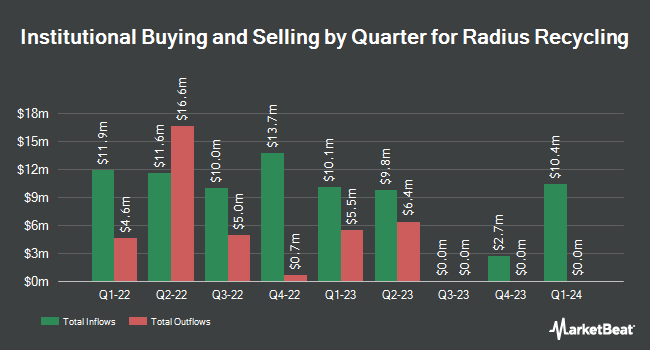

Swedbank AB purchased a new position in Radius Recycling, Inc. (NASDAQ:RDUS - Free Report) in the first quarter, according to the company in its most recent Form 13F filing with the SEC. The fund purchased 68,000 shares of the basic materials company's stock, valued at approximately $1,437,000. Swedbank AB owned approximately 0.24% of Radius Recycling at the end of the most recent reporting period.

A number of other hedge funds and other institutional investors have also bought and sold shares of the stock. Acadian Asset Management LLC purchased a new stake in shares of Radius Recycling in the 1st quarter valued at $6,957,000. Jacobs Levy Equity Management Inc. purchased a new stake in shares of Radius Recycling in the 1st quarter valued at $4,667,000. Nordea Investment Management AB purchased a new stake in shares of Radius Recycling in the 1st quarter valued at $3,959,000. Russell Investments Group Ltd. purchased a new stake in shares of Radius Recycling in the 1st quarter valued at $3,884,000. Finally, Fisher Asset Management LLC bought a new stake in Radius Recycling during the 4th quarter valued at $4,488,000. Hedge funds and other institutional investors own 78.11% of the company's stock.

Radius Recycling Stock Down 7.1 %

Shares of Radius Recycling stock traded down $1.20 during trading on Friday, hitting $15.78. The company's stock had a trading volume of 188,862 shares, compared to its average volume of 236,576. The company has a debt-to-equity ratio of 0.43, a quick ratio of 0.92 and a current ratio of 1.96. The company has a fifty day simple moving average of $16.22 and a two-hundred day simple moving average of $19.22. The company has a market capitalization of $442.47 million, a PE ratio of -1.62 and a beta of 1.56. Radius Recycling, Inc. has a 52 week low of $12.69 and a 52 week high of $34.71.

Radius Recycling (NASDAQ:RDUS - Get Free Report) last released its quarterly earnings data on Tuesday, July 2nd. The basic materials company reported ($0.59) earnings per share for the quarter, beating analysts' consensus estimates of ($0.66) by $0.07. Radius Recycling had a negative net margin of 10.28% and a negative return on equity of 5.89%. The business had revenue of $673.92 million during the quarter, compared to analyst estimates of $693.90 million. During the same period last year, the business earned $0.67 EPS. Radius Recycling's revenue was down 16.8% compared to the same quarter last year. Equities research analysts predict that Radius Recycling, Inc. will post -3.06 earnings per share for the current year.

Radius Recycling Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Monday, August 5th. Investors of record on Monday, July 22nd will be given a dividend of $0.1875 per share. The ex-dividend date is Monday, July 22nd. This represents a $0.75 annualized dividend and a yield of 4.75%. Radius Recycling's dividend payout ratio (DPR) is -7.72%.

Analyst Ratings Changes

A number of research firms recently commented on RDUS. Seaport Res Ptn upgraded shares of Radius Recycling from a "strong sell" rating to a "hold" rating in a report on Thursday, May 30th. StockNews.com lowered shares of Radius Recycling from a "hold" rating to a "sell" rating in a report on Thursday, July 11th.

Get Our Latest Stock Report on RDUS

Radius Recycling Company Profile

(

Free Report)

Radius Recycling, Inc recycles ferrous and nonferrous metal, and manufactures finished steel products worldwide. The company acquires, processes, and recycles salvaged vehicles, rail cars, home appliances, industrial machinery, manufacturing scrap, and construction and demolition scrap. It offers recycled ferrous metal, a feedstock used in the production of finished steel products; and nonferrous products, including mixed metal joint products recovered from the shredding process, such as zorba, zurik, aluminum, copper, stainless steel, nickel, brass, titanium, lead, and high temperature alloys.

Further Reading

Before you consider Radius Recycling, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Radius Recycling wasn't on the list.

While Radius Recycling currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.