SoFi Technologies (NASDAQ:SOFI - Get Free Report) was downgraded by stock analysts at Citigroup from a "strong-buy" rating to a "hold" rating in a note issued to investors on Friday, Zacks.com reports.

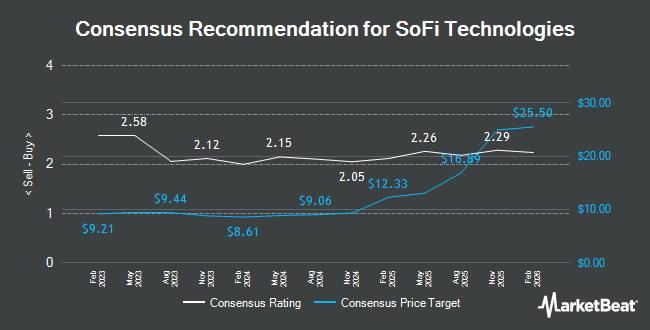

SOFI has been the topic of several other reports. Barclays decreased their price target on shares of SoFi Technologies from $10.00 to $8.00 and set an "equal weight" rating on the stock in a report on Tuesday, July 9th. Needham & Company LLC reaffirmed a "buy" rating and set a $10.00 target price on shares of SoFi Technologies in a research note on Wednesday, July 31st. Finally, Keefe, Bruyette & Woods dropped their price target on SoFi Technologies from $7.50 to $7.00 and set a "market perform" rating for the company in a research note on Tuesday, July 9th. Two analysts have rated the stock with a sell rating, seven have issued a hold rating and four have assigned a buy rating to the stock. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and a consensus price target of $9.25.

View Our Latest Stock Report on SOFI

SoFi Technologies Price Performance

SOFI traded up $0.18 during trading on Friday, hitting $10.58. 36,372,104 shares of the stock traded hands, compared to its average volume of 45,840,785. The business has a 50 day moving average price of $7.99 and a 200 day moving average price of $7.35. The company has a debt-to-equity ratio of 0.53, a current ratio of 0.88 and a quick ratio of 0.21. SoFi Technologies has a twelve month low of $6.01 and a twelve month high of $10.62. The company has a market cap of $11.19 billion, a price-to-earnings ratio of -34.13, a PEG ratio of 1.72 and a beta of 1.70.

SoFi Technologies (NASDAQ:SOFI - Get Free Report) last posted its quarterly earnings results on Tuesday, July 30th. The company reported $0.01 EPS for the quarter, hitting analysts' consensus estimates of $0.01. SoFi Technologies had a positive return on equity of 2.25% and a negative net margin of 5.15%. The company had revenue of $598.60 million during the quarter, compared to analysts' expectations of $565.19 million. During the same quarter in the previous year, the firm earned ($0.06) EPS. SoFi Technologies's revenue was up 20.2% on a year-over-year basis. Equities research analysts forecast that SoFi Technologies will post 0.1 earnings per share for the current fiscal year.

Insider Activity

In related news, CTO Jeremy Rishel sold 68,081 shares of the company's stock in a transaction that occurred on Friday, September 20th. The stock was sold at an average price of $8.12, for a total value of $552,817.72. Following the sale, the chief technology officer now directly owns 521,505 shares in the company, valued at $4,234,620.60. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this hyperlink. In related news, CTO Jeremy Rishel sold 68,081 shares of SoFi Technologies stock in a transaction on Friday, September 20th. The shares were sold at an average price of $8.12, for a total transaction of $552,817.72. Following the completion of the transaction, the chief technology officer now owns 521,505 shares of the company's stock, valued at $4,234,620.60. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website. Also, EVP Kelli Keough sold 9,308 shares of the company's stock in a transaction on Monday, September 23rd. The shares were sold at an average price of $7.99, for a total transaction of $74,370.92. Following the sale, the executive vice president now directly owns 161,511 shares in the company, valued at $1,290,472.89. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders sold 102,328 shares of company stock valued at $808,246. Company insiders own 2.60% of the company's stock.

Institutional Investors Weigh In On SoFi Technologies

Hedge funds have recently added to or reduced their stakes in the business. ORG Partners LLC bought a new stake in shares of SoFi Technologies in the 1st quarter valued at $27,000. Allspring Global Investments Holdings LLC increased its stake in SoFi Technologies by 55.3% in the second quarter. Allspring Global Investments Holdings LLC now owns 4,333 shares of the company's stock valued at $29,000 after purchasing an additional 1,543 shares in the last quarter. Waldron Private Wealth LLC acquired a new position in shares of SoFi Technologies during the third quarter valued at about $39,000. GAMMA Investing LLC boosted its position in shares of SoFi Technologies by 65.3% during the 2nd quarter. GAMMA Investing LLC now owns 5,017 shares of the company's stock worth $33,000 after purchasing an additional 1,981 shares in the last quarter. Finally, Future Financial Wealth Managment LLC acquired a new stake in shares of SoFi Technologies in the 1st quarter valued at about $37,000. 38.43% of the stock is currently owned by institutional investors.

About SoFi Technologies

(

Get Free Report)

SoFi Technologies, Inc provides various financial services in the United States, Latin America, and Canada. It operates through three segments: Lending, Technology Platform, and Financial Services. The company offers lending and financial services and products that allows its members to borrow, save, spend, invest, and protect money.

Read More

Before you consider SoFi Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SoFi Technologies wasn't on the list.

While SoFi Technologies currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.