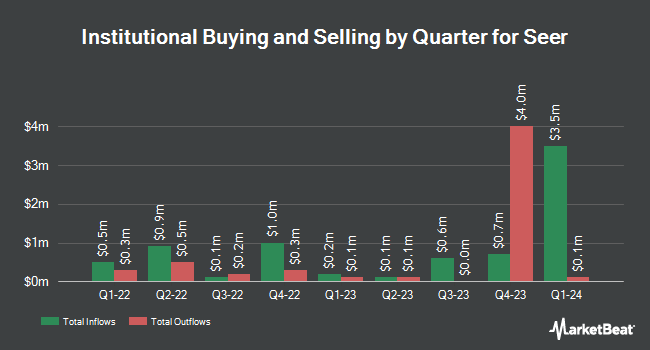

Renaissance Technologies LLC trimmed its position in Seer, Inc. (NASDAQ:SEER - Free Report) by 46.6% in the second quarter, according to its most recent filing with the SEC. The fund owned 502,700 shares of the company's stock after selling 439,300 shares during the period. Renaissance Technologies LLC owned 0.78% of Seer worth $845,000 as of its most recent filing with the SEC.

A number of other large investors also recently modified their holdings of the company. Vanguard Group Inc. raised its position in Seer by 1.0% during the 1st quarter. Vanguard Group Inc. now owns 2,636,577 shares of the company's stock worth $5,009,000 after purchasing an additional 25,944 shares during the last quarter. Acadian Asset Management LLC raised its position in Seer by 35.5% during the 2nd quarter. Acadian Asset Management LLC now owns 1,802,106 shares of the company's stock worth $3,024,000 after purchasing an additional 472,283 shares during the last quarter. Kent Lake Capital LLC bought a new position in Seer during the 1st quarter worth $1,425,000. Russell Investments Group Ltd. raised its position in Seer by 13.0% during the 1st quarter. Russell Investments Group Ltd. now owns 94,868 shares of the company's stock worth $180,000 after purchasing an additional 10,951 shares during the last quarter. Finally, American Century Companies Inc. raised its position in Seer by 42.1% during the 2nd quarter. American Century Companies Inc. now owns 61,752 shares of the company's stock worth $104,000 after purchasing an additional 18,302 shares during the last quarter. 75.20% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

Separately, Morgan Stanley decreased their price target on Seer from $7.00 to $3.00 and set an "equal weight" rating for the company in a report on Tuesday, August 13th.

Read Our Latest Analysis on Seer

Seer Price Performance

Seer stock remained flat at $1.94 during trading hours on Tuesday. The company's stock had a trading volume of 191,326 shares, compared to its average volume of 475,115. The stock's fifty day moving average price is $1.75 and its 200 day moving average price is $1.82. Seer, Inc. has a 52-week low of $1.46 and a 52-week high of $2.30. The firm has a market cap of $125.66 million, a price-to-earnings ratio of -1.48 and a beta of 1.46.

Seer (NASDAQ:SEER - Get Free Report) last issued its earnings results on Thursday, August 8th. The company reported ($0.35) EPS for the quarter, beating the consensus estimate of ($0.36) by $0.01. The company had revenue of $3.07 million during the quarter, compared to the consensus estimate of $3.33 million. Seer had a negative return on equity of 21.26% and a negative net margin of 559.21%. During the same period last year, the business posted ($0.37) EPS. On average, research analysts expect that Seer, Inc. will post -1.27 EPS for the current fiscal year.

Seer Profile

(

Free Report)

Seer, Inc, a life sciences company, engages in developing and commercializing products to decode the biology of the proteome. It develops Proteograph Product Suite, an integrated solution that includes proprietary engineered nanoparticles, consumables, automation instrumentation, and software to perform proteomic analysis to provide a solution that can be incorporated by nearly any lab for research use only.

Featured Stories

Before you consider Seer, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Seer wasn't on the list.

While Seer currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.