Farmers & Merchants Investments Inc. lifted its holdings in shares of Palo Alto Networks, Inc. (NASDAQ:PANW - Free Report) by 15.0% in the third quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 40,173 shares of the network technology company's stock after buying an additional 5,250 shares during the period. Farmers & Merchants Investments Inc.'s holdings in Palo Alto Networks were worth $13,731,000 as of its most recent filing with the SEC.

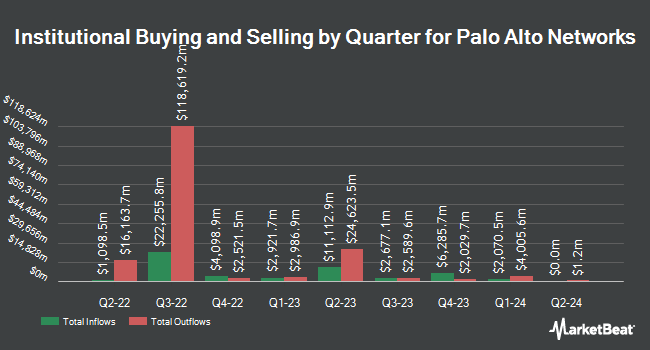

Several other institutional investors and hedge funds have also modified their holdings of the business. Pathway Financial Advisers LLC bought a new stake in Palo Alto Networks during the 1st quarter worth $25,000. Capital Advisors Ltd. LLC boosted its position in Palo Alto Networks by 113.9% during the 3rd quarter. Capital Advisors Ltd. LLC now owns 77 shares of the network technology company's stock worth $26,000 after buying an additional 41 shares during the period. Sound Income Strategies LLC grew its holdings in Palo Alto Networks by 352.6% during the 3rd quarter. Sound Income Strategies LLC now owns 86 shares of the network technology company's stock worth $29,000 after acquiring an additional 67 shares during the last quarter. Strategic Investment Solutions Inc. IL increased its position in Palo Alto Networks by 177.4% in the 3rd quarter. Strategic Investment Solutions Inc. IL now owns 86 shares of the network technology company's stock valued at $29,000 after acquiring an additional 55 shares during the period. Finally, Cape Investment Advisory Inc. raised its stake in shares of Palo Alto Networks by 1,111.1% during the first quarter. Cape Investment Advisory Inc. now owns 109 shares of the network technology company's stock valued at $31,000 after acquiring an additional 100 shares during the last quarter. 79.82% of the stock is currently owned by institutional investors.

Palo Alto Networks Stock Performance

PANW stock traded up $3.04 during mid-day trading on Tuesday, hitting $365.39. The company had a trading volume of 2,094,040 shares, compared to its average volume of 3,963,510. Palo Alto Networks, Inc. has a 12 month low of $233.81 and a 12 month high of $384.00. The stock's fifty day moving average price is $352.24 and its two-hundred day moving average price is $327.94. The firm has a market cap of $118.97 billion, a PE ratio of 50.40, a price-to-earnings-growth ratio of 5.31 and a beta of 1.13.

Palo Alto Networks (NASDAQ:PANW - Get Free Report) last posted its quarterly earnings data on Monday, August 19th. The network technology company reported $1.51 EPS for the quarter, beating the consensus estimate of $1.41 by $0.10. Palo Alto Networks had a return on equity of 26.83% and a net margin of 32.11%. The business had revenue of $2.19 billion for the quarter, compared to the consensus estimate of $2.16 billion. During the same quarter in the prior year, the business earned $0.80 earnings per share. Palo Alto Networks's revenue for the quarter was up 12.1% on a year-over-year basis. Equities analysts anticipate that Palo Alto Networks, Inc. will post 3.57 earnings per share for the current year.

Insiders Place Their Bets

In other news, EVP Lee Klarich sold 60,000 shares of the firm's stock in a transaction on Monday, August 5th. The stock was sold at an average price of $295.93, for a total value of $17,755,800.00. Following the completion of the transaction, the executive vice president now directly owns 159,009 shares of the company's stock, valued at $47,055,533.37. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. In other news, EVP Lee Klarich sold 60,000 shares of the stock in a transaction dated Monday, August 5th. The shares were sold at an average price of $295.93, for a total value of $17,755,800.00. Following the sale, the executive vice president now directly owns 159,009 shares of the company's stock, valued at approximately $47,055,533.37. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. Also, EVP Nir Zuk sold 36,000 shares of the firm's stock in a transaction that occurred on Thursday, August 1st. The shares were sold at an average price of $317.77, for a total transaction of $11,439,720.00. Following the completion of the transaction, the executive vice president now owns 1,187,567 shares of the company's stock, valued at $377,373,165.59. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 351,452 shares of company stock worth $118,643,279 over the last quarter. 3.30% of the stock is currently owned by company insiders.

Analyst Upgrades and Downgrades

A number of analysts recently weighed in on the company. BMO Capital Markets increased their price objective on Palo Alto Networks from $334.00 to $390.00 and gave the company an "outperform" rating in a report on Tuesday, August 20th. BTIG Research raised their price objective on Palo Alto Networks from $366.00 to $395.00 and gave the stock a "buy" rating in a research report on Tuesday, August 20th. BNP Paribas started coverage on shares of Palo Alto Networks in a research report on Tuesday, October 8th. They set an "outperform" rating and a $410.00 target price for the company. Truist Financial upped their price objective on shares of Palo Alto Networks from $350.00 to $400.00 and gave the company a "buy" rating in a research note on Tuesday, August 20th. Finally, Wedbush reaffirmed an "outperform" rating and set a $375.00 price target on shares of Palo Alto Networks in a research report on Friday, August 16th. Eleven equities research analysts have rated the stock with a hold rating, twenty-nine have given a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat, Palo Alto Networks currently has a consensus rating of "Moderate Buy" and an average price target of $376.82.

Read Our Latest Stock Analysis on Palo Alto Networks

About Palo Alto Networks

(

Free Report)

Palo Alto Networks, Inc provides cybersecurity solutions worldwide. The company offers firewall appliances and software; and Panorama, a security management solution for the global control of network security platform as a virtual or a physical appliance. It also provides subscription services covering the areas of threat prevention, malware and persistent threat, URL filtering, laptop and mobile device protection, DNS security, Internet of Things security, SaaS security API, and SaaS security inline, as well as threat intelligence, and data loss prevention.

Read More

Before you consider Palo Alto Networks, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Palo Alto Networks wasn't on the list.

While Palo Alto Networks currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.