Deroy & Devereaux Private Investment Counsel Inc. lifted its holdings in shares of Sonos, Inc. (NASDAQ:SONO - Free Report) by 67.9% in the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 1,655,942 shares of the company's stock after acquiring an additional 669,658 shares during the quarter. Deroy & Devereaux Private Investment Counsel Inc. owned approximately 1.37% of Sonos worth $20,352,000 as of its most recent SEC filing.

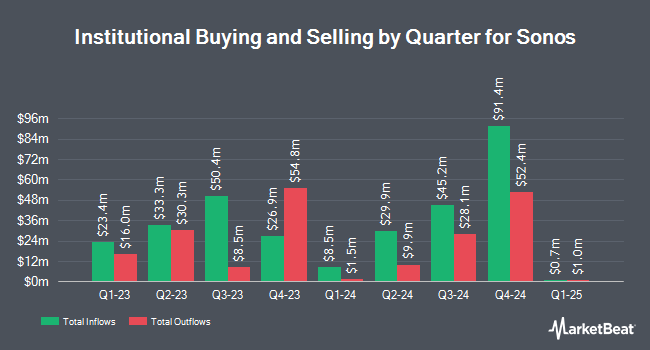

Other institutional investors have also made changes to their positions in the company. Pacer Advisors Inc. boosted its holdings in shares of Sonos by 24.8% during the second quarter. Pacer Advisors Inc. now owns 3,519,368 shares of the company's stock worth $51,946,000 after acquiring an additional 699,975 shares during the period. Victory Capital Management Inc. grew its position in Sonos by 21.9% during the second quarter. Victory Capital Management Inc. now owns 1,842,770 shares of the company's stock worth $27,199,000 after buying an additional 331,293 shares in the last quarter. Renaissance Technologies LLC raised its holdings in Sonos by 1,725.4% in the 2nd quarter. Renaissance Technologies LLC now owns 337,700 shares of the company's stock valued at $4,984,000 after acquiring an additional 319,200 shares in the last quarter. Cubist Systematic Strategies LLC lifted its position in shares of Sonos by 739.6% during the 2nd quarter. Cubist Systematic Strategies LLC now owns 256,333 shares of the company's stock valued at $3,783,000 after acquiring an additional 296,411 shares during the period. Finally, F M Investments LLC acquired a new stake in shares of Sonos during the 2nd quarter worth $4,218,000. 85.82% of the stock is owned by institutional investors and hedge funds.

Sonos Stock Up 2.2 %

Sonos stock traded up $0.27 during mid-day trading on Friday, hitting $12.80. 1,315,458 shares of the stock were exchanged, compared to its average volume of 1,898,713. The firm's fifty day simple moving average is $12.21 and its two-hundred day simple moving average is $13.99. Sonos, Inc. has a 12 month low of $10.10 and a 12 month high of $19.76. The stock has a market capitalization of $1.55 billion, a price-to-earnings ratio of -91.42 and a beta of 2.05.

Sonos (NASDAQ:SONO - Get Free Report) last released its earnings results on Wednesday, August 7th. The company reported $0.03 earnings per share (EPS) for the quarter, meeting the consensus estimate of $0.03. Sonos had a negative net margin of 1.04% and a positive return on equity of 0.42%. The business had revenue of $397.15 million for the quarter, compared to analyst estimates of $391.23 million. During the same quarter in the previous year, the business earned $0.02 earnings per share. Sonos's revenue for the quarter was up 6.4% on a year-over-year basis. As a group, analysts forecast that Sonos, Inc. will post -0.28 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

A number of brokerages have weighed in on SONO. Morgan Stanley downgraded Sonos from an "overweight" rating to an "underweight" rating and reduced their target price for the company from $25.00 to $11.00 in a report on Thursday, September 26th. Craig Hallum cut shares of Sonos from a "buy" rating to a "hold" rating and decreased their price target for the company from $25.00 to $10.00 in a research report on Thursday, August 8th. One equities research analyst has rated the stock with a sell rating, two have assigned a hold rating and one has issued a buy rating to the company. According to MarketBeat, the company currently has a consensus rating of "Hold" and a consensus target price of $14.25.

Get Our Latest Stock Analysis on Sonos

Insider Activity at Sonos

In other Sonos news, insider Shamayne Braman sold 6,438 shares of Sonos stock in a transaction that occurred on Friday, August 16th. The stock was sold at an average price of $11.56, for a total value of $74,423.28. Following the completion of the sale, the insider now directly owns 26,588 shares in the company, valued at approximately $307,357.28. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. 3.30% of the stock is owned by corporate insiders.

About Sonos

(

Free Report)

Sonos, Inc, together with its subsidiaries, designs, develops, manufactures, and sells audio products and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. It offers wireless, portable, and home theater speakers; components; and accessories. The company offers its products through approximately 10,000 third-party retail stores, including custom installers of home audio systems; and e-commerce retailers, as well as through its website.

Further Reading

Before you consider Sonos, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sonos wasn't on the list.

While Sonos currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.