Royal Bank of Canada restated their outperform rating on shares of SLM (NASDAQ:SLM - Free Report) in a report released on Thursday morning, Benzinga reports. Royal Bank of Canada currently has a $26.00 price target on the credit services provider's stock.

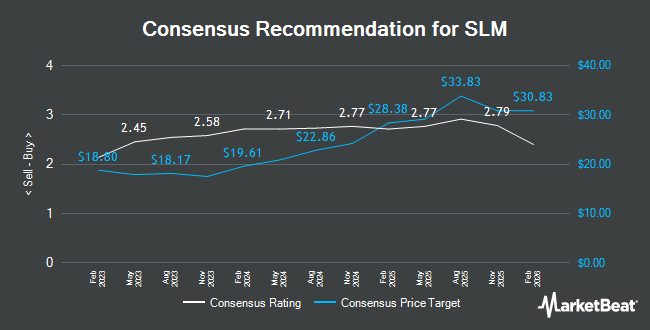

Several other equities research analysts have also recently commented on SLM. JPMorgan Chase & Co. lowered their target price on SLM from $25.00 to $24.00 and set a "neutral" rating for the company in a research note on Monday, October 7th. Barclays lowered their price objective on SLM from $27.00 to $26.00 and set an "overweight" rating for the company in a research report on Thursday. Keefe, Bruyette & Woods raised their target price on shares of SLM from $25.00 to $27.00 and gave the company an "outperform" rating in a research note on Thursday, July 25th. Deutsche Bank Aktiengesellschaft lifted their price target on shares of SLM from $25.00 to $29.00 and gave the stock a "buy" rating in a research report on Thursday, July 25th. Finally, Bank of America initiated coverage on shares of SLM in a report on Wednesday, September 25th. They issued a "buy" rating and a $27.00 price objective on the stock. Two analysts have rated the stock with a hold rating and ten have issued a buy rating to the stock. According to MarketBeat.com, SLM currently has a consensus rating of "Moderate Buy" and an average target price of $24.67.

Check Out Our Latest Report on SLM

SLM Price Performance

SLM traded down $0.59 during trading on Thursday, hitting $22.21. The company's stock had a trading volume of 4,723,994 shares, compared to its average volume of 1,788,436. The company has a quick ratio of 1.26, a current ratio of 1.26 and a debt-to-equity ratio of 2.66. The stock has a market capitalization of $4.88 billion, a price-to-earnings ratio of 6.94, a price-to-earnings-growth ratio of 0.60 and a beta of 1.15. The firm's 50 day moving average price is $21.90 and its two-hundred day moving average price is $21.49. SLM has a 12 month low of $12.26 and a 12 month high of $23.95.

SLM (NASDAQ:SLM - Get Free Report) last released its quarterly earnings results on Wednesday, October 23rd. The credit services provider reported ($0.23) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.07 by ($0.30). SLM had a net margin of 24.67% and a return on equity of 41.84%. During the same period in the prior year, the firm earned $0.11 earnings per share. Sell-side analysts forecast that SLM will post 2.85 earnings per share for the current fiscal year.

Insider Buying and Selling

In other news, Director Robert S. Strong sold 4,500 shares of the firm's stock in a transaction dated Thursday, August 1st. The stock was sold at an average price of $22.70, for a total transaction of $102,150.00. Following the sale, the director now owns 101,093 shares of the company's stock, valued at $2,294,811.10. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. 1.20% of the stock is currently owned by company insiders.

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently made changes to their positions in the stock. Assenagon Asset Management S.A. lifted its position in SLM by 3,800.6% in the 3rd quarter. Assenagon Asset Management S.A. now owns 2,406,384 shares of the credit services provider's stock valued at $55,034,000 after acquiring an additional 2,344,691 shares in the last quarter. Millennium Management LLC lifted its holdings in shares of SLM by 107.1% in the second quarter. Millennium Management LLC now owns 2,366,642 shares of the credit services provider's stock valued at $49,202,000 after purchasing an additional 1,224,015 shares in the last quarter. AQR Capital Management LLC boosted its position in shares of SLM by 253.8% during the second quarter. AQR Capital Management LLC now owns 1,290,997 shares of the credit services provider's stock worth $26,840,000 after buying an additional 926,120 shares during the period. American Century Companies Inc. boosted its position in shares of SLM by 23.9% during the second quarter. American Century Companies Inc. now owns 4,453,521 shares of the credit services provider's stock worth $92,589,000 after buying an additional 859,625 shares during the period. Finally, Boston Partners grew its holdings in shares of SLM by 5.7% during the first quarter. Boston Partners now owns 12,461,356 shares of the credit services provider's stock worth $271,626,000 after buying an additional 674,424 shares in the last quarter. Institutional investors and hedge funds own 98.94% of the company's stock.

SLM Company Profile

(

Get Free Report)

SLM Corporation, through its subsidiaries, originates and services private education loans to students and their families to finance the cost of their education in the United States. It is also involved in the provision of retail deposit accounts, including certificates of deposit, money market accounts, and high-yield savings accounts; and interest-bearing omnibus accounts.

Recommended Stories

Before you consider SLM, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SLM wasn't on the list.

While SLM currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.