Emerald Mutual Fund Advisers Trust lifted its position in shares of Sprout Social, Inc. (NASDAQ:SPT - Free Report) by 133.3% in the third quarter, according to its most recent 13F filing with the SEC. The firm owned 145,052 shares of the company's stock after purchasing an additional 82,879 shares during the quarter. Emerald Mutual Fund Advisers Trust owned about 0.25% of Sprout Social worth $4,217,000 as of its most recent filing with the SEC.

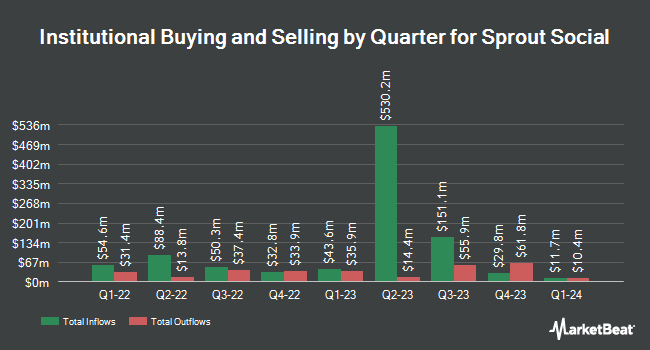

A number of other institutional investors have also modified their holdings of the company. Fidelis Capital Partners LLC purchased a new position in Sprout Social in the 1st quarter worth approximately $27,000. Quarry LP boosted its holdings in Sprout Social by 2,346.9% in the 2nd quarter. Quarry LP now owns 783 shares of the company's stock worth $28,000 after acquiring an additional 751 shares during the period. EntryPoint Capital LLC purchased a new position in Sprout Social in the 1st quarter worth approximately $37,000. Covestor Ltd raised its position in shares of Sprout Social by 35,450.0% in the 1st quarter. Covestor Ltd now owns 711 shares of the company's stock valued at $42,000 after purchasing an additional 709 shares in the last quarter. Finally, Bessemer Group Inc. acquired a new position in shares of Sprout Social in the 1st quarter valued at approximately $61,000.

Analysts Set New Price Targets

A number of brokerages have issued reports on SPT. Needham & Company LLC reaffirmed a "buy" rating and issued a $55.00 target price on shares of Sprout Social in a research report on Friday, August 2nd. KeyCorp lowered Sprout Social from a "sector weight" rating to an "underweight" rating and set a $28.00 target price on the stock. in a research report on Thursday, August 22nd. Cantor Fitzgerald reaffirmed an "overweight" rating and issued a $46.00 target price on shares of Sprout Social in a research report on Friday, August 2nd. Oppenheimer cut their target price on Sprout Social from $43.00 to $40.00 and set an "outperform" rating on the stock in a research report on Thursday, October 24th. Finally, Barclays dropped their price target on Sprout Social from $48.00 to $38.00 and set an "overweight" rating on the stock in a research report on Friday, October 11th. One investment analyst has rated the stock with a sell rating, six have assigned a hold rating and seven have given a buy rating to the company's stock. According to MarketBeat.com, the company presently has an average rating of "Hold" and an average target price of $48.00.

View Our Latest Analysis on Sprout Social

Sprout Social Stock Performance

NASDAQ SPT traded up $0.62 during trading hours on Monday, hitting $27.59. The company had a trading volume of 484,070 shares, compared to its average volume of 746,803. Sprout Social, Inc. has a fifty-two week low of $25.05 and a fifty-two week high of $68.41. The company has a quick ratio of 0.98, a current ratio of 0.98 and a debt-to-equity ratio of 0.26. The business has a fifty day simple moving average of $28.47 and a 200-day simple moving average of $33.08. The firm has a market cap of $1.57 billion, a P/E ratio of -20.59 and a beta of 0.99.

Sprout Social (NASDAQ:SPT - Get Free Report) last issued its earnings results on Thursday, August 1st. The company reported $0.09 earnings per share for the quarter, topping the consensus estimate of $0.08 by $0.01. Sprout Social had a negative return on equity of 44.38% and a negative net margin of 19.60%. The firm had revenue of $99.40 million for the quarter, compared to analyst estimates of $98.70 million. During the same period last year, the company earned ($0.23) earnings per share. The firm's revenue for the quarter was up 25.3% on a year-over-year basis. Equities analysts predict that Sprout Social, Inc. will post -0.9 EPS for the current year.

Insiders Place Their Bets

In related news, CEO Justyn Russell Howard sold 20,000 shares of the firm's stock in a transaction dated Tuesday, August 6th. The stock was sold at an average price of $30.68, for a total transaction of $613,600.00. Following the completion of the transaction, the chief executive officer now owns 310,812 shares of the company's stock, valued at $9,535,712.16. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through the SEC website. In related news, CEO Justyn Russell Howard sold 20,000 shares of the stock in a transaction on Tuesday, August 6th. The stock was sold at an average price of $30.68, for a total value of $613,600.00. Following the completion of the transaction, the chief executive officer now owns 310,812 shares in the company, valued at $9,535,712.16. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Also, CEO Ryan Paul Barretto sold 16,800 shares of the stock in a transaction on Monday, October 7th. The shares were sold at an average price of $28.25, for a total value of $474,600.00. Following the completion of the transaction, the chief executive officer now owns 170,175 shares of the company's stock, valued at $4,807,443.75. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 86,382 shares of company stock valued at $2,523,941 over the last three months. Company insiders own 10.97% of the company's stock.

Sprout Social Profile

(

Free Report)

Sprout Social, Inc designs, develops, and operates a web-based social media management platform in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. The company provides cloud software for social messaging, data and workflows in a unified system of record, intelligence, and action.

Further Reading

Before you consider Sprout Social, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sprout Social wasn't on the list.

While Sprout Social currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.