Emerald Advisers LLC boosted its position in Impinj, Inc. (NASDAQ:PI - Free Report) by 8.2% in the 3rd quarter, according to its most recent filing with the SEC. The firm owned 182,481 shares of the company's stock after acquiring an additional 13,884 shares during the period. Impinj comprises approximately 1.5% of Emerald Advisers LLC's holdings, making the stock its 13th biggest holding. Emerald Advisers LLC owned 0.66% of Impinj worth $39,511,000 at the end of the most recent quarter.

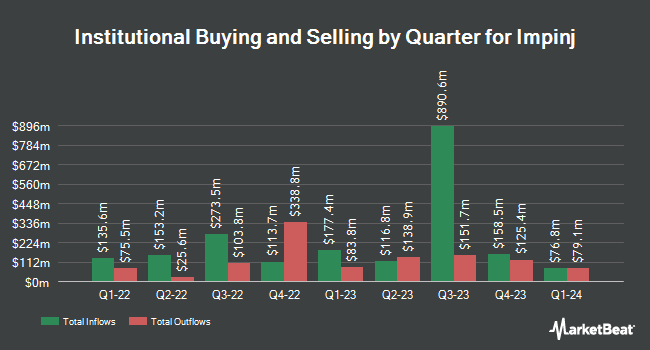

Several other hedge funds and other institutional investors have also recently bought and sold shares of PI. Van ECK Associates Corp acquired a new position in shares of Impinj in the 3rd quarter valued at $314,000. Janney Montgomery Scott LLC acquired a new position in shares of Impinj in the 3rd quarter valued at $1,777,000. Emerald Mutual Fund Advisers Trust boosted its holdings in shares of Impinj by 4.2% in the 3rd quarter. Emerald Mutual Fund Advisers Trust now owns 143,219 shares of the company's stock valued at $31,010,000 after purchasing an additional 5,716 shares during the last quarter. Farther Finance Advisors LLC boosted its holdings in shares of Impinj by 1,084.6% in the 3rd quarter. Farther Finance Advisors LLC now owns 154 shares of the company's stock valued at $33,000 after purchasing an additional 141 shares during the last quarter. Finally, New York State Teachers Retirement System acquired a new position in shares of Impinj in the 3rd quarter valued at $1,126,000.

Analyst Upgrades and Downgrades

Several research firms recently weighed in on PI. Susquehanna lifted their target price on shares of Impinj from $215.00 to $260.00 and gave the company a "positive" rating in a report on Monday, October 21st. Roth Mkm lifted their target price on shares of Impinj from $145.00 to $175.00 and gave the company a "buy" rating in a report on Thursday, July 25th. Evercore ISI restated an "outperform" rating and set a $270.00 target price (up previously from $205.00) on shares of Impinj in a report on Thursday, October 24th. Piper Sandler restated an "overweight" rating and set a $235.00 target price (up previously from $225.00) on shares of Impinj in a report on Thursday, October 24th. Finally, StockNews.com lowered shares of Impinj from a "hold" rating to a "sell" rating in a report on Friday, October 25th. One research analyst has rated the stock with a sell rating, one has issued a hold rating and nine have given a buy rating to the stock. According to data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus price target of $224.60.

View Our Latest Research Report on PI

Insider Buying and Selling at Impinj

In other Impinj news, CRO Jeffrey Dossett sold 488 shares of the business's stock in a transaction dated Monday, October 14th. The shares were sold at an average price of $237.84, for a total transaction of $116,065.92. Following the completion of the transaction, the executive now directly owns 65,294 shares of the company's stock, valued at $15,529,524.96. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. In other Impinj news, CRO Jeffrey Dossett sold 488 shares of the business's stock in a transaction dated Monday, October 14th. The shares were sold at an average price of $237.84, for a total transaction of $116,065.92. Following the completion of the transaction, the executive now directly owns 65,294 shares of the company's stock, valued at $15,529,524.96. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, major shareholder Sylebra Capital Llc sold 32,031 shares of the company's stock in a transaction that occurred on Wednesday, October 30th. The stock was sold at an average price of $195.35, for a total transaction of $6,257,255.85. Following the completion of the sale, the insider now directly owns 3,021,548 shares of the company's stock, valued at approximately $590,259,401.80. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 98,284 shares of company stock valued at $19,783,007 in the last ninety days. Company insiders own 51.00% of the company's stock.

Impinj Stock Up 2.5 %

Shares of PI traded up $4.72 during midday trading on Friday, hitting $194.71. The company had a trading volume of 340,252 shares, compared to its average volume of 593,066. Impinj, Inc. has a 52 week low of $62.84 and a 52 week high of $239.88. The company's 50 day moving average price is $199.89 and its 200 day moving average price is $172.25. The stock has a market cap of $5.51 billion, a price-to-earnings ratio of 218.78 and a beta of 1.82.

Impinj (NASDAQ:PI - Get Free Report) last announced its quarterly earnings data on Wednesday, October 23rd. The company reported $0.56 earnings per share for the quarter, beating analysts' consensus estimates of $0.48 by $0.08. Impinj had a net margin of 8.21% and a negative return on equity of 1.64%. The business had revenue of $95.20 million during the quarter, compared to the consensus estimate of $92.86 million. During the same quarter in the prior year, the firm earned ($0.36) EPS. The company's revenue for the quarter was up 46.5% compared to the same quarter last year. Equities analysts anticipate that Impinj, Inc. will post 0.4 EPS for the current fiscal year.

About Impinj

(

Free Report)

Impinj, Inc operates a cloud connectivity platform in the Americas, the Asia Pacific, Europe, the Middle East, and Africa. Its platform wirelessly connects items and delivers data about the connected items to business and consumer applications. The company's platform comprises endpoint ICs, a miniature radios-on-a-chip that attaches to a host item and includes a number to identify the item.

Featured Articles

Before you consider Impinj, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Impinj wasn't on the list.

While Impinj currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.