Construction Partners (NASDAQ:ROAD - Get Free Report) had its target price hoisted by Robert W. Baird from $68.00 to $92.00 in a research report issued on Tuesday, Benzinga reports. The firm currently has a "neutral" rating on the stock. Robert W. Baird's price target would suggest a potential upside of 9.80% from the stock's previous close.

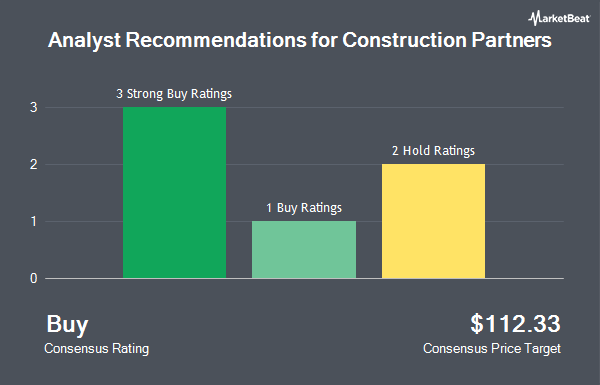

ROAD has been the topic of a number of other reports. Stifel Nicolaus raised their price objective on shares of Construction Partners from $61.00 to $67.00 and gave the company a "buy" rating in a research note on Monday, August 12th. DA Davidson raised their price objective on shares of Construction Partners from $50.00 to $55.00 and gave the company a "neutral" rating in a research note on Tuesday, August 13th. Finally, Raymond James increased their target price on shares of Construction Partners from $69.00 to $72.00 and gave the company a "strong-buy" rating in a report on Monday, August 12th. Three analysts have rated the stock with a hold rating, one has assigned a buy rating and one has given a strong buy rating to the stock. According to MarketBeat.com, Construction Partners has a consensus rating of "Moderate Buy" and an average target price of $69.00.

Check Out Our Latest Analysis on ROAD

Construction Partners Stock Down 1.1 %

NASDAQ ROAD traded down $0.91 on Tuesday, hitting $83.79. 411,342 shares of the company were exchanged, compared to its average volume of 358,168. The company has a market cap of $4.42 billion, a PE ratio of 72.39, a PEG ratio of 1.35 and a beta of 0.67. Construction Partners has a 12 month low of $36.70 and a 12 month high of $86.00. The stock has a fifty day moving average of $67.11 and a 200-day moving average of $60.07. The company has a current ratio of 1.60, a quick ratio of 1.30 and a debt-to-equity ratio of 0.82.

Construction Partners (NASDAQ:ROAD - Get Free Report) last issued its earnings results on Friday, August 9th. The company reported $0.59 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.54 by $0.05. Construction Partners had a net margin of 4.01% and a return on equity of 13.34%. The business had revenue of $517.80 million for the quarter, compared to analyst estimates of $503.57 million. During the same period in the prior year, the firm earned $0.41 earnings per share. Construction Partners's revenue was up 22.7% on a year-over-year basis. As a group, analysts forecast that Construction Partners will post 1.43 earnings per share for the current year.

Insider Activity

In other news, Director Mark R. Matteson sold 25,408 shares of the firm's stock in a transaction that occurred on Thursday, August 22nd. The shares were sold at an average price of $61.97, for a total value of $1,574,533.76. Following the completion of the transaction, the director now directly owns 102,592 shares in the company, valued at approximately $6,357,626.24. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. 18.80% of the stock is owned by company insiders.

Institutional Inflows and Outflows

Several large investors have recently made changes to their positions in ROAD. Allspring Global Investments Holdings LLC increased its stake in shares of Construction Partners by 47.9% in the third quarter. Allspring Global Investments Holdings LLC now owns 207,422 shares of the company's stock worth $14,478,000 after buying an additional 67,150 shares during the period. nVerses Capital LLC increased its stake in shares of Construction Partners by 19.0% in the third quarter. nVerses Capital LLC now owns 2,500 shares of the company's stock worth $174,000 after buying an additional 400 shares during the period. NBC Securities Inc. increased its stake in shares of Construction Partners by 36.9% in the third quarter. NBC Securities Inc. now owns 4,927 shares of the company's stock worth $343,000 after buying an additional 1,327 shares during the period. Creative Planning increased its stake in shares of Construction Partners by 22.8% in the third quarter. Creative Planning now owns 7,060 shares of the company's stock worth $493,000 after buying an additional 1,311 shares during the period. Finally, GAMMA Investing LLC increased its stake in shares of Construction Partners by 24.4% in the third quarter. GAMMA Investing LLC now owns 873 shares of the company's stock worth $61,000 after buying an additional 171 shares during the period. 94.83% of the stock is owned by hedge funds and other institutional investors.

About Construction Partners

(

Get Free Report)

Construction Partners, Inc, a civil infrastructure company, constructs and maintains roadways in Alabama, Florida, Georgia, North Carolina, South Carolina, and Tennessee. The company provides various products and services to public and private infrastructure projects, such as highways, roads, bridges, airports, and commercial and residential developments.

See Also

Before you consider Construction Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Construction Partners wasn't on the list.

While Construction Partners currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.