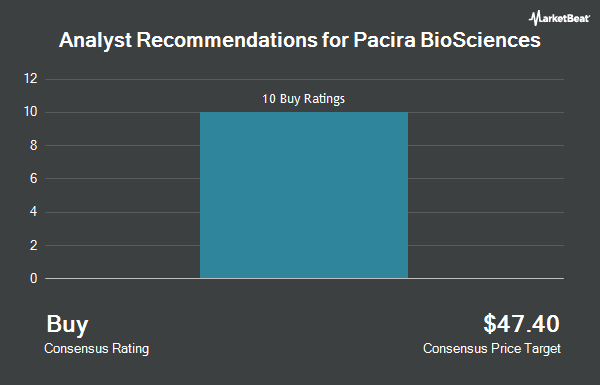

Pacira BioSciences, Inc. (NASDAQ:PCRX - Get Free Report) has been assigned a consensus recommendation of "Hold" from the ten ratings firms that are covering the company, MarketBeat.com reports. Two investment analysts have rated the stock with a sell rating, four have assigned a hold rating and four have issued a buy rating on the company. The average 1 year price objective among brokers that have issued a report on the stock in the last year is $24.20.

PCRX has been the subject of several research reports. JPMorgan Chase & Co. restated an "underweight" rating and set a $10.00 price target (down previously from $45.00) on shares of Pacira BioSciences in a research report on Monday, August 12th. Truist Financial downgraded Pacira BioSciences from a "buy" rating to a "sell" rating and decreased their target price for the stock from $30.00 to $8.00 in a research report on Tuesday, August 13th. Raymond James cut Pacira BioSciences from an "outperform" rating to a "market perform" rating in a research report on Monday, August 12th. Piper Sandler lowered Pacira BioSciences from an "overweight" rating to a "neutral" rating and decreased their price objective for the stock from $42.00 to $11.00 in a report on Monday, August 12th. Finally, HC Wainwright dropped their price objective on shares of Pacira BioSciences from $57.00 to $39.00 and set a "buy" rating on the stock in a report on Monday, August 12th.

Get Our Latest Stock Report on PCRX

Insider Activity at Pacira BioSciences

In related news, CEO Frank D. Lee acquired 8,264 shares of the firm's stock in a transaction that occurred on Monday, August 12th. The shares were bought at an average cost of $12.10 per share, for a total transaction of $99,994.40. Following the completion of the transaction, the chief executive officer now owns 107,784 shares in the company, valued at approximately $1,304,186.40. This trade represents a 0.00 % increase in their ownership of the stock. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Over the last quarter, insiders acquired 11,176 shares of company stock valued at $136,240. Company insiders own 6.40% of the company's stock.

Hedge Funds Weigh In On Pacira BioSciences

A number of large investors have recently modified their holdings of PCRX. Vanguard Group Inc. increased its holdings in shares of Pacira BioSciences by 0.3% in the first quarter. Vanguard Group Inc. now owns 5,113,384 shares of the company's stock worth $149,413,000 after buying an additional 14,960 shares during the period. Pacer Advisors Inc. increased its stake in Pacira BioSciences by 37.5% in the 2nd quarter. Pacer Advisors Inc. now owns 2,162,787 shares of the company's stock worth $61,877,000 after purchasing an additional 590,082 shares during the period. Renaissance Technologies LLC lifted its position in Pacira BioSciences by 9.8% in the second quarter. Renaissance Technologies LLC now owns 2,066,197 shares of the company's stock valued at $59,114,000 after purchasing an additional 184,000 shares during the last quarter. Dimensional Fund Advisors LP boosted its stake in shares of Pacira BioSciences by 12.2% during the second quarter. Dimensional Fund Advisors LP now owns 1,828,065 shares of the company's stock valued at $52,300,000 after purchasing an additional 198,936 shares during the period. Finally, Clearbridge Investments LLC boosted its stake in shares of Pacira BioSciences by 2.3% during the first quarter. Clearbridge Investments LLC now owns 1,172,150 shares of the company's stock valued at $34,250,000 after purchasing an additional 26,463 shares during the period. 99.73% of the stock is owned by hedge funds and other institutional investors.

Pacira BioSciences Stock Up 5.0 %

Shares of Pacira BioSciences stock traded up $0.83 on Tuesday, hitting $17.28. The company had a trading volume of 417,558 shares, compared to its average volume of 864,076. The company has a debt-to-equity ratio of 0.67, a quick ratio of 5.70 and a current ratio of 6.82. The stock has a market capitalization of $797.07 million, a price-to-earnings ratio of 13.28 and a beta of 0.82. The stock has a 50 day moving average of $15.43 and a 200-day moving average of $21.18. Pacira BioSciences has a 1 year low of $11.16 and a 1 year high of $35.95.

About Pacira BioSciences

(

Get Free ReportPacira BioSciences, Inc engages in the development, manufacture, marketing, distribution, and sale of non-opioid pain management and regenerative health solutions to healthcare practitioners in the United States. The company offers EXPAREL, a bupivacaine liposome injectable suspension; ZILRETTA, a triamcinolone acetonide extended-release injectable suspension; and iovera system, a non-opioid handheld cryoanalgesia device used to produce controlled doses of cold temperature to targeted nerves.

See Also

Before you consider Pacira BioSciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pacira BioSciences wasn't on the list.

While Pacira BioSciences currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for November 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.