QuinStreet (NASDAQ:QNST - Get Free Report) will release its earnings data after the market closes on Monday, November 4th. Analysts expect QuinStreet to post earnings of $0.18 per share for the quarter. QuinStreet has set its FY 2025 guidance at EPS and its Q1 2025 guidance at EPS.Persons interested in registering for the company's earnings conference call can do so using this link.

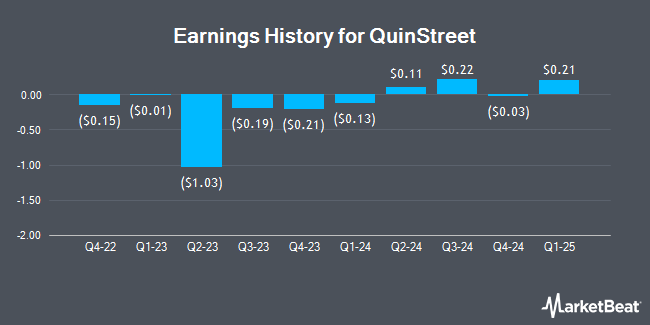

QuinStreet (NASDAQ:QNST - Get Free Report) last posted its earnings results on Thursday, August 8th. The technology company reported $0.11 EPS for the quarter, beating analysts' consensus estimates of $0.10 by $0.01. QuinStreet had a negative return on equity of 13.00% and a negative net margin of 5.11%. The firm had revenue of $198.32 million for the quarter, compared to analysts' expectations of $186.39 million. During the same period last year, the firm earned ($1.03) EPS. The company's quarterly revenue was up 52.2% on a year-over-year basis. On average, analysts expect QuinStreet to post $0 EPS for the current fiscal year and $0 EPS for the next fiscal year.

QuinStreet Price Performance

QNST stock traded up $0.26 during trading on Monday, hitting $18.83. The stock had a trading volume of 213,463 shares, compared to its average volume of 393,511. QuinStreet has a twelve month low of $10.17 and a twelve month high of $20.91. The stock has a market capitalization of $1.06 billion, a P/E ratio of -32.89 and a beta of 1.11. The company's 50-day moving average price is $18.93 and its two-hundred day moving average price is $17.95.

Wall Street Analysts Forecast Growth

Several brokerages have recently weighed in on QNST. B. Riley boosted their target price on QuinStreet from $21.50 to $24.00 and gave the stock a "buy" rating in a report on Friday, August 9th. Craig Hallum lifted their price target on shares of QuinStreet from $22.00 to $25.00 and gave the company a "buy" rating in a research report on Friday, August 9th. StockNews.com raised shares of QuinStreet from a "sell" rating to a "hold" rating in a research report on Thursday, October 17th. Finally, Barrington Research reaffirmed an "outperform" rating and set a $22.00 price target on shares of QuinStreet in a research report on Friday, August 9th. One investment analyst has rated the stock with a hold rating and four have assigned a buy rating to the stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average target price of $22.25.

Read Our Latest Report on QuinStreet

About QuinStreet

(

Get Free Report)

QuinStreet, Inc, an online performance marketing company, provides customer acquisition services for its clients in the United States and internationally. The company offers online marketing services, such as qualified clicks, leads, calls, applications, and customers through its websites or third-party publishers.

Featured Stories

Before you consider QuinStreet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and QuinStreet wasn't on the list.

While QuinStreet currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.