Pegasystems (NASDAQ:PEGA - Free Report) had its price objective raised by Barclays from $74.00 to $82.00 in a research report report published on Friday morning, Benzinga reports. The firm currently has an equal weight rating on the technology company's stock.

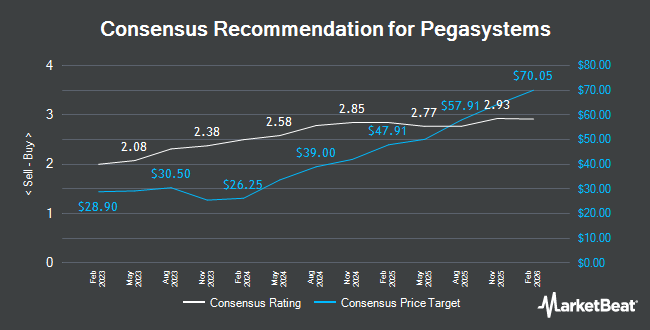

Several other research firms have also commented on PEGA. The Goldman Sachs Group upped their price objective on Pegasystems from $70.00 to $78.00 and gave the stock a "neutral" rating in a research report on Friday, July 26th. Rosenblatt Securities increased their price target on shares of Pegasystems from $90.00 to $95.00 and gave the stock a "buy" rating in a report on Friday. JPMorgan Chase & Co. lifted their price objective on shares of Pegasystems from $78.00 to $83.00 and gave the company an "overweight" rating in a report on Wednesday, July 31st. Loop Capital upgraded shares of Pegasystems from a "hold" rating to a "buy" rating and upped their price objective for the stock from $68.00 to $84.00 in a research report on Thursday, August 1st. Finally, StockNews.com upgraded Pegasystems from a "buy" rating to a "strong-buy" rating in a research report on Friday. Three investment analysts have rated the stock with a hold rating, eight have assigned a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus target price of $85.90.

Check Out Our Latest Research Report on PEGA

Pegasystems Stock Performance

PEGA traded up $0.07 during trading on Friday, hitting $80.03. The stock had a trading volume of 1,463,468 shares, compared to its average volume of 549,402. The stock has a 50 day simple moving average of $70.20 and a two-hundred day simple moving average of $64.12. Pegasystems has a twelve month low of $38.94 and a twelve month high of $82.22. The company has a market capitalization of $6.84 billion, a PE ratio of 55.19 and a beta of 1.07.

Pegasystems (NASDAQ:PEGA - Get Free Report) last issued its earnings results on Wednesday, October 23rd. The technology company reported $0.39 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.35 by $0.04. The company had revenue of $325.10 million during the quarter, compared to analyst estimates of $326.16 million. Pegasystems had a return on equity of 49.62% and a net margin of 8.72%. The firm's quarterly revenue was down 2.8% on a year-over-year basis. During the same quarter last year, the business posted $0.14 EPS. On average, equities research analysts anticipate that Pegasystems will post 1.54 EPS for the current year.

Pegasystems Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Tuesday, October 15th. Stockholders of record on Tuesday, October 1st were given a $0.03 dividend. The ex-dividend date of this dividend was Tuesday, October 1st. This represents a $0.12 dividend on an annualized basis and a dividend yield of 0.15%. Pegasystems's dividend payout ratio (DPR) is presently 8.28%.

Insiders Place Their Bets

In related news, CAO Efstathios A. Kouninis sold 750 shares of the business's stock in a transaction dated Wednesday, July 31st. The stock was sold at an average price of $72.09, for a total value of $54,067.50. Following the transaction, the chief accounting officer now owns 752 shares in the company, valued at $54,211.68. The trade was a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available at the SEC website. In other news, CAO Efstathios A. Kouninis sold 750 shares of the business's stock in a transaction that occurred on Wednesday, July 31st. The stock was sold at an average price of $72.09, for a total transaction of $54,067.50. Following the sale, the chief accounting officer now owns 752 shares of the company's stock, valued at $54,211.68. The trade was a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, CAO Efstathios A. Kouninis sold 932 shares of Pegasystems stock in a transaction on Friday, August 30th. The stock was sold at an average price of $71.00, for a total value of $66,172.00. Following the transaction, the chief accounting officer now directly owns 2 shares of the company's stock, valued at $142. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 44,955 shares of company stock valued at $3,136,247. 50.10% of the stock is currently owned by insiders.

Hedge Funds Weigh In On Pegasystems

A number of hedge funds have recently made changes to their positions in PEGA. Vanguard Group Inc. grew its stake in Pegasystems by 4.9% in the first quarter. Vanguard Group Inc. now owns 5,369,237 shares of the technology company's stock worth $347,067,000 after purchasing an additional 250,273 shares in the last quarter. Edgestream Partners L.P. acquired a new position in shares of Pegasystems during the first quarter worth approximately $1,161,000. Price T Rowe Associates Inc. MD boosted its position in shares of Pegasystems by 309.5% during the first quarter. Price T Rowe Associates Inc. MD now owns 130,281 shares of the technology company's stock worth $8,422,000 after buying an additional 98,465 shares during the period. State Board of Administration of Florida Retirement System grew its holdings in Pegasystems by 6.1% in the 1st quarter. State Board of Administration of Florida Retirement System now owns 49,541 shares of the technology company's stock worth $3,202,000 after buying an additional 2,831 shares in the last quarter. Finally, Susquehanna Fundamental Investments LLC acquired a new stake in Pegasystems in the 1st quarter valued at approximately $2,038,000. Institutional investors and hedge funds own 46.89% of the company's stock.

Pegasystems Company Profile

(

Get Free Report)

Pegasystems Inc develops, markets, licenses, hosts, and supports enterprise software in the United States, rest of the Americas, the United Kingdom, rest of Europe, the Middle East, Africa, and the Asia-Pacific. The company provides Pega Infinity, a software portfolio comprising of Pega Customer Decision Hub, a real-time AI-powered decision engine to enhance customer acquisition and experiences across inbound, outbound, and paid media channels; Pega Customer Service to anticipate customer needs, connect customers to people and systems, and automate customer interactions to evolve the customer service experience, as well as to allow enterprises to deliver interactions across channels and enhance employee productivity; and Pega Platform, an intelligent automation software for increasing efficiency of clients' processes and workflows.

See Also

Before you consider Pegasystems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pegasystems wasn't on the list.

While Pegasystems currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.