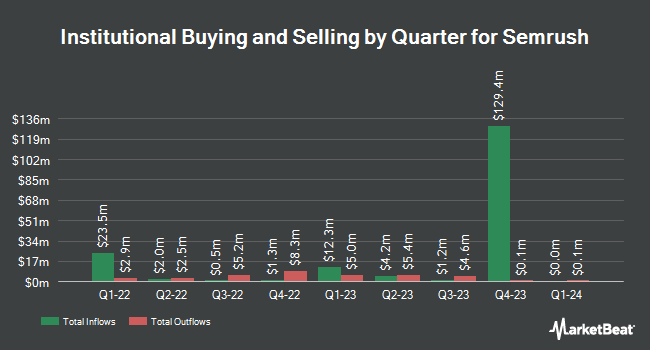

Millennium Management LLC raised its position in Semrush Holdings, Inc. (NASDAQ:SEMR - Free Report) by 126.5% during the second quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 294,374 shares of the company's stock after purchasing an additional 164,395 shares during the period. Millennium Management LLC owned about 0.20% of Semrush worth $3,942,000 at the end of the most recent reporting period.

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in SEMR. Dark Forest Capital Management LP purchased a new position in shares of Semrush during the 2nd quarter worth $1,435,000. Squarepoint Ops LLC increased its stake in Semrush by 33.0% in the second quarter. Squarepoint Ops LLC now owns 247,488 shares of the company's stock valued at $3,314,000 after purchasing an additional 61,456 shares during the last quarter. Cubist Systematic Strategies LLC purchased a new position in Semrush during the second quarter worth about $3,006,000. Sei Investments Co. acquired a new stake in Semrush in the 2nd quarter worth about $730,000. Finally, XTX Topco Ltd purchased a new stake in Semrush in the 2nd quarter valued at about $344,000. 32.86% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

Several brokerages have recently weighed in on SEMR. KeyCorp increased their price objective on shares of Semrush from $19.00 to $21.00 and gave the stock an "overweight" rating in a report on Wednesday, October 2nd. Needham & Company LLC reiterated a "buy" rating and issued a $18.00 price target on shares of Semrush in a report on Wednesday, October 2nd. The Goldman Sachs Group upped their price objective on Semrush from $14.00 to $16.00 and gave the stock a "neutral" rating in a report on Monday, October 7th. Finally, JPMorgan Chase & Co. lifted their target price on Semrush from $16.00 to $17.00 and gave the company an "overweight" rating in a report on Wednesday, October 2nd. Three investment analysts have rated the stock with a hold rating and four have given a buy rating to the company. Based on data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average target price of $15.57.

Check Out Our Latest Stock Analysis on SEMR

Semrush Stock Up 0.4 %

Shares of SEMR stock traded up $0.05 during mid-day trading on Monday, reaching $13.21. The company's stock had a trading volume of 187,535 shares, compared to its average volume of 519,395. The firm has a market capitalization of $1.92 billion, a PE ratio of 146.78 and a beta of 1.58. The company's 50 day simple moving average is $13.93 and its 200-day simple moving average is $13.91. Semrush Holdings, Inc. has a 12-month low of $7.36 and a 12-month high of $16.42.

Semrush (NASDAQ:SEMR - Get Free Report) last released its quarterly earnings data on Monday, August 5th. The company reported $0.01 EPS for the quarter, missing the consensus estimate of $0.03 by ($0.02). Semrush had a net margin of 4.39% and a return on equity of 6.61%. The company had revenue of $90.95 million during the quarter, compared to analysts' expectations of $89.70 million. As a group, research analysts anticipate that Semrush Holdings, Inc. will post 0.08 EPS for the current fiscal year.

Insider Activity at Semrush

In other Semrush news, Director Dmitry Melnikov sold 8,666 shares of the company's stock in a transaction that occurred on Friday, August 16th. The stock was sold at an average price of $14.00, for a total value of $121,324.00. Following the completion of the transaction, the director now owns 9,372,430 shares in the company, valued at $131,214,020. This represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. In related news, COO Vitalii Obishchenko sold 55,000 shares of Semrush stock in a transaction on Wednesday, September 11th. The shares were sold at an average price of $13.43, for a total value of $738,650.00. Following the completion of the sale, the chief operating officer now owns 848,923 shares in the company, valued at approximately $11,401,035.89. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. Also, Director Dmitry Melnikov sold 8,666 shares of the stock in a transaction on Friday, August 16th. The shares were sold at an average price of $14.00, for a total transaction of $121,324.00. Following the transaction, the director now owns 9,372,430 shares in the company, valued at $131,214,020. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 168,660 shares of company stock worth $2,387,791. 57.83% of the stock is currently owned by company insiders.

About Semrush

(

Free Report)

Semrush Holdings, Inc develops an online visibility management software-as-a-service platform in the United States, the United Kingdom, and internationally. The company enables companies to identify and reach the right audience for their content through the right channels. Its platform enables the company's customers to understand trends and act upon insights to enhance the online visibility, and drive traffic to their websites and social media pages, as well as online listings, distribute targeted content to their customers, and measure the digital marketing campaigns.

Further Reading

Before you consider Semrush, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Semrush wasn't on the list.

While Semrush currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.