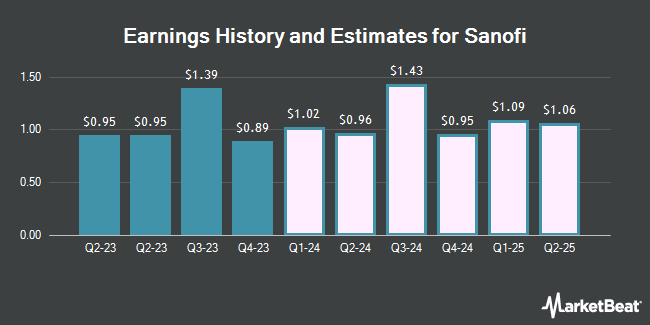

Sanofi (NASDAQ:SNY - Free Report) - Equities researchers at Leerink Partnrs upped their FY2024 earnings per share estimates for Sanofi in a note issued to investors on Sunday, October 27th. Leerink Partnrs analyst D. Risinger now expects that the company will post earnings per share of $4.25 for the year, up from their prior forecast of $4.14. The consensus estimate for Sanofi's current full-year earnings is $4.25 per share. Leerink Partnrs also issued estimates for Sanofi's FY2026 earnings at $4.99 EPS, FY2027 earnings at $5.73 EPS and FY2028 earnings at $6.15 EPS.

Several other research analysts also recently commented on the company. Argus lifted their price objective on Sanofi from $55.00 to $60.00 and gave the stock a "buy" rating in a report on Friday, July 26th. Citigroup raised Sanofi to a "strong-buy" rating in a research note on Tuesday, September 17th. Finally, StockNews.com cut Sanofi from a "strong-buy" rating to a "buy" rating in a research note on Monday, October 14th. Three research analysts have rated the stock with a hold rating, two have issued a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $57.50.

Read Our Latest Analysis on SNY

Sanofi Trading Down 0.7 %

Shares of SNY traded down $0.38 during trading hours on Wednesday, hitting $53.45. The company had a trading volume of 2,609,002 shares, compared to its average volume of 2,042,151. The firm has a market cap of $135.65 billion, a P/E ratio of 27.46, a P/E/G ratio of 1.55 and a beta of 0.60. The stock's 50 day moving average price is $56.06 and its 200 day moving average price is $51.89. The company has a quick ratio of 0.65, a current ratio of 1.00 and a debt-to-equity ratio of 0.17. Sanofi has a 52-week low of $45.00 and a 52-week high of $58.97.

Sanofi (NASDAQ:SNY - Get Free Report) last released its quarterly earnings data on Friday, October 25th. The company reported $1.57 EPS for the quarter, topping the consensus estimate of $0.22 by $1.35. The firm had revenue of $13.44 billion for the quarter, compared to the consensus estimate of $16.59 billion. Sanofi had a return on equity of 20.59% and a net margin of 9.96%. The company's quarterly revenue was up 12.3% on a year-over-year basis. During the same quarter in the previous year, the business earned $2.55 earnings per share.

Institutional Trading of Sanofi

Several large investors have recently bought and sold shares of the company. PDS Planning Inc boosted its position in Sanofi by 3.1% during the 3rd quarter. PDS Planning Inc now owns 6,643 shares of the company's stock valued at $383,000 after acquiring an additional 200 shares in the last quarter. Garrison Asset Management LLC bought a new stake in Sanofi during the 3rd quarter valued at approximately $231,000. QRG Capital Management Inc. boosted its position in Sanofi by 8.7% during the 3rd quarter. QRG Capital Management Inc. now owns 152,406 shares of the company's stock valued at $8,783,000 after acquiring an additional 12,245 shares in the last quarter. GFS Advisors LLC boosted its position in Sanofi by 1,017.9% during the 3rd quarter. GFS Advisors LLC now owns 12,800 shares of the company's stock valued at $738,000 after acquiring an additional 11,655 shares in the last quarter. Finally, Farther Finance Advisors LLC boosted its position in shares of Sanofi by 12.1% in the 3rd quarter. Farther Finance Advisors LLC now owns 2,861 shares of the company's stock worth $165,000 after purchasing an additional 309 shares in the last quarter. 10.04% of the stock is owned by institutional investors.

Sanofi Company Profile

(

Get Free Report)

Sanofi, a healthcare company, engages in the research, development, manufacture, and marketing of therapeutic solutions in the United States, Europe, Canada, and internationally. It operates through Pharmaceuticals, Vaccines, and Consumer Healthcare segments. The company provides specialty care, such as DUPIXENT, neurology and immunology, rare diseases, oncology, and rare blood disorders; medicines for diabetes and cardiovascular diseases; and established prescription products.

Further Reading

Before you consider Sanofi, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sanofi wasn't on the list.

While Sanofi currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.