries, engages in electric utility, manufacturing, and plastic pipe businesses in the United States. It operates through three segments: Electric, Manufacturing, and Plastics. The Electric segment produces, transmits, distributes, and sells electric energy in Minnesota, North Dakota, and South Dakota; and operates as a participant in the Midcontinent Independent System Operator markets.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Otter Tail, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Otter Tail wasn't on the list.

While Otter Tail currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.