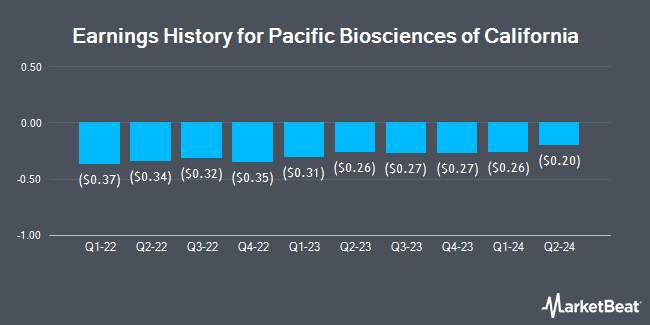

Pacific Biosciences of California (NASDAQ:PACB - Get Free Report) is scheduled to be releasing its earnings data after the market closes on Thursday, November 7th. Analysts expect Pacific Biosciences of California to post earnings of ($0.20) per share for the quarter. Individual that are interested in registering for the company's earnings conference call can do so using this link.

Pacific Biosciences of California (NASDAQ:PACB - Get Free Report) last posted its quarterly earnings data on Wednesday, August 7th. The biotechnology company reported ($0.20) EPS for the quarter, beating analysts' consensus estimates of ($0.24) by $0.04. Pacific Biosciences of California had a negative net margin of 211.99% and a negative return on equity of 40.98%. The company had revenue of $36.01 million during the quarter, compared to the consensus estimate of $40.52 million. On average, analysts expect Pacific Biosciences of California to post $-1 EPS for the current fiscal year and $-1 EPS for the next fiscal year.

Pacific Biosciences of California Trading Up 0.5 %

Shares of PACB traded up $0.01 during mid-day trading on Thursday, hitting $2.17. The company had a trading volume of 7,940,094 shares, compared to its average volume of 9,346,773. Pacific Biosciences of California has a 1-year low of $1.16 and a 1-year high of $10.65. The company has a quick ratio of 7.14, a current ratio of 8.01 and a debt-to-equity ratio of 1.81. The business's 50-day simple moving average is $1.72 and its 200-day simple moving average is $1.71. The stock has a market cap of $591.39 million, a PE ratio of -1.44 and a beta of 2.05.

Analyst Upgrades and Downgrades

A number of analysts have recently commented on the company. Canaccord Genuity Group dropped their price objective on Pacific Biosciences of California from $3.50 to $3.00 and set a "buy" rating for the company in a report on Thursday, August 8th. Scotiabank decreased their target price on Pacific Biosciences of California from $8.00 to $7.00 and set a "sector outperform" rating for the company in a report on Wednesday, August 28th. Morgan Stanley dropped their target price on shares of Pacific Biosciences of California from $4.00 to $2.00 and set an "equal weight" rating for the company in a research report on Monday, August 12th. StockNews.com raised shares of Pacific Biosciences of California to a "sell" rating in a research report on Tuesday, August 13th. Finally, Cantor Fitzgerald reissued an "overweight" rating and issued a $3.50 price objective on shares of Pacific Biosciences of California in a research report on Thursday, August 8th. One analyst has rated the stock with a sell rating, seven have assigned a hold rating and eight have given a buy rating to the company's stock. Based on data from MarketBeat, the company has a consensus rating of "Hold" and a consensus price target of $4.50.

Get Our Latest Report on Pacific Biosciences of California

Insider Activity at Pacific Biosciences of California

In related news, insider Oene Mark Van sold 38,011 shares of Pacific Biosciences of California stock in a transaction on Friday, August 16th. The shares were sold at an average price of $1.66, for a total value of $63,098.26. Following the completion of the sale, the insider now owns 1,630,815 shares in the company, valued at approximately $2,707,152.90. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. In other news, insider Oene Mark Van sold 38,011 shares of the stock in a transaction dated Friday, August 16th. The shares were sold at an average price of $1.66, for a total transaction of $63,098.26. Following the transaction, the insider now owns 1,630,815 shares of the company's stock, valued at approximately $2,707,152.90. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, insider Jeff Eidel sold 26,760 shares of the business's stock in a transaction dated Monday, August 19th. The shares were sold at an average price of $1.59, for a total value of $42,548.40. Following the completion of the sale, the insider now directly owns 869,730 shares of the company's stock, valued at approximately $1,382,870.70. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 2.40% of the stock is currently owned by company insiders.

Pacific Biosciences of California Company Profile

(

Get Free Report)

Pacific Biosciences of California, Inc designs, develops, and manufactures sequencing solution to resolve genetically complex problems. The company provides sequencing systems; consumable products, including single molecule real-time (SMRT) technology; long-red sequencing; and various reagent kits designed for specific workflow, such as preparation kit to convert DNA into SMRTbell double-stranded DNA library formats, including molecular biology reagents, such as ligase, buffers, and exonucleases.

Featured Stories

Before you consider Pacific Biosciences of California, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pacific Biosciences of California wasn't on the list.

While Pacific Biosciences of California currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.