Semanteon Capital Management LP reduced its holdings in shares of Impinj, Inc. (NASDAQ:PI - Free Report) by 81.8% in the 3rd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 1,419 shares of the company's stock after selling 6,363 shares during the quarter. Semanteon Capital Management LP's holdings in Impinj were worth $307,000 at the end of the most recent reporting period.

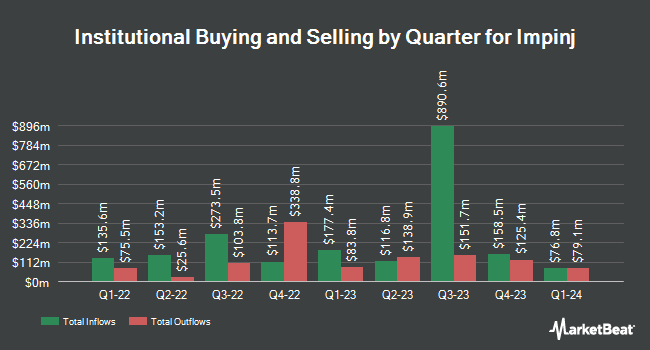

Other large investors have also bought and sold shares of the company. Principal Financial Group Inc. lifted its stake in Impinj by 16.9% in the 1st quarter. Principal Financial Group Inc. now owns 3,137 shares of the company's stock valued at $403,000 after purchasing an additional 454 shares during the last quarter. Mirae Asset Global Investments Co. Ltd. boosted its holdings in shares of Impinj by 13.0% during the 1st quarter. Mirae Asset Global Investments Co. Ltd. now owns 63,111 shares of the company's stock valued at $7,990,000 after acquiring an additional 7,247 shares in the last quarter. Jennison Associates LLC bought a new stake in Impinj during the 1st quarter worth $25,747,000. SG Americas Securities LLC acquired a new position in Impinj in the 1st quarter worth about $513,000. Finally, TimesSquare Capital Management LLC bought a new position in Impinj in the first quarter valued at about $19,195,000.

Impinj Stock Performance

PI traded down $5.63 during midday trading on Tuesday, reaching $200.00. 643,234 shares of the company were exchanged, compared to its average volume of 471,169. The company has a market cap of $5.54 billion, a price-to-earnings ratio of -575.29 and a beta of 1.80. Impinj, Inc. has a one year low of $58.56 and a one year high of $239.88. The company's fifty day moving average price is $197.25 and its 200 day moving average price is $170.16.

Impinj (NASDAQ:PI - Get Free Report) last posted its earnings results on Wednesday, October 23rd. The company reported $0.56 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.48 by $0.08. Impinj had a net margin of 8.21% and a negative return on equity of 1.64%. The firm had revenue of $95.20 million during the quarter, compared to analyst estimates of $92.86 million. During the same quarter in the prior year, the business posted ($0.36) EPS. The business's revenue was up 46.5% compared to the same quarter last year. As a group, sell-side analysts anticipate that Impinj, Inc. will post 0.35 earnings per share for the current fiscal year.

Analyst Ratings Changes

Several equities analysts have issued reports on the stock. StockNews.com cut shares of Impinj from a "hold" rating to a "sell" rating in a research report on Friday. Roth Mkm increased their target price on shares of Impinj from $145.00 to $175.00 and gave the company a "buy" rating in a research report on Thursday, July 25th. Lake Street Capital boosted their price target on shares of Impinj from $190.00 to $251.00 and gave the stock a "buy" rating in a research report on Thursday, October 24th. Needham & Company LLC upped their price objective on shares of Impinj from $195.00 to $245.00 and gave the company a "buy" rating in a research note on Thursday, October 24th. Finally, Evercore ISI reissued an "outperform" rating and set a $270.00 target price (up previously from $205.00) on shares of Impinj in a research note on Thursday, October 24th. One research analyst has rated the stock with a sell rating, one has issued a hold rating and nine have given a buy rating to the company's stock. According to MarketBeat, Impinj has a consensus rating of "Moderate Buy" and a consensus price target of $224.60.

Read Our Latest Research Report on Impinj

Insider Buying and Selling at Impinj

In other Impinj news, CEO Chris Ph.D. Diorio sold 1,498 shares of Impinj stock in a transaction dated Tuesday, September 24th. The shares were sold at an average price of $209.12, for a total value of $313,261.76. Following the sale, the chief executive officer now owns 292,532 shares of the company's stock, valued at approximately $61,174,291.84. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is accessible through this link. In other Impinj news, CFO Cary Baker sold 366 shares of the company's stock in a transaction dated Monday, October 14th. The shares were sold at an average price of $237.83, for a total transaction of $87,045.78. Following the sale, the chief financial officer now directly owns 71,096 shares of the company's stock, valued at $16,908,761.68. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, CEO Chris Ph.D. Diorio sold 1,498 shares of Impinj stock in a transaction dated Tuesday, September 24th. The stock was sold at an average price of $209.12, for a total transaction of $313,261.76. Following the completion of the transaction, the chief executive officer now owns 292,532 shares of the company's stock, valued at $61,174,291.84. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 21,779 shares of company stock worth $3,825,046 in the last quarter. 51.00% of the stock is currently owned by company insiders.

Impinj Company Profile

(

Free Report)

Impinj, Inc operates a cloud connectivity platform in the Americas, the Asia Pacific, Europe, the Middle East, and Africa. Its platform wirelessly connects items and delivers data about the connected items to business and consumer applications. The company's platform comprises endpoint ICs, a miniature radios-on-a-chip that attaches to a host item and includes a number to identify the item.

Featured Articles

Before you consider Impinj, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Impinj wasn't on the list.

While Impinj currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.