Claro Advisors LLC reduced its stake in First Trust NASDAQ Rising Dividend Achievers (NASDAQ:RDVY - Free Report) by 89.8% during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 4,931 shares of the company's stock after selling 43,605 shares during the period. Claro Advisors LLC's holdings in First Trust NASDAQ Rising Dividend Achievers were worth $292,000 at the end of the most recent reporting period.

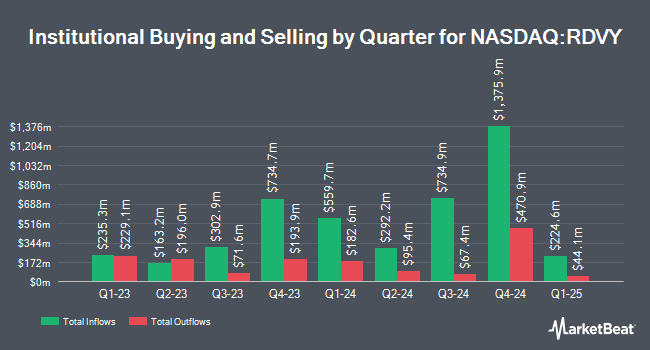

A number of other hedge funds have also added to or reduced their stakes in RDVY. Cetera Investment Advisers boosted its stake in shares of First Trust NASDAQ Rising Dividend Achievers by 178.5% during the first quarter. Cetera Investment Advisers now owns 2,264,096 shares of the company's stock valued at $127,174,000 after purchasing an additional 1,451,045 shares in the last quarter. Raymond James Financial Services Advisors Inc. boosted its stake in shares of First Trust NASDAQ Rising Dividend Achievers by 18.7% during the second quarter. Raymond James Financial Services Advisors Inc. now owns 6,872,756 shares of the company's stock valued at $376,283,000 after purchasing an additional 1,084,117 shares in the last quarter. LPL Financial LLC boosted its stake in shares of First Trust NASDAQ Rising Dividend Achievers by 3.7% during the second quarter. LPL Financial LLC now owns 19,372,722 shares of the company's stock valued at $1,060,656,000 after purchasing an additional 687,098 shares in the last quarter. Cetera Advisors LLC boosted its stake in shares of First Trust NASDAQ Rising Dividend Achievers by 111.8% during the first quarter. Cetera Advisors LLC now owns 910,777 shares of the company's stock valued at $51,158,000 after purchasing an additional 480,766 shares in the last quarter. Finally, Koshinski Asset Management Inc. boosted its stake in shares of First Trust NASDAQ Rising Dividend Achievers by 1,707.8% during the first quarter. Koshinski Asset Management Inc. now owns 500,465 shares of the company's stock valued at $28,111,000 after purchasing an additional 472,782 shares in the last quarter.

First Trust NASDAQ Rising Dividend Achievers Stock Down 1.2 %

Shares of NASDAQ RDVY traded down $0.71 during midday trading on Monday, reaching $59.86. 456,041 shares of the company's stock traded hands, compared to its average volume of 721,523. The stock's 50 day simple moving average is $58.12 and its 200-day simple moving average is $56.17. First Trust NASDAQ Rising Dividend Achievers has a one year low of $43.30 and a one year high of $60.94. The company has a market cap of $12.27 billion, a price-to-earnings ratio of 10.08 and a beta of 1.15.

First Trust NASDAQ Rising Dividend Achievers Cuts Dividend

The company also recently announced a quarterly dividend, which was paid on Monday, September 30th. Investors of record on Thursday, September 26th were given a dividend of $0.1912 per share. The ex-dividend date of this dividend was Thursday, September 26th. This represents a $0.76 dividend on an annualized basis and a yield of 1.28%.

About First Trust NASDAQ Rising Dividend Achievers

(

Free Report)

The First Trust Rising Dividend Achievers ETF (RDVY) is an exchange-traded fund that is based on the NASDAQ US Rising Dividend Achievers index. The fund tracks an index of 50 large-cap stocks with rising, high-quality dividends. RDVY was launched on Jan 6, 2014 and is managed by First Trust.

Featured Articles

Before you consider First Trust NASDAQ Rising Dividend Achievers, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and First Trust NASDAQ Rising Dividend Achievers wasn't on the list.

While First Trust NASDAQ Rising Dividend Achievers currently has a "hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.