Sanmina (NASDAQ:SANM - Get Free Report) is set to post its quarterly earnings results after the market closes on Monday, November 4th. Analysts expect Sanmina to post earnings of $1.39 per share for the quarter.

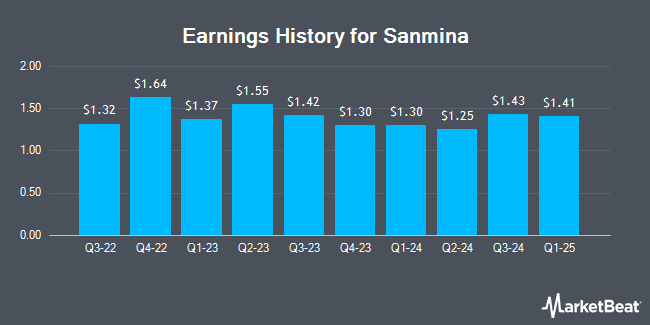

Sanmina (NASDAQ:SANM - Get Free Report) last posted its quarterly earnings data on Monday, July 29th. The electronics maker reported $1.25 earnings per share for the quarter, missing the consensus estimate of $1.28 by ($0.03). The firm had revenue of $1.84 billion during the quarter, compared to analyst estimates of $1.86 billion. Sanmina had a net margin of 2.93% and a return on equity of 10.79%. Sanmina's revenue was down 16.6% compared to the same quarter last year. During the same period in the previous year, the company posted $1.37 earnings per share. On average, analysts expect Sanmina to post $4 EPS for the current fiscal year and $5 EPS for the next fiscal year.

Sanmina Stock Performance

Shares of NASDAQ:SANM traded up $1.67 during trading on Tuesday, reaching $70.18. The company had a trading volume of 408,637 shares, compared to its average volume of 420,627. The firm has a market capitalization of $3.84 billion, a price-to-earnings ratio of 18.18, a price-to-earnings-growth ratio of 1.54 and a beta of 0.89. The company has a debt-to-equity ratio of 0.13, a current ratio of 2.03 and a quick ratio of 1.27. Sanmina has a fifty-two week low of $43.40 and a fifty-two week high of $76.84. The stock's fifty day moving average price is $67.56 and its 200 day moving average price is $67.10.

Insider Transactions at Sanmina

In other news, CEO Jure Sola sold 82,328 shares of the business's stock in a transaction that occurred on Friday, August 9th. The shares were sold at an average price of $69.67, for a total value of $5,735,791.76. Following the completion of the transaction, the chief executive officer now owns 1,198,594 shares of the company's stock, valued at $83,506,043.98. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available at the SEC website. In other Sanmina news, CEO Jure Sola sold 82,328 shares of the firm's stock in a transaction dated Friday, August 9th. The stock was sold at an average price of $69.67, for a total value of $5,735,791.76. Following the sale, the chief executive officer now directly owns 1,198,594 shares of the company's stock, valued at approximately $83,506,043.98. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, Director Eugene A. Delaney sold 8,688 shares of the business's stock in a transaction that occurred on Wednesday, July 31st. The shares were sold at an average price of $74.83, for a total transaction of $650,123.04. Following the completion of the sale, the director now owns 92,199 shares of the company's stock, valued at approximately $6,899,251.17. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 104,320 shares of company stock valued at $7,294,883 over the last three months. 3.09% of the stock is currently owned by insiders.

Analyst Ratings Changes

Separately, StockNews.com raised Sanmina from a "hold" rating to a "buy" rating in a report on Sunday, October 13th.

Check Out Our Latest Stock Report on SANM

Sanmina Company Profile

(

Get Free Report)

Sanmina Corporation provides integrated manufacturing solutions, components, products and repair, logistics, and after-market services worldwide. It operates in two businesses, Integrated Manufacturing Solutions; and Components, Products and Services. The company offers product design and engineering, including concept development, detailed design, prototyping, validation, preproduction, manufacturing design release, and product industrialization; assembly and test services; direct order fulfillment and logistics services; after-market product service and support; and supply chain management services, as well as engages in the manufacturing of components, subassemblies, and complete systems.

Featured Articles

Before you consider Sanmina, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sanmina wasn't on the list.

While Sanmina currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.