Vontobel Holding Ltd. increased its position in shares of Rivian Automotive, Inc. (NASDAQ:RIVN - Free Report) by 543.8% in the 3rd quarter, according to the company in its most recent disclosure with the SEC. The fund owned 142,712 shares of the electric vehicle automaker's stock after purchasing an additional 120,544 shares during the quarter. Vontobel Holding Ltd.'s holdings in Rivian Automotive were worth $1,601,000 as of its most recent filing with the SEC.

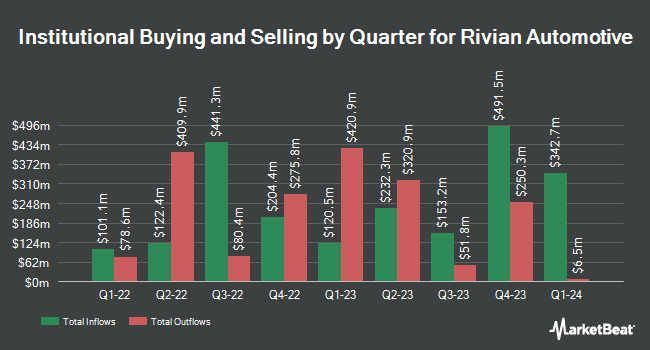

Several other hedge funds and other institutional investors have also recently bought and sold shares of the company. Baillie Gifford & Co. grew its holdings in Rivian Automotive by 714.3% during the 1st quarter. Baillie Gifford & Co. now owns 25,301,005 shares of the electric vehicle automaker's stock valued at $277,046,000 after buying an additional 22,194,018 shares during the last quarter. Mirae Asset Global Investments Co. Ltd. increased its position in Rivian Automotive by 1,521.2% during the 1st quarter. Mirae Asset Global Investments Co. Ltd. now owns 6,327,941 shares of the electric vehicle automaker's stock worth $69,291,000 after purchasing an additional 5,937,605 shares in the last quarter. Renaissance Technologies LLC raised its stake in Rivian Automotive by 153.2% in the 2nd quarter. Renaissance Technologies LLC now owns 5,430,500 shares of the electric vehicle automaker's stock valued at $72,877,000 after purchasing an additional 3,285,867 shares during the last quarter. Spirepoint Private Client LLC acquired a new stake in shares of Rivian Automotive during the 1st quarter worth about $15,635,000. Finally, AQR Capital Management LLC raised its position in shares of Rivian Automotive by 102.8% in the second quarter. AQR Capital Management LLC now owns 2,479,559 shares of the electric vehicle automaker's stock valued at $33,276,000 after buying an additional 1,257,106 shares during the last quarter. 66.25% of the stock is owned by institutional investors and hedge funds.

Rivian Automotive Stock Down 0.8 %

Shares of NASDAQ RIVN traded down $0.08 during midday trading on Friday, reaching $10.04. 18,480,916 shares of the company's stock were exchanged, compared to its average volume of 39,530,004. The company has a debt-to-equity ratio of 0.81, a quick ratio of 4.01 and a current ratio of 5.25. Rivian Automotive, Inc. has a 52-week low of $8.26 and a 52-week high of $24.61. The business's fifty day moving average price is $12.36 and its two-hundred day moving average price is $12.26. The stock has a market capitalization of $9.99 billion, a PE ratio of -1.74 and a beta of 2.03.

Rivian Automotive (NASDAQ:RIVN - Get Free Report) last posted its quarterly earnings data on Tuesday, August 6th. The electric vehicle automaker reported ($1.39) earnings per share (EPS) for the quarter, missing the consensus estimate of ($1.25) by ($0.14). The business had revenue of $1.16 billion for the quarter, compared to analysts' expectations of $1.17 billion. Rivian Automotive had a negative return on equity of 65.40% and a negative net margin of 115.50%. Analysts forecast that Rivian Automotive, Inc. will post -4.88 EPS for the current year.

Analyst Ratings Changes

RIVN has been the subject of several recent analyst reports. Wedbush reaffirmed an "outperform" rating and issued a $20.00 target price on shares of Rivian Automotive in a research note on Wednesday, August 7th. Deutsche Bank Aktiengesellschaft reaffirmed a "hold" rating and issued a $14.00 price objective on shares of Rivian Automotive in a research report on Tuesday, September 10th. Piper Sandler reiterated an "overweight" rating and set a $21.00 target price on shares of Rivian Automotive in a research report on Wednesday, June 26th. Barclays decreased their price target on Rivian Automotive from $16.00 to $13.00 and set an "equal weight" rating on the stock in a research note on Tuesday, October 15th. Finally, DA Davidson increased their price objective on shares of Rivian Automotive from $12.00 to $13.00 and gave the stock a "neutral" rating in a report on Friday, June 28th. One analyst has rated the stock with a sell rating, eleven have given a hold rating and eleven have given a buy rating to the company's stock. Based on data from MarketBeat, the stock has an average rating of "Hold" and an average price target of $17.18.

Read Our Latest Research Report on RIVN

Insider Buying and Selling

In related news, CFO Claire Mcdonough sold 3,210 shares of the business's stock in a transaction dated Friday, August 16th. The stock was sold at an average price of $13.57, for a total value of $43,559.70. Following the completion of the sale, the chief financial officer now directly owns 392,662 shares of the company's stock, valued at $5,328,423.34. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. In other news, CEO Robert J. Scaringe sold 83,333 shares of Rivian Automotive stock in a transaction dated Thursday, September 12th. The shares were sold at an average price of $13.68, for a total value of $1,139,995.44. Following the completion of the transaction, the chief executive officer now directly owns 886,526 shares of the company's stock, valued at approximately $12,127,675.68. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is accessible through this hyperlink. Also, CFO Claire Mcdonough sold 3,210 shares of the stock in a transaction dated Friday, August 16th. The stock was sold at an average price of $13.57, for a total transaction of $43,559.70. Following the sale, the chief financial officer now owns 392,662 shares in the company, valued at approximately $5,328,423.34. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders sold 241,305 shares of company stock worth $3,369,273. Insiders own 2.30% of the company's stock.

About Rivian Automotive

(

Free Report)

Rivian Automotive, Inc, together with its subsidiaries, designs, develops, manufactures, and sells electric vehicles and accessories. The company offers consumer vehicles, including a two-row, five-passenger pickup truck under the R1T brand, a three-row, seven-passenger sport utility vehicle under the R1S name.

See Also

Before you consider Rivian Automotive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rivian Automotive wasn't on the list.

While Rivian Automotive currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report