Wealth Enhancement Advisory Services LLC boosted its position in shares of Ultragenyx Pharmaceutical Inc. (NASDAQ:RARE - Free Report) by 195.6% during the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 21,753 shares of the biopharmaceutical company's stock after purchasing an additional 14,394 shares during the period. Wealth Enhancement Advisory Services LLC's holdings in Ultragenyx Pharmaceutical were worth $1,208,000 as of its most recent SEC filing.

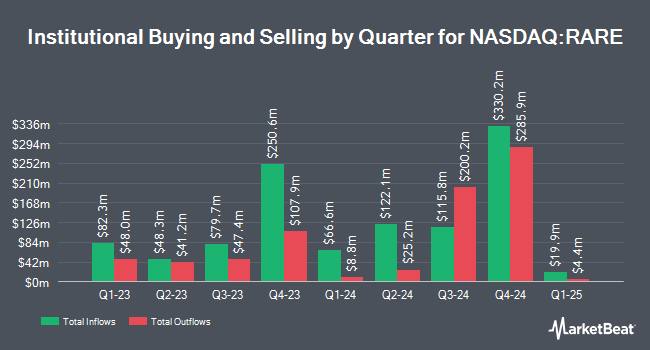

Other hedge funds also recently added to or reduced their stakes in the company. Headlands Technologies LLC purchased a new stake in Ultragenyx Pharmaceutical in the 1st quarter valued at about $28,000. nVerses Capital LLC purchased a new stake in Ultragenyx Pharmaceutical in the 2nd quarter valued at about $33,000. UMB Bank n.a. boosted its position in Ultragenyx Pharmaceutical by 58.1% in the 2nd quarter. UMB Bank n.a. now owns 958 shares of the biopharmaceutical company's stock valued at $39,000 after buying an additional 352 shares during the period. Values First Advisors Inc. purchased a new stake in Ultragenyx Pharmaceutical in the 3rd quarter valued at about $56,000. Finally, Allspring Global Investments Holdings LLC boosted its position in Ultragenyx Pharmaceutical by 67.7% in the 1st quarter. Allspring Global Investments Holdings LLC now owns 3,318 shares of the biopharmaceutical company's stock valued at $155,000 after buying an additional 1,339 shares during the period. 97.67% of the stock is currently owned by institutional investors.

Ultragenyx Pharmaceutical Stock Performance

NASDAQ RARE traded up $1.12 during mid-day trading on Tuesday, reaching $52.18. 1,716,008 shares of the stock were exchanged, compared to its average volume of 777,716. The company has a market capitalization of $4.81 billion, a P/E ratio of -7.15 and a beta of 0.58. Ultragenyx Pharmaceutical Inc. has a 1 year low of $34.06 and a 1 year high of $60.37. The business's 50 day moving average is $55.47 and its 200-day moving average is $48.09.

Wall Street Analyst Weigh In

Several research firms have issued reports on RARE. Canaccord Genuity Group reissued a "buy" rating and issued a $111.00 price objective on shares of Ultragenyx Pharmaceutical in a research report on Tuesday, July 23rd. TD Cowen upped their price target on shares of Ultragenyx Pharmaceutical from $61.00 to $73.00 and gave the stock a "buy" rating in a research report on Monday, October 21st. Cantor Fitzgerald reaffirmed an "overweight" rating and issued a $116.00 price target on shares of Ultragenyx Pharmaceutical in a research report on Tuesday, October 22nd. Wedbush upped their price target on shares of Ultragenyx Pharmaceutical from $43.00 to $46.00 and gave the stock a "neutral" rating in a research report on Friday, August 2nd. Finally, Barclays lowered their price target on shares of Ultragenyx Pharmaceutical from $83.00 to $81.00 and set an "overweight" rating for the company in a research report on Monday, August 5th. Two research analysts have rated the stock with a hold rating and eleven have given a buy rating to the company's stock. Based on data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and an average price target of $85.17.

Read Our Latest Stock Analysis on Ultragenyx Pharmaceutical

Insider Buying and Selling at Ultragenyx Pharmaceutical

In related news, CFO Howard Horn sold 7,465 shares of the firm's stock in a transaction dated Thursday, October 10th. The shares were sold at an average price of $52.76, for a total transaction of $393,853.40. Following the completion of the sale, the chief financial officer now directly owns 92,301 shares in the company, valued at approximately $4,869,800.76. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. In other Ultragenyx Pharmaceutical news, CFO Howard Horn sold 7,465 shares of Ultragenyx Pharmaceutical stock in a transaction dated Thursday, October 10th. The shares were sold at an average price of $52.76, for a total transaction of $393,853.40. Following the completion of the sale, the chief financial officer now directly owns 92,301 shares in the company, valued at $4,869,800.76. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, CEO Emil D. Kakkis sold 20,000 shares of Ultragenyx Pharmaceutical stock in a transaction that occurred on Tuesday, September 3rd. The shares were sold at an average price of $55.85, for a total transaction of $1,117,000.00. Following the completion of the transaction, the chief executive officer now owns 2,223,985 shares of the company's stock, valued at $124,209,562.25. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 27,556 shares of company stock valued at $1,515,967 over the last ninety days. Corporate insiders own 5.80% of the company's stock.

Ultragenyx Pharmaceutical Company Profile

(

Free Report)

Ultragenyx Pharmaceutical Inc, a biopharmaceutical company, focuses on the identification, acquisition, development, and commercialization of novel products for the treatment of rare and ultra-rare genetic diseases in North America, Latin America, Japan, Europe, and internationally. Its biologic products include Crysvita (burosumab), an antibody targeting fibroblast growth factor 23 for the treatment of X-linked hypophosphatemia, as well as tumor-induced osteomalacia; Mepsevii, an enzyme replacement therapy for the treatment of children and adults with Mucopolysaccharidosis VII; Dojolvi for treating long-chain fatty acid oxidation disorders; and Evkeeza (evinacumab) for the treatment of homozygous familial hypercholesterolemia.

See Also

Before you consider Ultragenyx Pharmaceutical, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ultragenyx Pharmaceutical wasn't on the list.

While Ultragenyx Pharmaceutical currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.