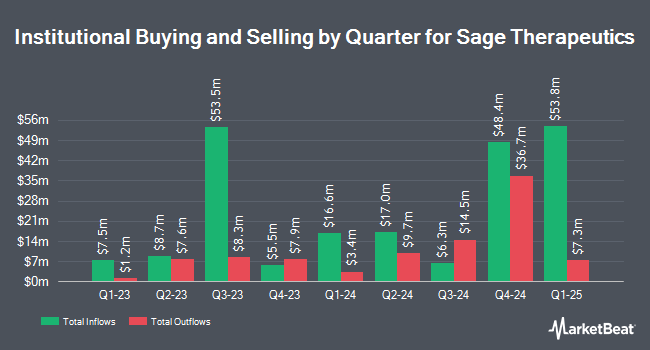

AQR Capital Management LLC purchased a new position in shares of Sage Therapeutics, Inc. (NASDAQ:SAGE - Free Report) during the second quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund purchased 93,830 shares of the biopharmaceutical company's stock, valued at approximately $1,008,000. AQR Capital Management LLC owned about 0.15% of Sage Therapeutics as of its most recent SEC filing.

Other institutional investors have also recently bought and sold shares of the company. Headlands Technologies LLC increased its position in Sage Therapeutics by 245.3% during the second quarter. Headlands Technologies LLC now owns 3,916 shares of the biopharmaceutical company's stock worth $43,000 after buying an additional 2,782 shares during the last quarter. Lazard Asset Management LLC acquired a new position in shares of Sage Therapeutics in the first quarter valued at approximately $127,000. Quest Partners LLC grew its position in shares of Sage Therapeutics by 14.5% in the second quarter. Quest Partners LLC now owns 11,763 shares of the biopharmaceutical company's stock valued at $128,000 after purchasing an additional 1,486 shares during the last quarter. Point72 DIFC Ltd acquired a new position in shares of Sage Therapeutics in the second quarter valued at approximately $153,000. Finally, SG Americas Securities LLC acquired a new position in shares of Sage Therapeutics in the second quarter valued at approximately $177,000. Institutional investors and hedge funds own 99.22% of the company's stock.

Analysts Set New Price Targets

Several research firms have recently commented on SAGE. TD Cowen downgraded Sage Therapeutics from a "buy" rating to a "hold" rating and decreased their target price for the company from $16.00 to $10.00 in a research report on Tuesday, July 30th. Raymond James reaffirmed a "market perform" rating on shares of Sage Therapeutics in a research report on Thursday. Royal Bank of Canada cut Sage Therapeutics from an "outperform" rating to a "sector perform" rating and cut their price target for the company from $10.00 to $4.00 in a research note on Friday, October 4th. The Goldman Sachs Group cut their price target on Sage Therapeutics from $19.00 to $11.00 and set a "neutral" rating for the company in a research note on Friday, July 26th. Finally, Mizuho cut their price target on Sage Therapeutics from $18.00 to $16.00 and set a "neutral" rating for the company in a research note on Friday, July 19th. Two investment analysts have rated the stock with a sell rating, eighteen have issued a hold rating and one has issued a buy rating to the stock. Based on data from MarketBeat, the stock has an average rating of "Hold" and an average price target of $13.76.

View Our Latest Report on Sage Therapeutics

Sage Therapeutics Trading Up 3.5 %

NASDAQ SAGE traded up $0.22 on Friday, hitting $6.59. 659,917 shares of the company's stock were exchanged, compared to its average volume of 992,208. The stock has a 50-day moving average of $7.68 and a 200-day moving average of $10.85. Sage Therapeutics, Inc. has a 52 week low of $5.84 and a 52 week high of $28.26. The stock has a market cap of $396.60 million, a price-to-earnings ratio of -0.78 and a beta of 0.91.

Sage Therapeutics (NASDAQ:SAGE - Get Free Report) last announced its quarterly earnings results on Wednesday, July 31st. The biopharmaceutical company reported ($1.70) EPS for the quarter, missing analysts' consensus estimates of ($1.68) by ($0.02). Sage Therapeutics had a negative net margin of 458.30% and a negative return on equity of 55.87%. The firm had revenue of $8.65 million during the quarter, compared to the consensus estimate of $8.85 million. During the same quarter in the previous year, the company posted ($2.68) earnings per share. The firm's revenue was up 249.8% on a year-over-year basis. As a group, analysts predict that Sage Therapeutics, Inc. will post -6.47 earnings per share for the current year.

Sage Therapeutics Company Profile

(

Free Report)

Sage Therapeutics, Inc, a biopharmaceutical company, develops and commercializes brain health medicines. Its product candidates include ZULRESSO, a CIV injection for the treatment of postpartum depression (PPD) in adults; and ZURZUVAE, a neuroactive steroid, a positive allosteric modulator of GABAA receptors, targeting both synaptic and extrasynaptic GABAA receptors, for the treatment of postpartum depression.

Featured Stories

Before you consider Sage Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sage Therapeutics wasn't on the list.

While Sage Therapeutics currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.