Saia (NASDAQ:SAIA - Free Report) had its target price upped by Stephens from $481.00 to $515.00 in a research report report published on Tuesday morning, Benzinga reports. They currently have an overweight rating on the transportation company's stock.

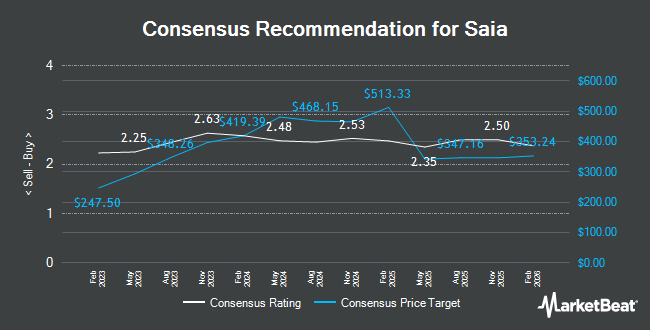

A number of other research analysts also recently issued reports on SAIA. Evercore ISI lowered their price target on Saia from $503.00 to $488.00 and set an "outperform" rating on the stock in a report on Thursday, October 3rd. The Goldman Sachs Group lowered their price target on Saia from $510.00 to $490.00 and set a "neutral" rating on the stock in a report on Wednesday, October 9th. TD Cowen upped their price objective on Saia from $416.00 to $418.00 and gave the company a "hold" rating in a research report on Thursday, September 5th. Jefferies Financial Group upped their price objective on Saia from $480.00 to $500.00 and gave the company a "buy" rating in a research report on Thursday, October 10th. Finally, Citigroup started coverage on Saia in a research report on Wednesday, October 9th. They set a "buy" rating and a $518.00 price objective for the company. One analyst has rated the stock with a sell rating, five have issued a hold rating and twelve have given a buy rating to the company's stock. Based on data from MarketBeat, Saia currently has an average rating of "Moderate Buy" and an average price target of $492.00.

Read Our Latest Stock Analysis on SAIA

Saia Stock Down 0.5 %

Shares of NASDAQ SAIA traded down $2.39 during mid-day trading on Tuesday, hitting $476.99. 494,430 shares of the stock traded hands, compared to its average volume of 389,933. The company has a debt-to-equity ratio of 0.08, a quick ratio of 1.36 and a current ratio of 1.26. The stock has a fifty day moving average price of $424.22 and a 200-day moving average price of $434.48. Saia has a 52 week low of $346.34 and a 52 week high of $628.34. The company has a market cap of $12.68 billion, a price-to-earnings ratio of 34.56, a PEG ratio of 2.21 and a beta of 1.74.

Saia (NASDAQ:SAIA - Get Free Report) last released its earnings results on Friday, October 25th. The transportation company reported $3.46 EPS for the quarter, missing the consensus estimate of $3.53 by ($0.07). Saia had a return on equity of 18.00% and a net margin of 11.83%. The company had revenue of $842.10 million during the quarter, compared to the consensus estimate of $839.82 million. During the same period last year, the firm posted $3.67 earnings per share. The company's revenue was up 8.6% compared to the same quarter last year. Research analysts anticipate that Saia will post 13.88 EPS for the current year.

Institutional Trading of Saia

Several hedge funds have recently modified their holdings of SAIA. Wealth Enhancement Advisory Services LLC raised its holdings in shares of Saia by 5.4% during the 1st quarter. Wealth Enhancement Advisory Services LLC now owns 4,310 shares of the transportation company's stock worth $2,521,000 after acquiring an additional 219 shares in the last quarter. State of Michigan Retirement System raised its holdings in Saia by 1.6% during the 1st quarter. State of Michigan Retirement System now owns 6,486 shares of the transportation company's stock valued at $3,794,000 after buying an additional 100 shares during the period. Norden Group LLC increased its position in Saia by 1,556.1% during the first quarter. Norden Group LLC now owns 26,299 shares of the transportation company's stock valued at $15,385,000 after acquiring an additional 24,711 shares during the last quarter. Commonwealth Equity Services LLC lifted its holdings in shares of Saia by 49.8% in the 1st quarter. Commonwealth Equity Services LLC now owns 2,321 shares of the transportation company's stock worth $1,358,000 after acquiring an additional 772 shares during the last quarter. Finally, Van ECK Associates Corp lifted its holdings in shares of Saia by 36.5% in the 1st quarter. Van ECK Associates Corp now owns 10,465 shares of the transportation company's stock worth $6,122,000 after acquiring an additional 2,799 shares during the last quarter.

About Saia

(

Get Free Report)

Saia, Inc, together with its subsidiaries, operates as a transportation company in North America. The company provides less-than-truckload services for shipments between 100 and 10,000 pounds; and other value-added services, including non-asset truckload, expedited, and logistics services. It also offers other value-added services, including non-asset truckload, expedited, and logistics services.

See Also

Before you consider Saia, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Saia wasn't on the list.

While Saia currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.