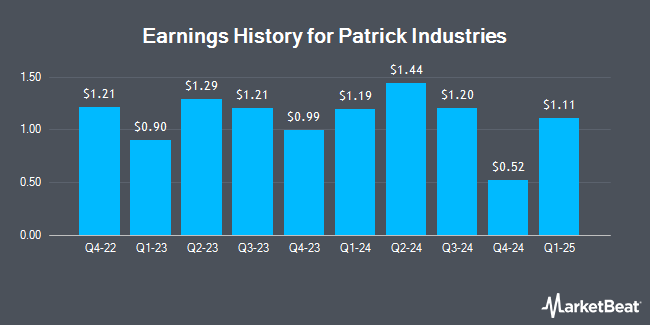

Patrick Industries (NASDAQ:PATK - Get Free Report) posted its quarterly earnings results on Thursday. The construction company reported $1.80 EPS for the quarter, missing the consensus estimate of $1.83 by ($0.03), Briefing.com reports. Patrick Industries had a net margin of 4.26% and a return on equity of 15.06%. The business had revenue of $919.44 million during the quarter, compared to the consensus estimate of $935.75 million. During the same quarter in the prior year, the firm posted $1.81 EPS. The company's revenue for the quarter was up 6.2% compared to the same quarter last year.

Patrick Industries Trading Down 6.0 %

Shares of Patrick Industries stock opened at $125.98 on Friday. The firm's 50 day simple moving average is $137.01 and its two-hundred day simple moving average is $121.62. The firm has a market capitalization of $2.82 billion, a price-to-earnings ratio of 18.07, a PEG ratio of 1.26 and a beta of 1.61. Patrick Industries has a 12-month low of $73.26 and a 12-month high of $148.35. The company has a current ratio of 2.29, a quick ratio of 0.94 and a debt-to-equity ratio of 1.19.

Patrick Industries Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Monday, September 9th. Shareholders of record on Monday, August 26th were given a dividend of $0.55 per share. This represents a $2.20 annualized dividend and a yield of 1.75%. The ex-dividend date of this dividend was Monday, August 26th. Patrick Industries's dividend payout ratio is presently 31.56%.

Wall Street Analyst Weigh In

A number of equities analysts recently commented on PATK shares. Raymond James assumed coverage on shares of Patrick Industries in a research note on Tuesday, October 1st. They issued an "outperform" rating and a $160.00 price objective for the company. Robert W. Baird boosted their price target on Patrick Industries from $120.00 to $128.00 and gave the stock an "outperform" rating in a research report on Friday, August 2nd. BMO Capital Markets upped their price objective on Patrick Industries from $125.00 to $135.00 and gave the stock an "outperform" rating in a research note on Friday, August 2nd. Truist Financial lifted their target price on Patrick Industries from $150.00 to $165.00 and gave the company a "buy" rating in a research note on Friday, September 20th. Finally, Benchmark reissued a "buy" rating and set a $145.00 price target on shares of Patrick Industries in a research report on Tuesday, September 17th. Two research analysts have rated the stock with a hold rating and seven have assigned a buy rating to the stock. Based on data from MarketBeat.com, Patrick Industries has an average rating of "Moderate Buy" and an average price target of $140.38.

Check Out Our Latest Stock Analysis on PATK

Insider Transactions at Patrick Industries

In related news, insider Jeff Rodino sold 20,000 shares of the company's stock in a transaction on Thursday, September 12th. The stock was sold at an average price of $131.37, for a total value of $2,627,400.00. Following the transaction, the insider now directly owns 139,109 shares of the company's stock, valued at $18,274,749.33. This represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. In other news, COO Hugo E. Gonzalez sold 1,911 shares of the company's stock in a transaction on Thursday, August 29th. The shares were sold at an average price of $130.11, for a total value of $248,640.21. Following the sale, the chief operating officer now directly owns 23,759 shares of the company's stock, valued at $3,091,283.49. This represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, insider Jeff Rodino sold 20,000 shares of the firm's stock in a transaction on Thursday, September 12th. The stock was sold at an average price of $131.37, for a total transaction of $2,627,400.00. Following the transaction, the insider now directly owns 139,109 shares of the company's stock, valued at approximately $18,274,749.33. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 29,411 shares of company stock worth $3,858,915. Company insiders own 4.70% of the company's stock.

About Patrick Industries

(

Get Free Report)

Patrick Industries, Inc manufactures and distributes component products and materials for the recreational vehicle, marine, manufactured housing, and industrial markets in the United States, Mexico, China, and Canada. Its Manufacturing segment manufactures and sells laminated products for furniture, shelving, wall, countertop, and cabinet products; cabinet doors, fiberglass bath fixtures, and tile systems; hardwood furniture, vinyl printing, amplifiers, tower speakers, soundbars, and subwoofers; solid surface, granite, and quartz countertop fabrication; aluminum products; fiberglass and plastic components; RV paintings; decorative vinyl and paper laminated panels; softwoods lumber; custom cabinets; polymer-based flooring products; dash panels; and other products.

Featured Stories

Before you consider Patrick Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Patrick Industries wasn't on the list.

While Patrick Industries currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.