StockNews.com upgraded shares of Progress Software (NASDAQ:PRGS - Free Report) from a buy rating to a strong-buy rating in a research report released on Wednesday.

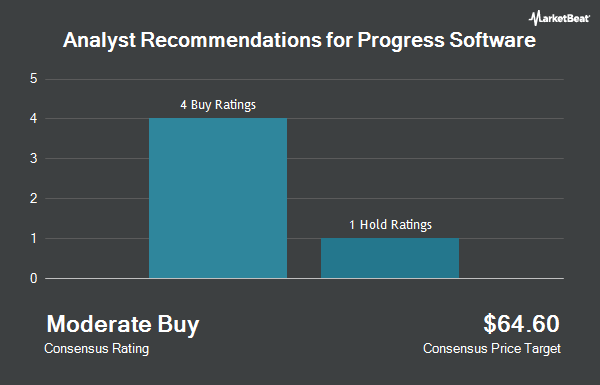

Several other analysts have also issued reports on PRGS. DA Davidson boosted their price target on Progress Software from $65.00 to $70.00 and gave the company a "buy" rating in a report on Wednesday, September 25th. Wedbush reissued an "outperform" rating and issued a $68.00 target price on shares of Progress Software in a report on Tuesday, September 10th. Oppenheimer lifted their price target on shares of Progress Software from $70.00 to $80.00 and gave the company an "outperform" rating in a report on Tuesday, October 22nd. Finally, Guggenheim raised their price objective on shares of Progress Software from $64.00 to $70.00 and gave the company a "buy" rating in a research report on Wednesday, September 25th. One investment analyst has rated the stock with a hold rating, five have given a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat.com, Progress Software presently has a consensus rating of "Buy" and an average target price of $67.67.

Read Our Latest Stock Analysis on PRGS

Progress Software Stock Performance

Shares of NASDAQ PRGS traded down $0.35 during midday trading on Wednesday, hitting $64.78. 119,901 shares of the stock traded hands, compared to its average volume of 502,934. The firm has a market capitalization of $2.78 billion, a P/E ratio of 34.83, a PEG ratio of 8.21 and a beta of 0.92. Progress Software has a one year low of $48.00 and a one year high of $67.89. The company has a debt-to-equity ratio of 1.87, a quick ratio of 1.23 and a current ratio of 1.23. The firm has a 50-day moving average of $61.67 and a two-hundred day moving average of $55.90.

Progress Software (NASDAQ:PRGS - Get Free Report) last announced its earnings results on Tuesday, September 24th. The software maker reported $1.26 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.14 by $0.12. The business had revenue of $178.69 million for the quarter, compared to analysts' expectations of $176.16 million. Progress Software had a return on equity of 38.69% and a net margin of 11.55%. The business's revenue for the quarter was up 1.7% on a year-over-year basis. During the same period last year, the firm posted $0.90 earnings per share. On average, equities analysts forecast that Progress Software will post 3.95 EPS for the current fiscal year.

Insider Activity

In other Progress Software news, CFO Anthony Folger sold 7,797 shares of Progress Software stock in a transaction on Wednesday, October 16th. The shares were sold at an average price of $67.39, for a total value of $525,439.83. Following the completion of the transaction, the chief financial officer now directly owns 33,774 shares of the company's stock, valued at $2,276,029.86. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available at this link. In other Progress Software news, insider Ian Pitt sold 1,747 shares of the firm's stock in a transaction on Wednesday, October 23rd. The stock was sold at an average price of $65.07, for a total transaction of $113,677.29. Following the transaction, the insider now directly owns 3,167 shares in the company, valued at $206,076.69. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. Also, CFO Anthony Folger sold 7,797 shares of the company's stock in a transaction on Wednesday, October 16th. The stock was sold at an average price of $67.39, for a total value of $525,439.83. Following the completion of the sale, the chief financial officer now owns 33,774 shares of the company's stock, valued at $2,276,029.86. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 9,844 shares of company stock worth $656,550. 3.30% of the stock is currently owned by insiders.

Institutional Inflows and Outflows

Several hedge funds and other institutional investors have recently added to or reduced their stakes in the business. Canada Pension Plan Investment Board purchased a new position in Progress Software during the second quarter valued at approximately $27,000. GAMMA Investing LLC lifted its stake in shares of Progress Software by 76.7% during the 3rd quarter. GAMMA Investing LLC now owns 1,117 shares of the software maker's stock worth $75,000 after purchasing an additional 485 shares during the last quarter. Blue Trust Inc. boosted its position in Progress Software by 29.2% during the second quarter. Blue Trust Inc. now owns 1,640 shares of the software maker's stock valued at $87,000 after purchasing an additional 371 shares in the last quarter. EntryPoint Capital LLC grew its stake in Progress Software by 993.5% in the first quarter. EntryPoint Capital LLC now owns 2,176 shares of the software maker's stock valued at $116,000 after purchasing an additional 1,977 shares during the last quarter. Finally, Quest Partners LLC bought a new position in Progress Software in the second quarter worth about $160,000.

About Progress Software

(

Get Free Report)

Progress Software Corporation develops, deploys, and manages business applications in the United States and internationally. The company offers OpenEdge, an application development platform for running business-critical applications; Chef, a DevOps/DevSecOps automation software; Developer Tools that consists of software development tooling collection, including .NET and JavaScript UI components for web, desktop and mobile applications, reporting and report management tools, and automated testing and mocking tools; Kemp LoadMaster, an application delivery and security product offering cloud-native, and virtual and hardware load balancers; and Sitefinity, a digital experience platform foundation delivering intelligent and ROI-driving tools for marketers.

Featured Stories

Before you consider Progress Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Progress Software wasn't on the list.

While Progress Software currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.