Super Micro Computer (NASDAQ:SMCI - Get Free Report) is set to announce its earnings results after the market closes on Tuesday, November 5th. Analysts expect the company to announce earnings of $0.75 per share for the quarter. Individual interested in registering for the company's earnings conference call can do so using this link.

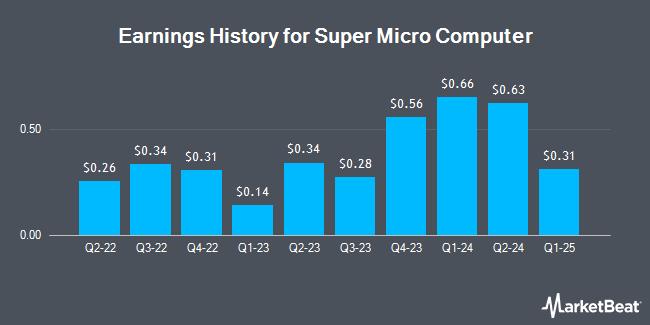

Super Micro Computer (NASDAQ:SMCI - Get Free Report) last released its quarterly earnings results on Tuesday, August 6th. The company reported $0.62 EPS for the quarter, missing the consensus estimate of $0.76 by ($0.14). The firm had revenue of $5.31 billion for the quarter, compared to analyst estimates of $5.32 billion. Super Micro Computer had a return on equity of 30.57% and a net margin of 8.09%. The company's quarterly revenue was up 142.9% on a year-over-year basis. During the same period last year, the firm earned $0.34 EPS. On average, analysts expect Super Micro Computer to post $3 EPS for the current fiscal year and $3 EPS for the next fiscal year.

Super Micro Computer Stock Performance

Shares of SMCI stock traded down $3.06 during trading hours on Friday, hitting $26.05. The stock had a trading volume of 102,739,043 shares, compared to its average volume of 59,429,240. The stock's 50 day moving average is $44.64 and its 200 day moving average is $66.86. The firm has a market capitalization of $14.57 billion, a PE ratio of 13.08 and a beta of 1.28. Super Micro Computer has a twelve month low of $22.74 and a twelve month high of $122.90. The company has a debt-to-equity ratio of 0.32, a current ratio of 3.77 and a quick ratio of 1.93.

Analyst Ratings Changes

SMCI has been the topic of several research reports. Needham & Company LLC started coverage on shares of Super Micro Computer in a research report on Wednesday, September 18th. They set a "buy" rating and a $60.00 price objective on the stock. Barclays lowered their price target on Super Micro Computer from $438.00 to $42.00 and set an "equal weight" rating on the stock in a report on Wednesday, October 2nd. Wells Fargo & Company reduced their price objective on Super Micro Computer from $65.00 to $37.50 and set an "equal weight" rating for the company in a research note on Wednesday, August 28th. Nomura Securities downgraded Super Micro Computer from a "strong-buy" rating to a "hold" rating in a research note on Wednesday, July 10th. Finally, The Goldman Sachs Group dropped their target price on Super Micro Computer from $77.50 to $67.50 and set a "neutral" rating on the stock in a report on Thursday, August 8th. Two analysts have rated the stock with a sell rating, twelve have given a hold rating and four have issued a buy rating to the company's stock. Based on data from MarketBeat.com, the stock presently has an average rating of "Hold" and an average price target of $74.53.

Read Our Latest Report on SMCI

About Super Micro Computer

(

Get Free Report)

Super Micro Computer, Inc, together with its subsidiaries, develops and manufactures high performance server and storage solutions based on modular and open architecture in the United States, Europe, Asia, and internationally. Its solutions range from complete server, storage systems, modular blade servers, blades, workstations, full racks, networking devices, server sub-systems, server management software, and security software.

Featured Articles

Before you consider Super Micro Computer, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Super Micro Computer wasn't on the list.

While Super Micro Computer currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.