STAAR Surgical (NASDAQ:STAA - Get Free Report) is scheduled to be announcing its earnings results after the market closes on Wednesday, October 30th. Analysts expect the company to announce earnings of $0.19 per share for the quarter. STAAR Surgical has set its FY 2024 guidance at EPS.Persons interested in participating in the company's earnings conference call can do so using this link.

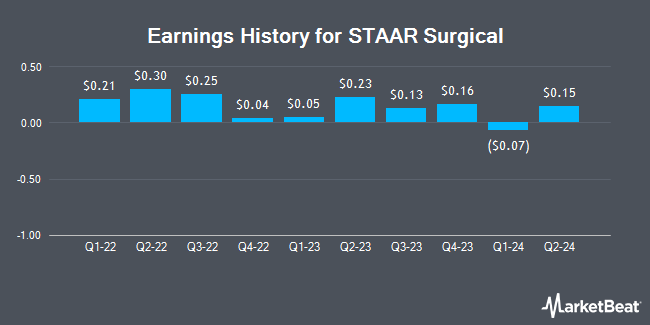

STAAR Surgical (NASDAQ:STAA - Get Free Report) last issued its earnings results on Wednesday, August 7th. The medical instruments supplier reported $0.15 EPS for the quarter, missing the consensus estimate of $0.24 by ($0.09). The firm had revenue of $99.01 million during the quarter, compared to analysts' expectations of $95.22 million. STAAR Surgical had a return on equity of 5.60% and a net margin of 4.99%. The firm's quarterly revenue was up 7.3% compared to the same quarter last year. During the same period in the previous year, the firm earned $0.23 earnings per share. On average, analysts expect STAAR Surgical to post $0 EPS for the current fiscal year and $0 EPS for the next fiscal year.

STAAR Surgical Price Performance

STAAR Surgical stock traded up $0.13 during trading hours on Thursday, reaching $30.32. The stock had a trading volume of 627,392 shares, compared to its average volume of 718,307. The company has a fifty day simple moving average of $32.72 and a 200-day simple moving average of $39.48. STAAR Surgical has a 52 week low of $26.66 and a 52 week high of $52.68. The stock has a market cap of $1.49 billion, a PE ratio of 89.18 and a beta of 0.59.

Insider Activity

In other STAAR Surgical news, Director Arthur C. Butcher purchased 1,315 shares of the firm's stock in a transaction that occurred on Monday, August 12th. The stock was bought at an average cost of $37.99 per share, for a total transaction of $49,956.85. Following the purchase, the director now directly owns 4,208 shares in the company, valued at $159,861.92. The trade was a 0.00 % increase in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Company insiders own 1.00% of the company's stock.

Wall Street Analysts Forecast Growth

Several research firms recently issued reports on STAA. Needham & Company LLC reissued a "hold" rating on shares of STAAR Surgical in a research note on Thursday, September 19th. Morgan Stanley cut STAAR Surgical from an "equal weight" rating to an "underweight" rating and reduced their target price for the company from $50.00 to $37.00 in a research note on Monday, July 15th. Stifel Nicolaus decreased their target price on STAAR Surgical from $50.00 to $44.00 and set a "buy" rating for the company in a report on Monday, August 26th. Canaccord Genuity Group cut their price target on shares of STAAR Surgical from $43.00 to $41.00 and set a "hold" rating on the stock in a report on Thursday, August 8th. Finally, BTIG Research boosted their price objective on shares of STAAR Surgical from $46.00 to $53.00 and gave the company a "buy" rating in a research report on Monday, July 15th. One equities research analyst has rated the stock with a sell rating, four have assigned a hold rating and four have assigned a buy rating to the company's stock. According to data from MarketBeat.com, STAAR Surgical currently has a consensus rating of "Hold" and a consensus price target of $45.57.

Read Our Latest Stock Analysis on STAA

STAAR Surgical Company Profile

(

Get Free Report)

STAAR Surgical Company, together with its subsidiaries, designs, develops, manufactures, markets, and sells implantable lenses for the eye, and companion delivery systems to deliver the lenses into the eye. The company provides implantable Collamer lens product family (ICLs) to treat visual disorders, such as myopia, hyperopia, astigmatism, and presbyopia.

Featured Articles

Before you consider STAAR Surgical, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and STAAR Surgical wasn't on the list.

While STAAR Surgical currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.