Pool (NASDAQ:POOL - Get Free Report) was downgraded by equities researchers at StockNews.com from a "hold" rating to a "sell" rating in a note issued to investors on Friday.

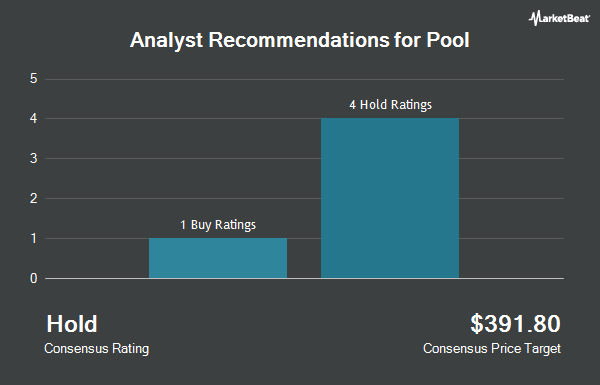

POOL has been the topic of a number of other reports. Loop Capital upped their price target on shares of Pool from $345.00 to $395.00 and gave the stock a "hold" rating in a report on Friday. Oppenheimer upped their price objective on shares of Pool from $356.00 to $380.00 and gave the stock an "outperform" rating in a research note on Friday, July 26th. Stifel Nicolaus upped their price objective on shares of Pool from $310.00 to $335.00 and gave the stock a "hold" rating in a research note on Friday, August 30th. Wells Fargo & Company upped their price objective on shares of Pool from $330.00 to $370.00 and gave the stock an "equal weight" rating in a research note on Monday, October 7th. Finally, The Goldman Sachs Group upped their price objective on shares of Pool from $365.00 to $415.00 and gave the stock a "buy" rating in a research note on Friday, July 26th. Two analysts have rated the stock with a sell rating, five have issued a hold rating and three have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, the stock has a consensus rating of "Hold" and a consensus target price of $367.89.

Read Our Latest Stock Analysis on POOL

Pool Trading Down 3.0 %

POOL stock traded down $11.33 during mid-day trading on Friday, reaching $366.00. 308,849 shares of the stock traded hands, compared to its average volume of 348,867. The company has a debt-to-equity ratio of 0.75, a quick ratio of 0.88 and a current ratio of 2.48. Pool has a one year low of $293.51 and a one year high of $422.73. The stock has a market capitalization of $14.00 billion, a PE ratio of 30.86, a PEG ratio of 2.57 and a beta of 1.01. The business has a 50-day moving average price of $359.72 and a two-hundred day moving average price of $353.39.

Pool (NASDAQ:POOL - Get Free Report) last posted its quarterly earnings data on Thursday, October 24th. The specialty retailer reported $3.26 earnings per share for the quarter, beating analysts' consensus estimates of $3.15 by $0.11. Pool had a net margin of 8.58% and a return on equity of 32.85%. The business had revenue of $1.43 billion for the quarter, compared to analysts' expectations of $1.40 billion. During the same quarter in the previous year, the business posted $3.50 earnings per share. The business's revenue was down 2.8% compared to the same quarter last year. Equities research analysts expect that Pool will post 10.98 EPS for the current year.

Institutional Trading of Pool

Hedge funds have recently modified their holdings of the company. Tortoise Investment Management LLC increased its holdings in shares of Pool by 68.9% during the second quarter. Tortoise Investment Management LLC now owns 103 shares of the specialty retailer's stock valued at $32,000 after acquiring an additional 42 shares in the last quarter. Crewe Advisors LLC increased its holdings in shares of Pool by 232.4% during the second quarter. Crewe Advisors LLC now owns 113 shares of the specialty retailer's stock valued at $35,000 after acquiring an additional 79 shares in the last quarter. UMB Bank n.a. increased its holdings in shares of Pool by 26.2% during the second quarter. UMB Bank n.a. now owns 207 shares of the specialty retailer's stock valued at $64,000 after acquiring an additional 43 shares in the last quarter. Ridgewood Investments LLC acquired a new position in shares of Pool during the second quarter valued at about $74,000. Finally, Summit Securities Group LLC acquired a new position in shares of Pool during the second quarter valued at about $75,000. 98.99% of the stock is owned by hedge funds and other institutional investors.

About Pool

(

Get Free Report)

Pool Corporation distributes swimming pool supplies, equipment, and related leisure products in the United States and internationally. The company offers maintenance products, including chemicals, supplies, and pool accessories; repair and replacement parts for pool equipment, such as cleaners, filters, heaters, pumps, and lights; and building materials, such as concrete, plumbing and electrical components, functional and decorative pool surfaces, decking materials, tiles, hardscapes, and natural stones for pool installations and remodeling.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Pool, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pool wasn't on the list.

While Pool currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.