International Assets Investment Management LLC boosted its stake in Prospect Capital Co. (NASDAQ:PSEC - Free Report) by 344.0% in the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 933,083 shares of the financial services provider's stock after purchasing an additional 722,925 shares during the quarter. International Assets Investment Management LLC owned about 0.22% of Prospect Capital worth $4,992,000 at the end of the most recent reporting period.

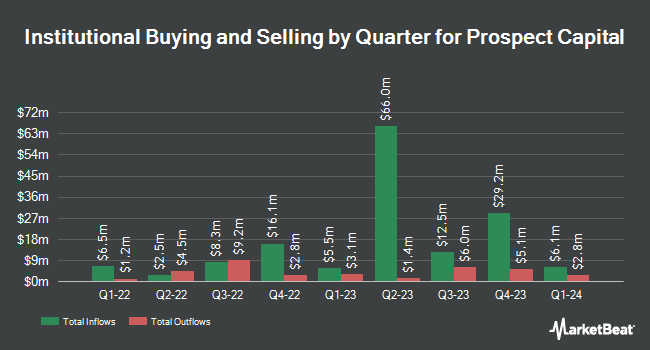

Several other institutional investors and hedge funds have also bought and sold shares of PSEC. Rothschild Investment LLC bought a new position in shares of Prospect Capital in the 2nd quarter valued at $27,000. Headlands Technologies LLC grew its position in Prospect Capital by 2,266.9% in the first quarter. Headlands Technologies LLC now owns 7,574 shares of the financial services provider's stock valued at $42,000 after acquiring an additional 7,254 shares during the last quarter. Empowered Funds LLC acquired a new position in Prospect Capital during the first quarter worth about $73,000. Family Wealth Partners LLC acquired a new stake in shares of Prospect Capital in the 3rd quarter valued at approximately $74,000. Finally, Apeiron RIA LLC bought a new stake in shares of Prospect Capital during the 2nd quarter valued at approximately $79,000. Institutional investors own 9.06% of the company's stock.

Prospect Capital Trading Down 1.2 %

NASDAQ PSEC traded down $0.06 during trading hours on Friday, reaching $5.13. The company's stock had a trading volume of 2,033,053 shares, compared to its average volume of 1,876,160. Prospect Capital Co. has a 52 week low of $4.69 and a 52 week high of $6.30. The company has a debt-to-equity ratio of 0.66, a current ratio of 0.93 and a quick ratio of 0.93. The stock has a market cap of $2.22 billion, a P/E ratio of 14.66 and a beta of 1.00. The firm has a fifty day simple moving average of $5.27 and a 200-day simple moving average of $5.37.

Prospect Capital (NASDAQ:PSEC - Get Free Report) last released its quarterly earnings results on Wednesday, August 28th. The financial services provider reported $0.25 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.18 by $0.07. The firm had revenue of $212.26 million during the quarter. Prospect Capital had a net margin of 28.07% and a return on equity of 13.53%. During the same period in the previous year, the business posted $0.23 EPS.

Prospect Capital Announces Dividend

The business also recently declared a monthly dividend, which will be paid on Tuesday, November 19th. Shareholders of record on Tuesday, October 29th will be given a $0.06 dividend. The ex-dividend date is Tuesday, October 29th. This represents a $0.72 dividend on an annualized basis and a dividend yield of 14.04%. Prospect Capital's dividend payout ratio (DPR) is presently 205.71%.

Wall Street Analysts Forecast Growth

A number of brokerages have weighed in on PSEC. Wells Fargo & Company cut their target price on shares of Prospect Capital from $5.00 to $4.50 and set an "underweight" rating on the stock in a research report on Friday, August 30th. StockNews.com lowered Prospect Capital from a "hold" rating to a "sell" rating in a research report on Friday, August 30th.

Get Our Latest Analysis on Prospect Capital

Prospect Capital Profile

(

Free Report)

Prospect Capital Corporation is a business development company. It specializes in middle market, mature, mezzanine finance, later stage, emerging growth, leveraged buyouts, refinancing, acquisitions, recapitalizations, turnaround, growth capital, development, capital expenditures and subordinated debt tranches of collateralized loan obligations, cash flow term loans, market place lending and bridge transactions.

Featured Articles

Before you consider Prospect Capital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Prospect Capital wasn't on the list.

While Prospect Capital currently has a "Sell" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.