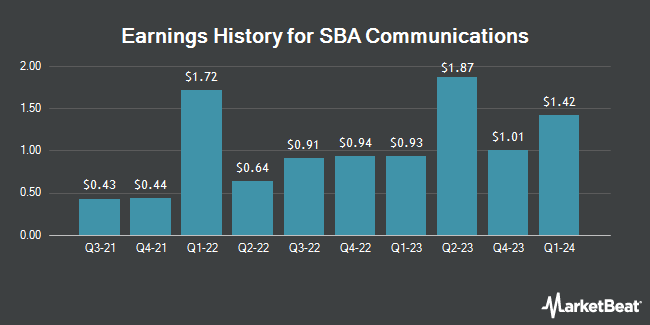

SBA Communications (NASDAQ:SBAC - Get Free Report) released its quarterly earnings data on Monday. The technology company reported $2.40 EPS for the quarter, missing analysts' consensus estimates of $3.17 by ($0.77), Zacks reports. The company had revenue of $667.60 million during the quarter, compared to the consensus estimate of $669.29 million. SBA Communications had a net margin of 19.22% and a negative return on equity of 9.85%. The company's revenue for the quarter was down 2.2% compared to the same quarter last year. During the same quarter in the prior year, the company posted $3.34 EPS. SBA Communications updated its FY24 guidance to $13.20-$13.45 EPS and its FY 2024 guidance to EPS.

SBA Communications Stock Performance

NASDAQ SBAC traded down $8.19 during trading hours on Tuesday, hitting $231.75. 1,363,466 shares of the company traded hands, compared to its average volume of 918,433. The business's 50-day moving average is $237.27 and its 200-day moving average is $213.83. SBA Communications has a twelve month low of $183.64 and a twelve month high of $258.76. The stock has a market capitalization of $24.91 billion, a price-to-earnings ratio of 48.94, a P/E/G ratio of 0.73 and a beta of 0.67.

Insider Activity at SBA Communications

In related news, Chairman Jeffrey Stoops sold 49,765 shares of the stock in a transaction that occurred on Thursday, August 1st. The stock was sold at an average price of $222.01, for a total transaction of $11,048,327.65. Following the completion of the transaction, the chairman now directly owns 109,583 shares of the company's stock, valued at approximately $24,328,521.83. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. In related news, Director George R. Krouse, Jr. sold 325 shares of the stock in a transaction that occurred on Wednesday, August 21st. The stock was sold at an average price of $219.58, for a total transaction of $71,363.50. Following the completion of the transaction, the director now directly owns 8,084 shares of the company's stock, valued at approximately $1,775,084.72. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, Chairman Jeffrey Stoops sold 49,765 shares of the company's stock in a transaction that occurred on Thursday, August 1st. The shares were sold at an average price of $222.01, for a total value of $11,048,327.65. Following the completion of the sale, the chairman now owns 109,583 shares in the company, valued at $24,328,521.83. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 51,590 shares of company stock valued at $11,483,981. Insiders own 1.30% of the company's stock.

Analyst Upgrades and Downgrades

A number of research firms recently commented on SBAC. Royal Bank of Canada upped their price objective on SBA Communications from $235.00 to $245.00 and gave the company an "outperform" rating in a report on Monday, August 5th. Deutsche Bank Aktiengesellschaft increased their price target on SBA Communications from $230.00 to $240.00 and gave the stock a "buy" rating in a report on Wednesday, August 14th. BMO Capital Markets increased their price target on SBA Communications from $255.00 to $260.00 and gave the stock an "outperform" rating in a report on Tuesday. TD Cowen increased their price target on SBA Communications from $251.00 to $261.00 and gave the stock a "buy" rating in a report on Tuesday. Finally, Raymond James increased their price target on SBA Communications from $285.00 to $300.00 and gave the stock a "strong-buy" rating in a report on Tuesday. Three analysts have rated the stock with a hold rating, ten have issued a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and a consensus target price of $257.23.

Get Our Latest Analysis on SBA Communications

SBA Communications Company Profile

(

Get Free Report)

SBA Communications Corporation is a leading independent owner and operator of wireless communications infrastructure including towers, buildings, rooftops, distributed antenna systems (DAS) and small cells. With a portfolio of more than 39,000 communications sites throughout the Americas, Africa and in Asia, SBA is listed on NASDAQ under the symbol SBAC.

See Also

Before you consider SBA Communications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SBA Communications wasn't on the list.

While SBA Communications currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.