U S Global Investors Inc. trimmed its position in shares of Royal Gold, Inc. (NASDAQ:RGLD - Free Report) TSE: RGL by 4.0% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 83,078 shares of the basic materials company's stock after selling 3,492 shares during the quarter. Royal Gold makes up 1.1% of U S Global Investors Inc.'s holdings, making the stock its 20th biggest holding. U S Global Investors Inc. owned approximately 0.13% of Royal Gold worth $11,656,000 at the end of the most recent reporting period.

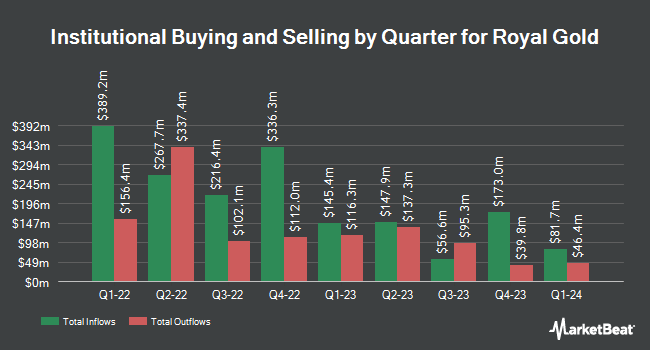

A number of other hedge funds have also recently made changes to their positions in the company. Vanguard Group Inc. lifted its stake in shares of Royal Gold by 0.3% in the first quarter. Vanguard Group Inc. now owns 6,664,975 shares of the basic materials company's stock worth $811,861,000 after acquiring an additional 21,407 shares during the period. Van ECK Associates Corp increased its holdings in shares of Royal Gold by 6.8% during the first quarter. Van ECK Associates Corp now owns 4,595,734 shares of the basic materials company's stock valued at $559,807,000 after acquiring an additional 292,357 shares in the last quarter. First Eagle Investment Management LLC increased its holdings in shares of Royal Gold by 0.6% during the second quarter. First Eagle Investment Management LLC now owns 3,584,967 shares of the basic materials company's stock valued at $448,694,000 after acquiring an additional 20,508 shares in the last quarter. Bank of New York Mellon Corp increased its holdings in shares of Royal Gold by 34.1% during the second quarter. Bank of New York Mellon Corp now owns 834,986 shares of the basic materials company's stock valued at $104,507,000 after acquiring an additional 212,316 shares in the last quarter. Finally, Dimensional Fund Advisors LP increased its holdings in shares of Royal Gold by 24.0% during the second quarter. Dimensional Fund Advisors LP now owns 806,872 shares of the basic materials company's stock valued at $100,991,000 after acquiring an additional 156,048 shares in the last quarter. 83.65% of the stock is owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Several brokerages recently issued reports on RGLD. StockNews.com upgraded Royal Gold from a "hold" rating to a "buy" rating in a report on Thursday, September 19th. CIBC upped their price target on Royal Gold from $166.00 to $175.00 and gave the stock a "neutral" rating in a report on Wednesday, July 10th. Scotiabank upped their price target on Royal Gold from $148.00 to $157.00 and gave the stock a "sector perform" rating in a report on Monday, August 19th. Cibc World Mkts upgraded Royal Gold to a "hold" rating in a report on Wednesday, July 10th. Finally, Bank of America upped their price target on Royal Gold from $129.00 to $131.00 and gave the stock an "underperform" rating in a report on Wednesday, June 26th. One equities research analyst has rated the stock with a sell rating, five have given a hold rating and four have issued a buy rating to the stock. Based on data from MarketBeat, the company currently has a consensus rating of "Hold" and a consensus price target of $158.86.

Get Our Latest Research Report on Royal Gold

Insiders Place Their Bets

In other Royal Gold news, Director Ronald J. Vance sold 1,000 shares of the company's stock in a transaction dated Monday, August 12th. The stock was sold at an average price of $132.16, for a total value of $132,160.00. Following the transaction, the director now directly owns 9,109 shares in the company, valued at $1,203,845.44. This represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. In other news, SVP Randy Shefman sold 4,600 shares of the stock in a transaction dated Wednesday, August 28th. The stock was sold at an average price of $140.31, for a total transaction of $645,426.00. Following the transaction, the senior vice president now directly owns 7,430 shares in the company, valued at approximately $1,042,503.30. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, Director Ronald J. Vance sold 1,000 shares of the stock in a transaction dated Monday, August 12th. The shares were sold at an average price of $132.16, for a total value of $132,160.00. Following the transaction, the director now owns 9,109 shares in the company, valued at $1,203,845.44. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 8,355 shares of company stock worth $1,170,315 in the last ninety days. 0.52% of the stock is currently owned by insiders.

Royal Gold Price Performance

Shares of NASDAQ RGLD traded up $1.76 during trading on Tuesday, reaching $154.27. 244,360 shares of the stock traded hands, compared to its average volume of 368,861. Royal Gold, Inc. has a 52-week low of $100.55 and a 52-week high of $155.10. The company has a 50-day moving average of $140.54 and a 200-day moving average of $132.38. The stock has a market capitalization of $10.14 billion, a P/E ratio of 44.99, a price-to-earnings-growth ratio of 1.28 and a beta of 0.90.

Royal Gold (NASDAQ:RGLD - Get Free Report) TSE: RGL last issued its quarterly earnings results on Wednesday, August 7th. The basic materials company reported $1.25 EPS for the quarter, beating analysts' consensus estimates of $1.18 by $0.07. Royal Gold had a return on equity of 8.74% and a net margin of 39.15%. The firm had revenue of $174.10 million for the quarter, compared to analysts' expectations of $172.12 million. During the same quarter in the prior year, the firm earned $0.88 EPS. The business's revenue for the quarter was up 20.9% compared to the same quarter last year. Analysts expect that Royal Gold, Inc. will post 4.89 earnings per share for the current fiscal year.

Royal Gold Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Friday, October 18th. Shareholders of record on Friday, October 4th were paid a $0.40 dividend. The ex-dividend date was Friday, October 4th. This represents a $1.60 dividend on an annualized basis and a yield of 1.04%. Royal Gold's dividend payout ratio is currently 47.20%.

Royal Gold Profile

(

Free Report)

Royal Gold, Inc, together with its subsidiaries, acquires and manages precious metal streams, royalties, and related interests. The company engages in acquiring stream and royalty interests or to finance projects that are in production, development, or in the exploration stage in exchange for stream or royalty interests, which primarily consists of gold, silver, copper, nickel, zinc, lead, and other metals.

See Also

Before you consider Royal Gold, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Royal Gold wasn't on the list.

While Royal Gold currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report