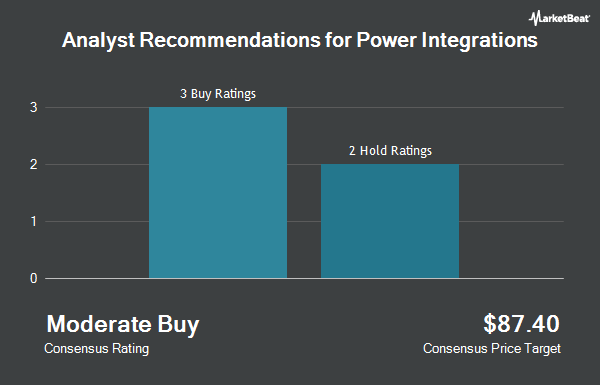

Power Integrations, Inc. (NASDAQ:POWI - Get Free Report) has been assigned an average recommendation of "Moderate Buy" from the seven ratings firms that are covering the firm, MarketBeat Ratings reports. Two investment analysts have rated the stock with a hold recommendation, four have issued a buy recommendation and one has issued a strong buy recommendation on the company. The average 12-month target price among brokers that have updated their coverage on the stock in the last year is $78.50.

A number of equities research analysts recently weighed in on POWI shares. Deutsche Bank Aktiengesellschaft dropped their price target on Power Integrations from $73.00 to $68.00 and set a "hold" rating on the stock in a research note on Wednesday, August 7th. Stifel Nicolaus restated a "buy" rating and issued a $95.00 price target (down previously from $100.00) on shares of Power Integrations in a research note on Monday, August 5th. Susquehanna dropped their price target on Power Integrations from $95.00 to $80.00 and set a "positive" rating on the stock in a research note on Thursday, August 8th. TD Cowen dropped their price target on Power Integrations from $80.00 to $70.00 and set a "hold" rating on the stock in a research note on Wednesday, August 7th. Finally, Benchmark restated a "buy" rating and issued a $78.00 price target on shares of Power Integrations in a research note on Wednesday, September 11th.

Read Our Latest Analysis on POWI

Power Integrations Trading Up 1.0 %

Shares of Power Integrations stock traded up $0.65 on Monday, reaching $63.48. 432,246 shares of the company were exchanged, compared to its average volume of 403,557. Power Integrations has a one year low of $56.63 and a one year high of $89.68. The company has a market capitalization of $3.61 billion, a price-to-earnings ratio of 83.77, a PEG ratio of 4.85 and a beta of 1.10. The company has a 50-day moving average of $62.34 and a 200 day moving average of $68.02.

Power Integrations (NASDAQ:POWI - Get Free Report) last announced its quarterly earnings data on Tuesday, August 6th. The semiconductor company reported $0.28 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.26 by $0.02. Power Integrations had a return on equity of 4.86% and a net margin of 10.38%. The company had revenue of $106.20 million for the quarter, compared to analysts' expectations of $105.02 million. During the same quarter in the prior year, the business posted $0.27 EPS. The business's revenue was down 13.8% compared to the same quarter last year. Analysts predict that Power Integrations will post 0.59 earnings per share for the current year.

Power Integrations Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Monday, September 30th. Stockholders of record on Friday, August 30th were issued a dividend of $0.20 per share. This represents a $0.80 annualized dividend and a dividend yield of 1.26%. The ex-dividend date of this dividend was Friday, August 30th. Power Integrations's dividend payout ratio (DPR) is currently 106.67%.

Insider Transactions at Power Integrations

In other news, VP Sunil Gupta sold 2,127 shares of the stock in a transaction on Tuesday, August 27th. The stock was sold at an average price of $65.90, for a total transaction of $140,169.30. Following the sale, the vice president now directly owns 51,899 shares of the company's stock, valued at approximately $3,420,144.10. This represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. 1.70% of the stock is currently owned by insiders.

Institutional Trading of Power Integrations

Several large investors have recently modified their holdings of POWI. GAMMA Investing LLC boosted its stake in Power Integrations by 69.8% in the second quarter. GAMMA Investing LLC now owns 365 shares of the semiconductor company's stock valued at $26,000 after buying an additional 150 shares in the last quarter. Fidelis Capital Partners LLC acquired a new stake in Power Integrations in the first quarter valued at about $55,000. Mather Group LLC. boosted its stake in Power Integrations by 22.8% in the second quarter. Mather Group LLC. now owns 868 shares of the semiconductor company's stock valued at $62,000 after buying an additional 161 shares in the last quarter. Migdal Insurance & Financial Holdings Ltd. acquired a new stake in Power Integrations in the second quarter valued at about $63,000. Finally, Quest Partners LLC boosted its stake in Power Integrations by 23.5% in the second quarter. Quest Partners LLC now owns 1,260 shares of the semiconductor company's stock valued at $88,000 after buying an additional 240 shares in the last quarter.

Power Integrations Company Profile

(

Get Free ReportPower Integrations, Inc designs, develops, manufactures, and markets analog and mixed-signal integrated circuits (ICs), and other electronic components and circuitry used in high-voltage power conversion worldwide. The company provides a range of alternating current to direct current power conversion products that address power supply ranging from less than one watt of output to approximately 500 watts of output for mobile-device chargers, consumer appliances, utility meters, LCD monitors, main and standby power supplies for desktop computers and TVs, LED lighting, and various other consumer and industrial applications, as well as power conversion in high-power applications comprising industrial motors, solar and wind-power systems, electric vehicles, and high-voltage DC transmission systems.

Further Reading

Before you consider Power Integrations, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Power Integrations wasn't on the list.

While Power Integrations currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.