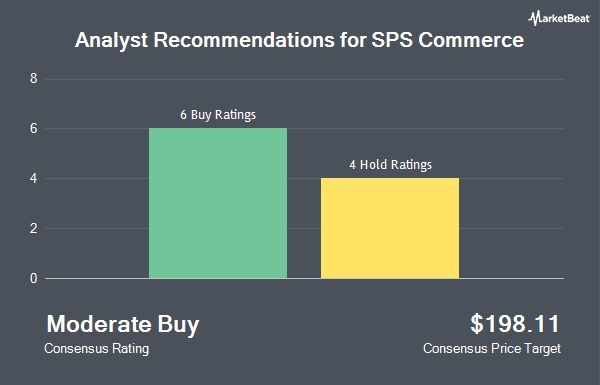

Shares of SPS Commerce, Inc. (NASDAQ:SPSC - Get Free Report) have received a consensus rating of "Moderate Buy" from the ten ratings firms that are covering the company, MarketBeat Ratings reports. Four research analysts have rated the stock with a hold rating and six have assigned a buy rating to the company. The average 12 month price target among brokerages that have issued a report on the stock in the last year is $220.25.

Several research firms have recently commented on SPSC. Needham & Company LLC reiterated a "buy" rating and set a $230.00 price objective on shares of SPS Commerce in a research note on Friday, August 2nd. Northland Securities downgraded shares of SPS Commerce from an "outperform" rating to a "market perform" rating and lifted their price objective for the stock from $205.00 to $209.00 in a research note on Monday, July 29th. DA Davidson lifted their price objective on shares of SPS Commerce from $225.00 to $240.00 and gave the stock a "buy" rating in a research note on Friday, July 26th. Robert W. Baird lifted their price objective on shares of SPS Commerce from $178.00 to $186.00 and gave the stock a "neutral" rating in a research note on Friday, July 26th. Finally, Northland Capmk downgraded shares of SPS Commerce from a "strong-buy" rating to a "hold" rating in a research note on Monday, July 29th.

Get Our Latest Report on SPS Commerce

SPS Commerce Price Performance

NASDAQ SPSC traded up $2.04 on Thursday, hitting $191.79. The stock had a trading volume of 112,057 shares, compared to its average volume of 177,296. The business's fifty day moving average price is $193.36 and its 200 day moving average price is $190.55. SPS Commerce has a 52-week low of $151.96 and a 52-week high of $218.74. The stock has a market cap of $7.12 billion, a price-to-earnings ratio of 98.83 and a beta of 0.82.

SPS Commerce (NASDAQ:SPSC - Get Free Report) last released its quarterly earnings results on Thursday, July 25th. The software maker reported $0.80 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.77 by $0.03. SPS Commerce had a net margin of 12.31% and a return on equity of 12.41%. The business had revenue of $153.60 million for the quarter, compared to analyst estimates of $151.87 million. During the same period in the previous year, the company earned $0.42 earnings per share. The business's revenue for the quarter was up 17.8% on a year-over-year basis. As a group, sell-side analysts anticipate that SPS Commerce will post 2.32 EPS for the current year.

Insider Activity at SPS Commerce

In other SPS Commerce news, Director Sven Wehrwein sold 2,000 shares of SPS Commerce stock in a transaction on Friday, August 9th. The shares were sold at an average price of $201.35, for a total value of $402,700.00. Following the completion of the transaction, the director now owns 16,212 shares of the company's stock, valued at approximately $3,264,286.20. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. 1.00% of the stock is currently owned by insiders.

Institutional Inflows and Outflows

A number of institutional investors and hedge funds have recently added to or reduced their stakes in the company. Vanguard Group Inc. increased its holdings in SPS Commerce by 1.4% in the first quarter. Vanguard Group Inc. now owns 4,347,206 shares of the software maker's stock valued at $803,798,000 after buying an additional 58,525 shares in the last quarter. Conestoga Capital Advisors LLC increased its stake in shares of SPS Commerce by 2.4% during the second quarter. Conestoga Capital Advisors LLC now owns 1,227,411 shares of the software maker's stock worth $230,950,000 after purchasing an additional 28,970 shares in the last quarter. William Blair Investment Management LLC increased its stake in shares of SPS Commerce by 2.9% during the first quarter. William Blair Investment Management LLC now owns 597,662 shares of the software maker's stock worth $110,508,000 after purchasing an additional 17,012 shares in the last quarter. Dimensional Fund Advisors LP increased its stake in shares of SPS Commerce by 2.6% during the second quarter. Dimensional Fund Advisors LP now owns 497,355 shares of the software maker's stock worth $93,583,000 after purchasing an additional 12,552 shares in the last quarter. Finally, Bank of New York Mellon Corp increased its stake in shares of SPS Commerce by 7.2% during the second quarter. Bank of New York Mellon Corp now owns 340,419 shares of the software maker's stock worth $64,053,000 after purchasing an additional 22,928 shares in the last quarter. Hedge funds and other institutional investors own 98.96% of the company's stock.

About SPS Commerce

(

Get Free ReportSPS Commerce, Inc provides cloud-based supply chain management solutions in the United States and internationally. It offers solutions through the SPS Commerce, a cloud-based platform that enhances the way retailers, grocers, suppliers, distributors, and logistics firms manage and fulfill omnichannel orders, optimize sell-through performance, and automate new trading relationships.

Featured Stories

Before you consider SPS Commerce, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SPS Commerce wasn't on the list.

While SPS Commerce currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.