Strategic Blueprint LLC reduced its stake in shares of First Trust NASDAQ Rising Dividend Achievers (NASDAQ:RDVY - Free Report) by 62.6% in the 3rd quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 21,575 shares of the company's stock after selling 36,086 shares during the quarter. Strategic Blueprint LLC's holdings in First Trust NASDAQ Rising Dividend Achievers were worth $1,277,000 as of its most recent filing with the SEC.

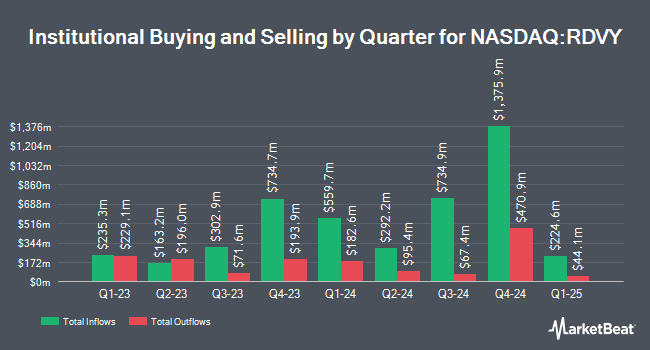

Several other large investors have also recently added to or reduced their stakes in the stock. Mainsail Financial Group LLC grew its stake in shares of First Trust NASDAQ Rising Dividend Achievers by 3.5% in the 1st quarter. Mainsail Financial Group LLC now owns 96,962 shares of the company's stock valued at $5,446,000 after buying an additional 3,292 shares in the last quarter. Kovack Advisors Inc. grew its position in First Trust NASDAQ Rising Dividend Achievers by 59.9% in the first quarter. Kovack Advisors Inc. now owns 82,701 shares of the company's stock worth $4,645,000 after acquiring an additional 30,983 shares in the last quarter. Cornerstone Wealth Management LLC increased its stake in shares of First Trust NASDAQ Rising Dividend Achievers by 9.8% during the 1st quarter. Cornerstone Wealth Management LLC now owns 83,096 shares of the company's stock worth $4,668,000 after purchasing an additional 7,446 shares during the last quarter. Accel Wealth Management raised its holdings in shares of First Trust NASDAQ Rising Dividend Achievers by 7.0% during the 1st quarter. Accel Wealth Management now owns 42,363 shares of the company's stock valued at $2,380,000 after purchasing an additional 2,773 shares in the last quarter. Finally, Ashton Thomas Private Wealth LLC lifted its stake in shares of First Trust NASDAQ Rising Dividend Achievers by 49.8% in the 1st quarter. Ashton Thomas Private Wealth LLC now owns 11,825 shares of the company's stock valued at $664,000 after purchasing an additional 3,930 shares during the last quarter.

First Trust NASDAQ Rising Dividend Achievers Price Performance

NASDAQ:RDVY traded up $0.26 during trading hours on Wednesday, reaching $60.01. The company's stock had a trading volume of 561,135 shares, compared to its average volume of 716,500. First Trust NASDAQ Rising Dividend Achievers has a one year low of $43.82 and a one year high of $60.94. The business's 50-day moving average is $58.58 and its 200-day moving average is $56.40. The company has a market cap of $12.33 billion, a price-to-earnings ratio of 10.08 and a beta of 1.15.

First Trust NASDAQ Rising Dividend Achievers Cuts Dividend

The business also recently disclosed a quarterly dividend, which was paid on Monday, September 30th. Stockholders of record on Thursday, September 26th were issued a dividend of $0.1912 per share. This represents a $0.76 dividend on an annualized basis and a dividend yield of 1.27%. The ex-dividend date was Thursday, September 26th.

About First Trust NASDAQ Rising Dividend Achievers

(

Free Report)

The First Trust Rising Dividend Achievers ETF (RDVY) is an exchange-traded fund that is based on the NASDAQ US Rising Dividend Achievers index. The fund tracks an index of 50 large-cap stocks with rising, high-quality dividends. RDVY was launched on Jan 6, 2014 and is managed by First Trust.

Featured Stories

Before you consider First Trust NASDAQ Rising Dividend Achievers, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and First Trust NASDAQ Rising Dividend Achievers wasn't on the list.

While First Trust NASDAQ Rising Dividend Achievers currently has a "hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.