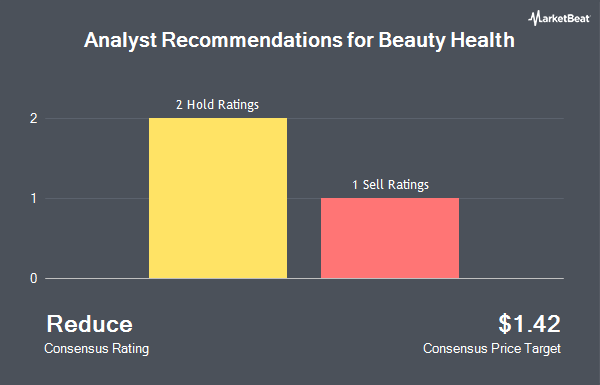

The Beauty Health Company (NASDAQ:SKIN - Get Free Report) has been assigned an average recommendation of "Reduce" from the eleven ratings firms that are covering the firm, Marketbeat reports. Three investment analysts have rated the stock with a sell rating, seven have assigned a hold rating and one has given a buy rating to the company. The average twelve-month target price among brokers that have updated their coverage on the stock in the last year is $2.46.

A number of brokerages have recently issued reports on SKIN. Stifel Nicolaus reduced their target price on shares of Beauty Health from $4.00 to $2.00 and set a "hold" rating for the company in a research report on Friday, July 26th. Canaccord Genuity Group lowered their target price on Beauty Health from $2.00 to $1.25 and set a "hold" rating for the company in a research note on Monday, August 12th. Finally, Piper Sandler reissued an "underweight" rating and set a $1.00 target price (down previously from $1.50) on shares of Beauty Health in a research note on Friday, August 9th.

Read Our Latest Stock Report on Beauty Health

Beauty Health Stock Up 4.0 %

Shares of NASDAQ:SKIN traded up $0.06 during midday trading on Friday, hitting $1.56. The stock had a trading volume of 522,689 shares, compared to its average volume of 957,281. Beauty Health has a 12 month low of $0.91 and a 12 month high of $5.71. The company has a quick ratio of 5.47, a current ratio of 6.49 and a debt-to-equity ratio of 7.96. The business's 50-day simple moving average is $1.50 and its 200-day simple moving average is $2.22. The company has a market cap of $193.47 million, a P/E ratio of -1.88 and a beta of 0.94.

Beauty Health (NASDAQ:SKIN - Get Free Report) last released its quarterly earnings data on Thursday, August 8th. The company reported ($0.10) EPS for the quarter, missing analysts' consensus estimates of ($0.05) by ($0.05). Beauty Health had a negative return on equity of 4.57% and a negative net margin of 22.86%. The company had revenue of $90.60 million for the quarter, compared to the consensus estimate of $98.46 million. On average, sell-side analysts forecast that Beauty Health will post -0.2 earnings per share for the current fiscal year.

Insider Activity at Beauty Health

In other Beauty Health news, Chairman Brent L. Saunders purchased 40,450 shares of the business's stock in a transaction on Monday, August 12th. The shares were purchased at an average cost of $1.08 per share, for a total transaction of $43,686.00. Following the acquisition, the chairman now owns 5,921,769 shares of the company's stock, valued at approximately $6,395,510.52. This represents a 0.00 % increase in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. 41.00% of the stock is currently owned by company insiders.

Hedge Funds Weigh In On Beauty Health

Institutional investors and hedge funds have recently modified their holdings of the business. HighMark Wealth Management LLC acquired a new position in shares of Beauty Health during the first quarter worth approximately $31,000. SageView Advisory Group LLC purchased a new stake in Beauty Health in the 1st quarter valued at $60,000. Caprock Group LLC purchased a new stake in Beauty Health in the 2nd quarter valued at $38,000. Sanctuary Advisors LLC purchased a new stake in Beauty Health in the 2nd quarter valued at $47,000. Finally, SG Americas Securities LLC purchased a new stake in Beauty Health in the 3rd quarter valued at $37,000. 93.26% of the stock is currently owned by institutional investors.

About Beauty Health

(

Get Free ReportThe Beauty Health Company designs, develops, manufactures, markets, and sells aesthetic technologies and products worldwide. The company's flagship product includes HydraFacial that enhance the skin to cleanse, extract, and hydrate the skin with proprietary solutions and serums. Its products also comprise Syndeo, a Delivery System designs to connects providers to the consumer's preferences to create a more personalized experience; consumables, such as single-use tips, solutions, and serums used to provide a hydrafacial treatment; SkinStylus SteriLock Microsystem, a microneedling device used for the treatment of enhancing appearance of surgical or traumatic hypertrophic scars on the abdomen and facial acne scarring in Fitzpatrick skin types I, II, and III; and Keravive, a treatment for scalp health.

See Also

Before you consider Beauty Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Beauty Health wasn't on the list.

While Beauty Health currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.