Allspring Global Investments Holdings LLC lifted its stake in shares of Sanofi (NASDAQ:SNY - Free Report) by 434.4% during the third quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 50,583 shares of the company's stock after purchasing an additional 41,117 shares during the quarter. Allspring Global Investments Holdings LLC's holdings in Sanofi were worth $2,915,000 as of its most recent filing with the Securities and Exchange Commission.

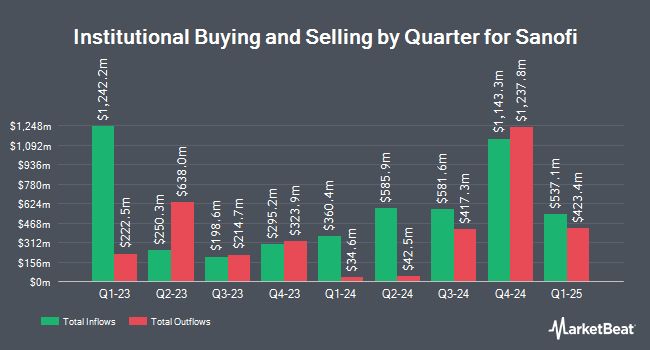

Other hedge funds have also made changes to their positions in the company. Barrow Hanley Mewhinney & Strauss LLC raised its stake in shares of Sanofi by 113.8% during the second quarter. Barrow Hanley Mewhinney & Strauss LLC now owns 5,943,547 shares of the company's stock valued at $288,381,000 after purchasing an additional 3,164,092 shares in the last quarter. Magnetar Financial LLC lifted its stake in shares of Sanofi by 1,153.1% in the 2nd quarter. Magnetar Financial LLC now owns 2,506,286 shares of the company's stock worth $121,605,000 after acquiring an additional 2,306,286 shares during the period. Bank of New York Mellon Corp boosted its holdings in shares of Sanofi by 19.0% in the second quarter. Bank of New York Mellon Corp now owns 8,594,740 shares of the company's stock valued at $417,017,000 after acquiring an additional 1,370,232 shares in the last quarter. Mondrian Investment Partners LTD increased its stake in shares of Sanofi by 43.1% during the first quarter. Mondrian Investment Partners LTD now owns 3,951,089 shares of the company's stock valued at $192,023,000 after acquiring an additional 1,190,141 shares during the period. Finally, BNP Paribas Financial Markets raised its holdings in Sanofi by 3,440.6% during the first quarter. BNP Paribas Financial Markets now owns 1,033,549 shares of the company's stock worth $50,230,000 after purchasing an additional 1,004,358 shares in the last quarter. Institutional investors own 10.04% of the company's stock.

Sanofi Price Performance

Shares of NASDAQ:SNY traded down $0.38 on Wednesday, reaching $53.45. 2,609,002 shares of the company traded hands, compared to its average volume of 2,042,151. Sanofi has a fifty-two week low of $45.00 and a fifty-two week high of $58.97. The stock has a market capitalization of $135.65 billion, a PE ratio of 27.46, a P/E/G ratio of 1.55 and a beta of 0.60. The company has a debt-to-equity ratio of 0.17, a current ratio of 1.00 and a quick ratio of 0.65. The company's 50 day moving average is $56.06 and its 200-day moving average is $51.89.

Sanofi (NASDAQ:SNY - Get Free Report) last posted its quarterly earnings data on Friday, October 25th. The company reported $1.57 EPS for the quarter, topping analysts' consensus estimates of $0.22 by $1.35. Sanofi had a net margin of 9.96% and a return on equity of 20.59%. The firm had revenue of $13.44 billion during the quarter, compared to analyst estimates of $16.59 billion. During the same quarter last year, the business posted $2.55 EPS. The company's revenue was up 12.3% on a year-over-year basis. As a group, analysts anticipate that Sanofi will post 4.25 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

A number of equities analysts have issued reports on SNY shares. Citigroup raised Sanofi to a "strong-buy" rating in a research note on Tuesday, September 17th. Argus raised their target price on Sanofi from $55.00 to $60.00 and gave the company a "buy" rating in a research note on Friday, July 26th. Finally, StockNews.com cut shares of Sanofi from a "strong-buy" rating to a "buy" rating in a research report on Monday, October 14th. Three research analysts have rated the stock with a hold rating, two have issued a buy rating and one has given a strong buy rating to the company's stock. According to MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average price target of $57.50.

View Our Latest Report on SNY

Sanofi Company Profile

(

Free Report)

Sanofi, a healthcare company, engages in the research, development, manufacture, and marketing of therapeutic solutions in the United States, Europe, Canada, and internationally. It operates through Pharmaceuticals, Vaccines, and Consumer Healthcare segments. The company provides specialty care, such as DUPIXENT, neurology and immunology, rare diseases, oncology, and rare blood disorders; medicines for diabetes and cardiovascular diseases; and established prescription products.

Featured Stories

Before you consider Sanofi, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sanofi wasn't on the list.

While Sanofi currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.