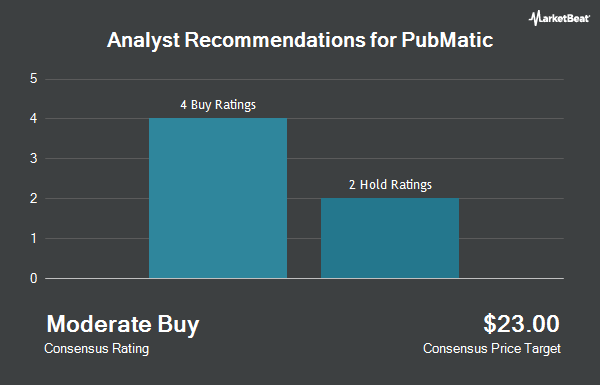

Shares of PubMatic, Inc. (NASDAQ:PUBM - Get Free Report) have earned an average rating of "Moderate Buy" from the seven analysts that are covering the firm, MarketBeat.com reports. Three investment analysts have rated the stock with a hold rating and four have assigned a buy rating to the company. The average 12-month price objective among analysts that have updated their coverage on the stock in the last year is $21.00.

PUBM has been the subject of several recent analyst reports. B. Riley decreased their target price on PubMatic from $31.00 to $22.00 and set a "buy" rating for the company in a research note on Friday, August 9th. Royal Bank of Canada lowered their target price on shares of PubMatic from $26.00 to $23.00 and set an "outperform" rating for the company in a report on Tuesday, August 20th. Raymond James downgraded shares of PubMatic from an "outperform" rating to a "market perform" rating in a research report on Friday, August 9th. Jefferies Financial Group reduced their price target on shares of PubMatic from $26.00 to $16.00 and set a "hold" rating for the company in a research report on Friday, August 9th. Finally, Wolfe Research initiated coverage on PubMatic in a report on Tuesday, July 16th. They set an "outperform" rating and a $25.00 price objective on the stock.

Read Our Latest Analysis on PubMatic

Insiders Place Their Bets

In other news, CAO Lisa Gimbel sold 2,397 shares of the company's stock in a transaction dated Friday, August 16th. The shares were sold at an average price of $13.66, for a total value of $32,743.02. Following the completion of the sale, the chief accounting officer now directly owns 3,956 shares of the company's stock, valued at approximately $54,038.96. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. In other news, CAO Lisa Gimbel sold 2,397 shares of the business's stock in a transaction that occurred on Friday, August 16th. The stock was sold at an average price of $13.66, for a total value of $32,743.02. Following the transaction, the chief accounting officer now owns 3,956 shares of the company's stock, valued at approximately $54,038.96. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, CFO Steven Pantelick sold 4,000 shares of the company's stock in a transaction that occurred on Tuesday, August 13th. The stock was sold at an average price of $14.03, for a total value of $56,120.00. Following the sale, the chief financial officer now owns 22,506 shares of the company's stock, valued at $315,759.18. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders have sold 85,896 shares of company stock valued at $1,263,213. Insiders own 2.90% of the company's stock.

Institutional Trading of PubMatic

Several hedge funds and other institutional investors have recently made changes to their positions in PUBM. CWA Asset Management Group LLC acquired a new stake in PubMatic in the third quarter valued at about $161,000. Olympiad Research LP acquired a new position in PubMatic during the 3rd quarter worth approximately $293,000. US Bancorp DE raised its stake in shares of PubMatic by 370.1% during the 3rd quarter. US Bancorp DE now owns 12,433 shares of the company's stock worth $185,000 after buying an additional 9,788 shares in the last quarter. New York State Teachers Retirement System acquired a new stake in shares of PubMatic in the 3rd quarter valued at approximately $51,000. Finally, BayBridge Capital Group LLC purchased a new stake in shares of PubMatic in the third quarter valued at approximately $387,000. Hedge funds and other institutional investors own 64.26% of the company's stock.

PubMatic Stock Performance

Shares of NASDAQ:PUBM traded down $0.27 during trading hours on Monday, reaching $14.35. The stock had a trading volume of 292,218 shares, compared to its average volume of 461,768. PubMatic has a 1 year low of $11.79 and a 1 year high of $25.36. The firm's 50 day moving average is $14.82 and its 200-day moving average is $18.64. The stock has a market capitalization of $711.53 million, a price-to-earnings ratio of 39.86 and a beta of 1.39.

PubMatic (NASDAQ:PUBM - Get Free Report) last posted its earnings results on Thursday, August 8th. The company reported $0.04 EPS for the quarter, beating the consensus estimate of ($0.02) by $0.06. The firm had revenue of $67.27 million for the quarter, compared to analyst estimates of $70.07 million. PubMatic had a return on equity of 6.92% and a net margin of 7.08%. PubMatic's revenue for the quarter was up 6.2% compared to the same quarter last year. During the same quarter in the prior year, the company posted ($0.11) earnings per share. Analysts forecast that PubMatic will post 0.2 EPS for the current year.

PubMatic Company Profile

(

Get Free ReportPubMatic, Inc, a technology company, engages in the provision of a cloud infrastructure platform that enables real-time programmatic advertising transactions for digital content creators, advertisers, agencies, agency trading desks, and demand side platforms worldwide. Its PubMatic SSP, a sell-side platform, used for the purchase and sale of digital advertising inventory for publishers and buyers.

Featured Articles

Before you consider PubMatic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PubMatic wasn't on the list.

While PubMatic currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.