PayPal (NASDAQ:PYPL - Get Free Report) had its price target increased by stock analysts at The Goldman Sachs Group from $79.00 to $87.00 in a report issued on Wednesday, Benzinga reports. The firm presently has a "neutral" rating on the credit services provider's stock. The Goldman Sachs Group's target price would suggest a potential upside of 10.84% from the company's previous close.

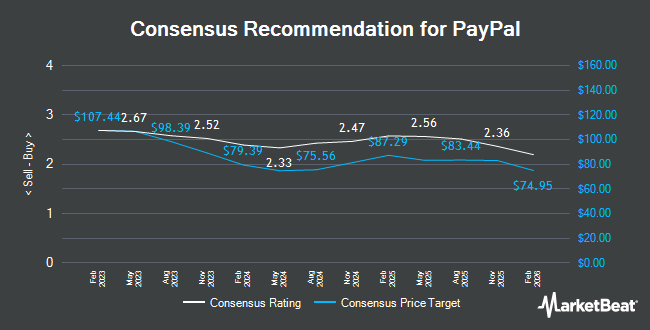

Other equities analysts have also issued reports about the company. Canaccord Genuity Group upped their target price on PayPal from $80.00 to $96.00 and gave the stock a "buy" rating in a research note on Wednesday. UBS Group increased their price objective on PayPal from $72.00 to $85.00 and gave the company a "neutral" rating in a research report on Wednesday. Daiwa America upgraded PayPal from a "moderate buy" rating to a "strong-buy" rating in a research report on Friday, August 9th. StockNews.com lowered PayPal from a "buy" rating to a "hold" rating in a research report on Saturday. Finally, Sanford C. Bernstein lowered PayPal from an "outperform" rating to a "market perform" rating and increased their price objective for the company from $75.00 to $80.00 in a research report on Thursday, October 10th. Seventeen investment analysts have rated the stock with a hold rating, eighteen have given a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat.com, PayPal has an average rating of "Moderate Buy" and an average price target of $82.03.

Get Our Latest Stock Analysis on PYPL

PayPal Stock Performance

Shares of NASDAQ:PYPL traded down $1.79 during midday trading on Wednesday, reaching $78.49. 9,450,848 shares of the company traded hands, compared to its average volume of 13,614,420. The company has a quick ratio of 1.24, a current ratio of 1.24 and a debt-to-equity ratio of 0.47. PayPal has a 12 month low of $50.80 and a 12 month high of $83.70. The firm has a market capitalization of $82.10 billion, a price-to-earnings ratio of 19.75, a price-to-earnings-growth ratio of 1.51 and a beta of 1.44. The firm's fifty day moving average price is $76.10 and its two-hundred day moving average price is $67.41.

PayPal (NASDAQ:PYPL - Get Free Report) last released its quarterly earnings data on Tuesday, October 29th. The credit services provider reported $1.20 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.08 by $0.12. PayPal had a return on equity of 22.82% and a net margin of 14.30%. The company had revenue of $7.85 billion for the quarter, compared to analyst estimates of $7.88 billion. During the same period in the previous year, the company posted $0.97 EPS. The firm's revenue for the quarter was up 6.0% compared to the same quarter last year. On average, equities analysts expect that PayPal will post 4.44 earnings per share for the current year.

Institutional Trading of PayPal

A number of hedge funds have recently bought and sold shares of PYPL. Allspring Global Investments Holdings LLC increased its position in PayPal by 18.8% during the first quarter. Allspring Global Investments Holdings LLC now owns 234,147 shares of the credit services provider's stock valued at $15,686,000 after acquiring an additional 36,994 shares during the last quarter. Norden Group LLC increased its position in PayPal by 197.3% during the first quarter. Norden Group LLC now owns 82,620 shares of the credit services provider's stock valued at $5,535,000 after acquiring an additional 54,832 shares during the last quarter. First Trust Direct Indexing L.P. increased its position in PayPal by 23.3% during the first quarter. First Trust Direct Indexing L.P. now owns 23,463 shares of the credit services provider's stock valued at $1,572,000 after acquiring an additional 4,434 shares during the last quarter. Van ECK Associates Corp increased its position in PayPal by 33.8% during the first quarter. Van ECK Associates Corp now owns 77,308 shares of the credit services provider's stock valued at $5,179,000 after acquiring an additional 19,510 shares during the last quarter. Finally, Private Advisor Group LLC grew its holdings in PayPal by 14.2% during the first quarter. Private Advisor Group LLC now owns 168,866 shares of the credit services provider's stock valued at $11,312,000 after purchasing an additional 21,047 shares during the period. Hedge funds and other institutional investors own 68.32% of the company's stock.

PayPal Company Profile

(

Get Free Report)

PayPal Holdings, Inc operates a technology platform that enables digital payments on behalf of merchants and consumers worldwide. It operates a two-sided network at scale that connects merchants and consumers that enables its customers to connect, transact, and send and receive payments through online and in person, as well as transfer and withdraw funds using various funding sources, such as bank accounts, PayPal or Venmo account balance, PayPal and Venmo branded credit products comprising its installment products, credit and debit cards, and cryptocurrencies, as well as other stored value products, including gift cards and eligible rewards.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider PayPal, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PayPal wasn't on the list.

While PayPal currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.